A trio of fraudsters have been sentenced for their involvement in a number of insurance fraud plots, orchestrated by boxer Hamid Sediqi, also known under the aliases Kevin Heartbreak, Richard Joseph Johnson and Najib Sharifi.

Investigations led by the City of London Police’s Insurance Fraud Enforcement Department (IFED) revealed that Sediqi had cloned a genuine claims management company in order to obtain referral fees from solicitors.

Sediqi was also found to have been involved in the orchestration of over sixty fraudulent motor insurance claims alongside his partner at the time, Belma Draganovic, and a further co-conspirator, Mason Smith, a former boxer and reality TV show participant.

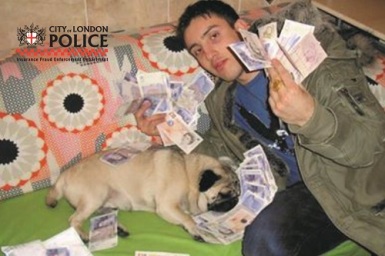

Sediqi and Draganovic used the money to fund their lavish lifestyle, purchasing a penthouse apartment in Gran Canaria and a number of ostentatious vehicles, including a bright pink Mazda RX7, well-known online with the hashtag #F1RX7, which was seized by police in 2018 and subsequently auctioned to provide compensation to victims of Sediqi’s previous frauds. The couple’s spendthrift nature is also evident from photos found on Sediqi’s phone, showing his pet dog covered in wads of cash.

The group was sentenced at Inner London Crown Court on Friday 14 May 2021 as follows:

- Hamid Sediqi, 36, of Hanwell, received a four-year custodial sentence.

- Belma Draganovic, 32, of Harrow, sentenced to eleven months imprisonment, suspended for eighteen months.

- Mason Smith, 24, of Hemel Hempstead, received a three-month tagged curfew order.

Sediqi is also being considered for a Serious Crime Prevention Order (SCPO). If granted, this order means that Sediqi will be subject to a number of restrictions to prevent him from committing further crimes. Breach of an SCPO is a criminal offence punishable by up to five years imprisonment and an unlimited fine. A court hearing will be set for later this year to decide this.

Proceedings will now commence under the Proceeds of Crime Act to recover the funds which were illegally obtained.

Detective Constable Haywood, from the City of London Police’s Insurance Fraud Enforcement Department (IFED), said:

“Sediqi was investigated by IFED in 2013 and received jail time for contriving Road Traffic Collisions. In spite of this custodial sentence, Sediqi clearly had not learned his lesson, and has yet again attempted to gain financially from a number of fraudulent activities.

“With accomplices in tow, Sediqi managed to fraudulently accrue nearly £245,000, targeting solicitors and insurance companies, and stealing the identities of companies and members of the public. The trio of criminals became tangled in a web of lies, which ultimately led to their downfall and the truth being exposed.

“Thank you to all the victims, members of the public and companies who assisted with the investigation. We also would like to thank the Government agencies who supported this investigation, including HMPO.”

Sediqi was referred to IFED for investigation after a claims management firm discovered that he had cloned the company for nearly two years. In April 2014, Sediqi contacted a solicitor specialising in personal injury claims in order to establish a business relationship. Sediqi used a pseudonym and posed as the director of the company, offering to refer claims to the solicitors in exchange for a fee. An agreement was made in which Heartbreak received £500 plus VAT for claims relating to Road Traffic Accidents, and £700 plus VAT for all other claims.

In total, Sediqi referred seventy-six claims to the solicitors, for which he received £26,070 in fees. As well as this, Heartbreak is thought to have received a minimum of £26,402 through the compensation paid out for the fraudulent claims he referred.

The genuine claims management company contacted the solicitors in January 2016, looking to work collaboratively. The director was shocked to learn that the solicitors allegedly had a working relationship established already with his company. Assuming that his company had been imitated, the director alerted the Ministry of Justice Claims Regulation Unit.

Investigations were conducted into the bank accounts which the solicitors had paid referral fees and claims into. This revealed the accounts were actually associated with various aliases used by Sediqi.

By September 2018, Aviva had detected sixty-two fraudulent motor insurance claims linked to Sediqi, dating from 2016 onwards. Sediqi acted with co-conspirators Draganovic and Smith, contriving Road Traffic Collisions to obtain compensation with an estimated total of nearly £200,000.

The trio operated by fraudulently opening bank accounts, using stolen IDs or completely fictitious details, to take out insurance policies with Aviva. With a policy established, one of the three would pose as the policyholder over the phone, claiming they had hit another vehicle. The third party would also be another member of the trio. To substantiate the claims, the group pulled photos of damaged vehicles from the internet and submitted them to the insurer.

IFED officers descended on Sediqi’s shop in Hanwell to arrest him and execute searches; however, upon their arrival, Sediqi initially was nowhere to be seen – until an officer caught a glimpse of him hiding under a desk. During a search of the shop, the team uncovered a large amount of evidence, which indicated that Sediqi had been conducting the frauds.

Evidence found by IFED officers also unveiled the lavish lifestyle these crimes were funding, with a number of photos on the phones of Sediqi showing him with Draganovic posing with designer goods and cars. Further images displayed cash piled on top of a desk at Heartbreak’s shop in Hanwell, as well as his pet dog.

A text message in a heated exchange between the pair also alluded to their involvement in this fraudulent activity, with Draganovic writing “you lie to me like I’m one of your fraud cases [sic]”.

Smith was also later arrested at his home address. All three responded “no comment” when questioned by officers.

Carl Mather, Special Investigations Unit Manager at Aviva, said:

“Aviva originally identified Kevin Heartbreak as a serial fraudster 10 years ago for which he was sentenced to 18 months’ imprisonment and was forced to pay back the proceeds of his crimes. This most recent case underlines the need for the incoming whiplash reforms to tackle the disproportionate compensation attached to whiplash claims, which continues to attract fraudsters, and which pushes up premiums for all genuine customers.

“Although Heartbreak may have believed his latest enterprise was beyond detection, he was wrong. I’m pleased that Aviva quickly uncovered the scale of his offending and the roles of those involved, and we will continue to fight fraud and prosecute offenders – in this case, for the second time.”