The Ardonagh Group has announced its results for the nine months ended 30 September 2021.

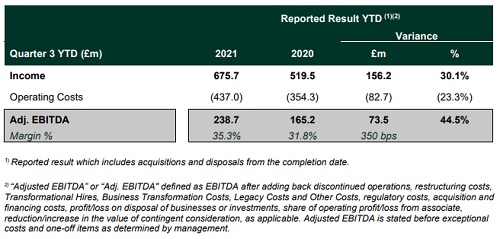

Income increased by 30.1% from £519.5 million to £675.7 million with especially strong growth in the Specialty and International platforms. Organic growth in the third quarter was 10%.

Adjusted EBITDA grew by 44.5% to £238.7 million due to acquisitions, organic growth and cost reduction from operational improvements and integration synergies.

Operating Cash Conversion was maintained at 96% for 12 months to 30 September 2021 and senior net leverage maintained at 5.2x with available liquidity of £744 million, pro forma for acquisitions completed to date.

Ardonagh completed £125 million of investment in the third quarter including Usay Group by Ardonagh Advisory in the UK, Cornerstone Risk Group by Resilium Partners in Australia and the full shareholding of Price Forbes Chile.

The acquisition of Besso Insurance, Ed Broking, and Piiq Risk Partners completed on 1 November, making Ardonagh Specialty the largest independent global specialty broker in the London market placing over $5 billion of insurance premiums.

Group CEO David Ross said: “The Group’s strong financial performance has again improved on all measurements. Our focus this year on building out the Specialty and International platforms has allowed us to harness global opportunities, backing ambitious specialist teams and businesses in high growth areas. The scale, support and expertise of Ardonagh combined with trust and autonomy is a powerful driver of the organic growth we report today.

“We approach year end as a truly global force with $1.5 billion income, placing $13 billion of insurance premium across the group and within our networks, and continuing to invest in the data and analytical capabilities to better serve our clients.”