Average quoted price of home insurance stands at £162 and quoted premiums rose 9.3% in the past three months ̶ the highest quarterly rise since 2014

The average quoted price of home insurance rose by 6.7% in the past year – the highest annual increase since 2018, the latest Consumer Intelligence Home Insurance Price Index shows.

Average quoted premiums for buildings and contents policies are £162 but could be heading higher Consumer Intelligence believes, with quoted prices rising 9.3% in the past three months – the second highest quarterly increase since it started tracking in 2014.

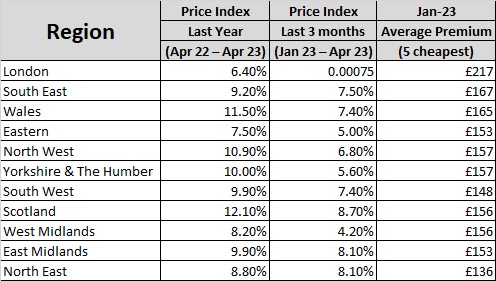

Londoners continue to face the highest quoted premiums at £217 for building and contents policies, with the North East the cheapest region with average quoted prices of £136.

“The sharp increases in quoted premiums in the past three months point to continuing rising prices for the rest of the year as insurers keep pace with inflation in the wider economy,” says Georgia Day, Senior Insight Analyst at Consumer Intelligence.

“With such significant inflation, it’s interesting to consider the increased presence of lower tiered ‘Essentials’ products entering the market,” Day adds.

Long-term view

Overall, quoted premiums have now risen by 12.2% since Consumer Intelligence first started collecting data in February 2014.

“Healthy competition in the home insurance market has historically tended to keep prices in check,” says Day.

Into the regions

Londoners face quoted prices a third higher than the UK average to insure their property and contents, with only households in the South East and Wales facing more than the UK average of £162 at £167 and £165 respectively.

Homeowners in Scotland have seen the biggest annual increases to quoted premiums at 12.1%, followed by Welsh customers with rises of 11.5%. Londoners saw the lowest rise in quoted prices at 6.4%.

The biggest increases in quoted prices in the last three months came in Scotland and the East Midlands at 8.7% and 8.1% respectively. The lowest increases were in the West Midlands at 4.2%.

Age differences

Older householders see slightly lower quotes for their home insurance with the average quoted premiums for over-50s at £164 compared with £159 for the under-50s. However quoted prices rose fastest for the over 50s in the past 12 months at 7.7% compared with 6.0%.

Property age

Older properties continue to attract the highest quoted premiums with Victorian-era homes built between 1850 and 1895 seeing average quoted costs of £225 for joint home and contents policies.

Quoted premiums for homes built since 2000 were the lowest at £150 while those built between 1970 and 1985, and 1985 and 2000, were both £154.

Quoted premiums for houses of all ages increased over the past 12 months with the lowest rises for those built between 1910 and 1925 at 2%. The biggest annual rises were for homes built between 1850 and 1895 at 11% followed by those built between 1895 and 1910 at 9.3%.

The Consumer Intelligence Home Insurance Price Index is compiled using real customer quotes from price comparison websites (PCWs) and key direct providers. The data is used by the Office for National Statistics, regulators, and insurance providers as the definitive benchmark of how price is changing for consumers.