The Ardonagh Group has announced its results for the nine months ended 30 September 2020.

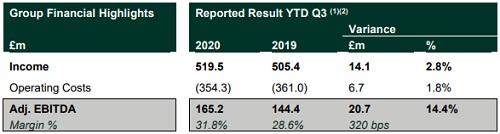

Adjusted EBITDA grew by 14.4% to £165.2m with strong margin improvement across all four operating segments.

Income increased by 2.8% to £519.5m driven by M&A and underlying organic growth of 2.2% in the quarter, excluding the limited impact of Covid-19. Ardonagh completed five acquisitions during the quarter including Thames Underwriting and Lloyd Latchford.

Operating cash conversion was maintained at 94% for the 12 months to 30 September 2020 and senior net leverage is stable at 5.6x with available liquidity of £568m, providing ample firepower for investments across all platforms.

Group CEO David Ross said: “Seven weeks after reporting our half year results we are pleased to confirm the strong trajectory into the final quarter of 2020.”

“Ardonagh has continued to deliver significant synergies from the integration of acquisitions and leverage combined scale and best practices across the businesses.”

“Our people have continued to react to the changing needs of customers and collaborate on solutions. Our latest results once again reflect the dedication, scale and diversity of our resilient business, having welcomed hundreds of new colleagues into the Group.”