Organic income growth of 10% with a growing international presence

Additional committed Capex, Acquisition and Re-organisation Facility and equity capital raise supporting M&A and investment strategy

The Ardonagh Group has announced its results for the six months ended 30 June 2021.

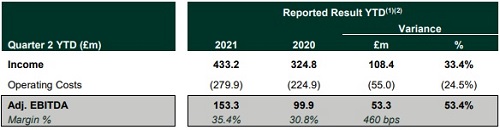

Income rose by 33.4% to £443.2 million and Adjusted EBITDA by 53.4% to £153.3 million. The results were underpinned by 10% organic income growth in the quarter and strong M&A momentum in particular for the Ardonagh Specialty and International platforms.

Operating cash conversion for the last 12 months was maintained at 97% which resulted in strong cash flow.

Ardonagh today further announces that its existing shareholders have subscribed for £350 million of additional equity combined with a £550m additional committed Capex, Acquisition and Re[1]organisation Facility backed by existing lenders. This combined funding will enable the Group to continue executing its M&A and investment strategy at pace both in the UK and internationally.

Ardonagh CEO David Ross commented: “This is an exceptionally strong set of results as the business and our clients rebound from the economic impacts of Covid-19 with vigour and confidence. It reflects the dedication of our 7,000+ people and the delivery of our strategy from the leadership teams across all operating segments.

“The first half of the year marked significant international expansion with the launch of Ardonagh Global Partners and Ardonagh Europe forming our new International platform and we were pleased to welcome new colleagues from Australia, Ireland, Germany, Chile, Bermuda and the United States as well as the UK.

“Our substantial investment in data and technology across the Group culminated with the launch of a Global Data and Risk Management Centre in July 2021 which will industrialise and optimise data collection and analytics across the Group to the benefit of clients, carriers and colleagues.

“In Specialty we announced an agreement to acquire the insurance operations of BGC Partners, a transformational acquisition and our largest to date. Upon completion of this acquisition, Ardonagh Specialty will become the largest privately owned London wholesale broker placing over $5 billion of insurance premium annually, providing a natural alternative for clients and producers who value both independence and scale. We also launched Inver Re, a new reinsurance broker which will harness the scale and reach of the Group and use sophisticated data science to provide new levels of risk insight and analysis.

“The further firepower provided by our investors is a ringing endorsement of all we have built and a strong vote of confidence in the future trajectory of our Group and the remarkable people behind it. “We enter the remainder of the year with unparalleled breadth and diversity – a leader in each of the sectors in which we operate and a phenomenal platform for growth with the virtuous circles of operational, organic and inorganic excellence at the heart of the business.”