Top line growth driven by targeted acquisitions

Margin improvement due to cost savings and integration benefits

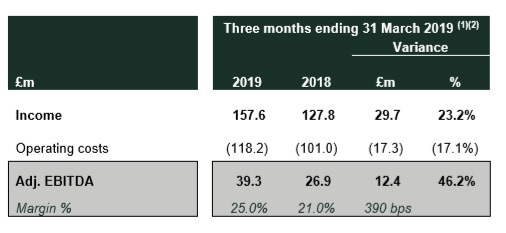

The Ardonagh Group today announces its results covering the three months to 31 March 2019 - See table below

Targeted acquisitions, growth in premium and policies under management boosted Group income by 23.2% to £157.6m from £127.8m.

Adjusted EBITDA increased by 46.2% to £39.3m due to acquisitions and delivery of cost savings.

Insurance Broking, the Group’s largest segment, had a particularly strong start to the year with organic growth of 2.9% driven by c. 90% retention and +15.2% new business growth. The roll out of Acturis in Advisory branches completed in Q1 and 28 branches now running renewals and new business 100% on the new system.

In our Retail segment, the integration of Swinton is ahead of plan – administrative and IT costs per policy have been reduced by 21% and customer renewal rates improved compared to Q1 2018.

Ardonagh Group CEO David Ross said: “We continue to reap the benefits of the investments we have made into building a multi-channel diversified platform.

“As we approach the mid-way point of 2019 we are tremendously excited about the opportunities that lie ahead with the full support of our shareholders, who this week reaffirmed their commitment with a £92m investment to increase their holdings in the Group.”