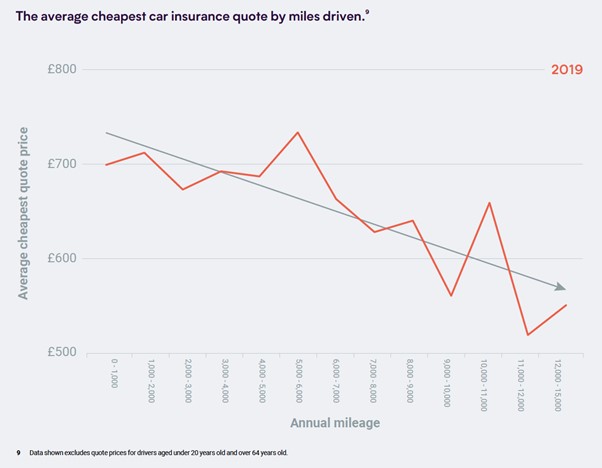

Research from pay-by-mile car insurance provider By Miles and MoneySuperMarket, shows that UK motorists driving under 7,000 miles a year are paying a low mileage penalty of £180, on average, compared to motorists driving over that threshold.

The worst affected drivers are 25-29 year olds declaring an annual mileage of 5,000-6,000 miles, paying an average of £239 more than those of the same age driving double that amount.

According to the latest MOT data from the Department for Transport, the average annual distance driven by UK cars is 7,090 miles, suggesting nearly 19.3 million drivers could be being overcharged.

New research shows nearly 19.3 million UK drivers are at risk of being overcharged for their car insurance thanks to a ‘low mileage penalty’.

UK pay-by-mile car insurance provider By Miles’ analysis of 1.7 million car insurance quotes on comparison site MoneySuperMarket reveals that low mileage drivers (motorists who drive under the UK average of 7,000 miles annually) are paying an average of £180 a year more than those that drive over 7,000 miles each year.

Traditional insurance providers spread the cost of insuring drivers across all of their customers to keep insurance premiums affordable for higher mileage drivers – the result being that lower mileage drivers end up subsidising higher mileage drivers increased risk and paying more despite driving less.

For example, the most popular annual mileage bracket declared in the data was between 5,000 and 6,000 miles. These low mileage drivers are being charged up to £215 more than motorists completing more than double that distance per year (11,000 – 12,000 miles).

Low mileage drivers aren’t more likely to claim

The quote data shows that the more miles someone drives, the more likely they are to make an insurance claim. While motorists who clock up 12,000 miles a year are 50% more likely to declare a claim in the past 5 years (when compared to the average low mileage driver completing under 7,000 miles annually), they are 300% more likely to declare a claim than those driving 1,000 miles a year. Despite this, lower mileage drivers are not rewarded with lower premiums for their safe, and reduced, driving.

Even experienced drivers are at risk. Drivers between the ages of 40 and 49 driving 5,000 - 6,000 miles a year are still paying an average of £150 more for their car insurance than motorists declaring double that distance.

By Miles is calling on the Association of British Insurers (ABI) to put an end to the low mileage penalty, and has sent an open letter to the body to ask for insurers to review their pricing to reflect reduced risk with decreased mileage, as well as greater transparency on pricing structures.

James Blackham, co-founder of By Miles, comments: “People are still reeling from the insurance industry’s loyalty penalty scandal and now we have another – the low mileage penalty. At a time when drivers are completing fewer miles during the lockdown, the unfairness of the traditional car insurance pricing structure is clear to see. If you drive less, you should pay less.

It’s a fact that lower mileage drivers are less likely to claim, so there is no logical reason for the higher charges they’re facing.

“Insurers must stop inflating premiums for lower mileage drivers to subsidise the higher claims costs of higher mileage motorists and start actively rewarding people for driving less. The technology needed to log the actual miles completed by drivers already exists, and it’s unfair to keep overcharging low mileage drivers just because that data isn’t being properly taken into account by insurers.

“We’ve taken steps to challenge the industry to act in a more transparent way. We believe the change can happen. Insurance needs to evolve to work in this new world.

“As a nation, we’re on a drive to lower carbon emissions and reducing car insurance costs for those that cut their mileage would be a strong incentive to reward and encourage positive changes in behaviour.

“Any lower mileage drivers who are concerned they might be impacted by this charge should join us in asking the industry to bring forward a fairer pricing for lower mileage drivers. If you do drive under 7,000 miles a year (that’s 150 miles a week) you could benefit from a pay-by-mile insurance policy – which rewards you for driving less. We make sure people who drive less, pay less.”

By Miles provides the UK’s leading pay-by-mile car insurance offering, ensuring motorists pay for the miles they drive – in a transparent and more flexible system.

Dave Merrick, Head of Motor at MoneySuperMarket comments, “At MoneySuperMarket, we want to help households across the country save money on their car insurance.

“If you have a low annual mileage, you may want to consider pay-as-you-go car insurance. Insurers such as By Miles offer a fixed annual cost which covers your car while it’s parked, meaning you only pay for the miles you drive each month.

“The most important thing is to shop around and find the best deal for your needs. You could save up to £269.”