About 18 months ago, I began writing a book about my experiences in the insurance industry. Mike McGavick, the CEO of XL Group Limited and who became my boss after XL acquired Catlin Group Limited, suggested in one of our first meetings after the acquisition that I share my knowledge of the industry with a wider audience. I quickly recruited Jim Burcke, who handled communications and media relations for Catlin for more than a decade, to be my co-writer. I would share my ideas with Jim, who would make sure that they were written down properly.

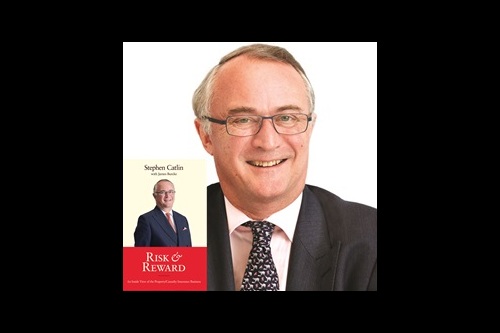

After a lot of hard work and considerable soul searching on both of our parts, the book, ‘Risk & Reward: An Inside View of the Property/Casualty Insurance Business’, has finally been published.

In 'Risk & Reward', I have drawn on more than 40 years of experience as an underwriter and insurance company executive to discuss some of the more important practices and concepts underlying the insurance business, subjects like underwriting, claims management, reinsurance, reserving, and the relationship between insurers and brokers.

The book also traces how Catlin Group Limited evolved from a tiny Lloyd's underwriting agency when I founded it in 1984 to a global insurer that wrote US$6 billion in annual premium volume when it was acquired in 2015. In addition, the book includes my thoughts regarding Lloyd's, including its turbulent history over the past 40 years, its role in today's global insurance industry and its future prospects.

Finally, the book covers subjects that any insurance organisation faces, including the necessity of strong leadership, how to attract and retain talented employees, how to build a cohesive brand, and how to work with – rather than against – regulators. In the final chapter, I attempt to outline the challenges that the insurance industry currently faces, including cyber claims and its woeful lack of success in solving what I call ‘the process problem’.

‘Risk & Reward’ is not an autobiography or a memoir as such. What I have attempted to do is – with Jim’s help – is to write a book that covers what a person really needs to know about the insurance business, with my experiences and opinions thrown in. While I hope anyone working in the insurance business will enjoy reading ‘Risk & Reward’, I think the book is especially valuable to newcomers to the insurance industry.

The book also includes a foreword by Nikolaus von Bomhard, the recently retired chairman of Munich Re’s board of management, as well as an afterword by Mike McGavick, XL’s CEO.

Hardbound copies of 'Risk & Reward' are available for £24.99 from either Amazon's UK site https://www.amazon.co.uk/Risk-Reward-Property-Casualty-Insurance/dp/0957559550/

Add new comment