The FCA’s thematic review of Price Comparison Websites (PCWs) is surely a welcome announcement. In the blurb on the FCA website, they say:

“Price comparison websites (PCWs) are a valuable tool for shopping around, but consumers may not be getting the best deal if they focus solely on price instead of the level of insurance cover.”

As a non-advised sale, it’s hard to imagine how, without giving consumers reams and reams of insurance blurb to read, PCWs will easily tackle this issue to the satisfaction of the regulator without eroding the slickness of their sales processes.

This news must auger well for those insurance brokers that provide their clients with a ‘high-touch’ professional service focused on delivering great advice and value (making sure what is being sold will deliver for the client).

Even if we don’t like to admit it, PCWs are highly adept distribution platforms and I wouldn’t be surprised that if they turned their focus to a different industry they would enjoy some success there as well. They get technology, distribution, are forward thinking and what’s more, they have the resource.

PCWs have seduced consumers with marketing that has seen the insurance catchphrase and jingle become commonplace. On the face of things PWCs entry into the UK market could be seen as a good thing for the consumer. That would be true, I guess, if all consumers cared about were cheap, cheap, cheap insurance premiums.

We all know that is seldom the case. Insured’s want competitively priced insurance products that meet their precise needs and will respond well in the event of a loss so that they can get on with their lives.

Sadly the focus of PCW’s is all too often aimed at cost, price and saving money. It’s probably fair to say that they have played a role in commoditising the personal lines insurance space.

At the same time, the subject of insurance itself has been trivialised by folksy gimmicky advertising. Fancy making a decision to purchase an insurance policy designed to protect one of your prized assets because you get a free cuddly toy?

The fact is that insurance policies are sometimes complicated legal contracts that need explaining and this is where using a professional insurance broker adviser can help.

Where’s the value?

Now we’ve all known for a long time that you get what you pay for and price shouldn’t always be the determining factor.

As a general rule, as consumers, we don’t buy the cheapest products available and yet when it comes to insurance this basic rule seems to go out of the window. If consumers did always buy on price and price alone then many of the worlds’ leading brands would go out of business, because arguably the consumer could always find a cheaper alternative elsewhere.

To counter this, enlightened brands have worked tirelessly to focus consumers’ minds on the inherent value of their products. In this regard there is arguably an education piece here for the UK insurance community to pick up that seeks to inform consumers on what ‘value’ looks and feels like in the round.

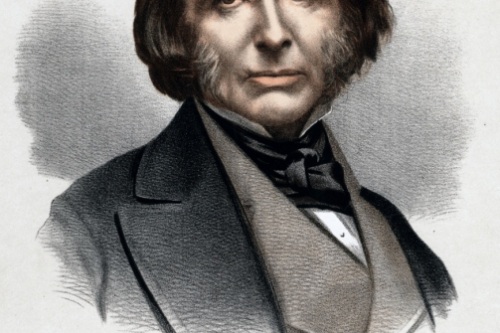

The debate surrounding the subject of value and price isn’t new, John Ruskin, the famous Victorian all-rounder wrote as much in his meditation ‘Common Law of Business Balance’

“It’s unwise to pay too much, but it’s worse to pay too little. When you pay too much, you lose a little money — that is all. When you pay too little, you sometimes lose everything, because the thing you bought was incapable of doing the thing it was bought to do.”

Maybe it’s time for this 19th century wisdom to be refreshed and catapulted into common use in the 21st century. If this latest FCA review has at its heart, ensuring that clients are treated fairly, then they should look at the service being delivered to personal lines clients by the large number of quality insurance brokers up and down the country who take time to fully explain why the advice they are giving to their clients is best for them (suitability statements).

The FCA should take this evidence and use it as a benchmark as part of their review. It can only be a good thing for insurance buyers in the end.

Add new comment