Construction sector borrows the most to fund insurance

Wholesale and Retail Trade is the fastest growing sector, Premium Credit Insurance Index shows

More than half of SMEs use some form of credit to pay for insurance, borrowing an average of £1,080

New analysis from the UK’s leading insurance premium finance company, Premium Credit, shows the Construction sector borrows the most to fund insurance but the Wholesale and Retail Trade sector is the fastest-growing.

Premium Credit’s Insurance Index, which monitors insurance buying and how it is financed, shows 55% of SMEs now use some form of credit to pay for insurance borrowing an average of £1,080. Around 15% of them say they have borrowed more than £3,000.

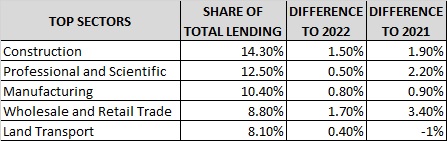

Construction firms were the most likely to use credit – they accounted for 14.3% of all net advances from Premium Credit last year. That was 1.5% higher than in 2022 and 1.9% higher than 2021.

The Professional and Scientific sector accounted for the second highest share of net advances at 12.5% last year followed by Manufacturing on 10.4%, Wholesale and Retail Trade on 8.8% and Land Transport on 8.1%.

However, it’s the Wholesale and Retail Trade sector which is recording the most growth – its share of net advances at 8.8% is 1.7% higher than in 2022 and 3.4% up on 2021.

Premium Credit’s Insurance Index shows around 50% of SMEs say the cost of their business insurance has increased in the past 12 months with 12% reporting dramatic increases. Around 17% of firms questioned say they have cut other costs in their business as a result of insurance premium increases in the past two years.

The table below shows the top five sectors for share of total lending to buy credit and how that has changed.

Jon Howells (pictured) Chief Commercial Officer at Premium Credit commented: “Insurance is vital for business operations across a wide range of sectors as demonstrated by the strong growth in net advances we have seen year on year. It is particularly important in the construction sector which is consistently the biggest sector for lending.”

Premium finance companies like Premium Credit provide businesses and consumers with the ability to use a loan to pay for their insurance in monthly instalments. By managing insurance payments in this way, businesses and consumers can spread the cost of their insurance, rather than pay their premiums in one lump sum.

Authored by Premium Credit

About Premium Credit

We are the leading provider of premium finance in the UK and Ireland, and the only company endorsed by BIBA.

We are authorised and regulated by the Financial Conduct Authority, and work with over 3,000 producers of all sizes. We serve over 2.1 million customers, process 24 million direct debits and receive advances of £3.5 billion.

For over 30 years, we’ve led the market through thought leadership, innovation and technology and have helped our partners offer finance compliantly to their customers through face-to-face, telephony and online channels.

We continue to invest to ensure we provide a quality service and support that helps you grow your business and commission. From the delivery of a seamless customer journey, which includes real time decisioning for financing and 24/7 account servicing, to consultation that improves the offer of finance to customers, we are committed to growing the premium finance market.

Our Specialist Lending division also provides finance to pay other annual costs, such as professional fees, membership subscriptions, commercial service charges, golf clubs and school fees.