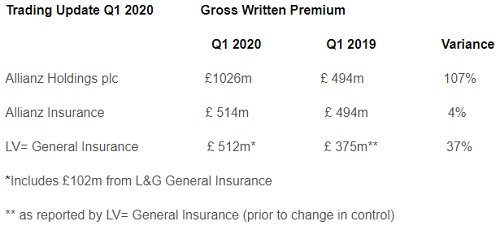

Allianz Holdings plc trading update for first quarter 2020

Jon Dye, CEO, Allianz Holdings, commented: “This is the first quarterly update of the enlarged Allianz Holdings Group, incorporating Allianz Insurance, LV= General Insurance and the general insurance business acquired from Legal & General. We opened a new chapter for our business and it would be no exaggeration to say that this coincided with the start of an unprecedented period for the market and the country, as we live through the largest insured event in history. I am tremendously proud of the way in which our colleagues across the business have performed against this backdrop. We mobilised quickly and effectively to achieve a remote working model which has maintained service levels to our customers and brokers, and we continue to adapt to meet the demands of this evolving situation. As part of our commitment to our people, we announced that no one would be furloughed.

“The company has doubled in size to become the second largest general insurer in the UK and achieved substantial underlying growth in both Commercial and Personal lines. However, the quarter also saw significant claims for storms and floods amounting to £68m, and the slowdown in new business due to COVID-19 was already being felt at the end of Q1.”

Steve Treloar, CEO of LV= General Insurance, added: “At LV=, we pride ourselves on always trying to do the right thing for our people, customers, suppliers and the communities we operate in. Our people work tirelessly every day to ensure our customers are put at the heart of everything they do and never has that been more true than it has been in these last few weeks, as we’ve all faced the challenges presented to us by COVID-19. From a performance perspective, the strength of our brand and the strong foundations we have as a business have resulted in us being able to deliver a good result, achieving solid growth in what continues to be an extremely competitive market.”

Allianz Insurance

The Allianz Commercial lines book grew by 7% in Q1, with a particularly strong performance in the Motor book. However flood related claims on the Motor Trade, Property and Packages accounts amounted to £43m, which was significantly above our provision for natural catastrophes.

Petplan continues to perform well, growing by 6% to help counterbalance ongoing claims inflation in the pet insurance market and the Engineering, Construction & Power insurance business has also achieved healthy growth.

Where businesses have purchased cover that enables them to claim for Business Interruption due to COVID-19, we’ve made over 200 interim and final settlement payments.

We have created the Coronavirus resource hub with FAQs and useful information to support customers in managing their businesses through this crisis.

In broker markets we’re responding to adjustments to exposures, change of use and policy conditions and payment restructure requests in a flexible manner.

Recognising the changing needs of SMEs, we've taken steps including automatic extension of cover for working from home, a temporary extension of full cover where premises become unoccupied and flexibility in our change of business underwriting appetite when this is humanitarian in nature or to protect employment.

Our Engineer Surveyors have overcome particular challenges to take a lead in supporting the national response to the Covid19 epidemic by ensuring critical industries are able to operate with safe plant and machinery.

Within ten days of lockdown, Petplan achieved normal service and continues to pay 90% of claims within five working days, receiving a Trustpilot rating of 4.5 / 5.

To support our communities, we have doubled our colleagues’ paid volunteering hours and made a donation of £100,000 to the British Red Cross and the National Emergencies Trust Coronavirus appeal.

LV= General Insurance

Trading in the first quarter was positive, delivering £512 million in GWP which included £102 million from L&G General Insurance. This is up 37% from the prior year. The business is in good health and we continue to maintain good momentum.

Our business was impacted by Storm Ciara, Dennis and Jorge, resulting in 12,000 claims at a cost of £26 million.

We recently announced that we’re making £30 million available to our direct car and motorbike insurance customers through our Green Heart Support to help those who are experiencing financial difficulties as a result of coronavirus. The money is being made available due to the savings that we expect to make as a result of reduced claims during the lockdown.

We’ve been helping all customers, across direct and broker, to reduce premiums by temporarily changing the cover they have. We’re also not charging administration or cancellation fees and waiving excesses on claims for the hardest hit financially, as well as offering free enhancements to cover for customers who are NHS and key workers.

We’ve been supporting our partner supplier network through increased payments to some suppliers, including bodyshops, breakdown drivers and home contractors.

As part of a wider contribution to the community we also launched The Green Heart Difference, helping our employees support local communities.

We also gave the Royal College of Nurses a donation of £85,000 as they are a key partner.

Outlook

There is much uncertainty around the UK’s short and medium term economic prospects and there will undoubtedly be recessionary impacts on the market resulting from COVID-19. Allianz is well-equipped to manage through the challenges of the future and to provide the products and services our customers demand.

Authored by Allianz

About Allianz

Allianz Insurance is one of the largest general insurers in the UK and part of the Allianz Group, a leading integrated financial services provider and the largest property and casualty insurer in the world.

The mission of Allianz Insurance is to be the outstanding competitor in our chosen markets by delivering products and services that our clients recommend, being a great company to work for and achieving the best combination of profit and growth. We aim to achieve this by putting the customer at the heart of everything we do.

Allianz is able to offer customers a wide range of products and services including home and motor and commercial insurance with full range of products and service for sole traders' right up to large commercial organisations.

Allianz Insurance employs over 4,500 people across a network of 20 offices in the UK and the company’s Head Office is situated in Guildford, Surrey. Our heritage and financial strength help make Allianz what it is today; a safe and trusted partner. Over 40 FTSE100 companies partner with Allianz. youTalk-insurance sharing Allianz Insurance news and video