What’s behind large losses in law firms?

Travelers data reveals key themes and risk management priorities

In a time of economic instability, a law firm that experiences a large loss may find itself in an especially difficult position. In addition to having to ride the waves of the current business environment, the firm could also face higher insurance premiums following the loss, then find less competitive options for professional indemnity cover as a result.

Many law firms are feeling the pressure. Data from the Solicitors Regulation Authority found that in the 12 months ending in June of this year, 572 law firms had closed, while over roughly the same period, 383 firms had opened. Although a sliver of the closures (17%) happened due to a merger/amalgamation, the majority of other closures occurred because the firms had ceased practising.

Mitigating large losses can help smooth the waters for firms. Insurers, of course, also have a vested interest in helping their law firm clients anticipate their risks and take action to contain them – and the loss patterns they identify can say a lot about the exposures of a profession.

Loss patterns emerge from the data

Paul Smith (pictured above), Senior Risk Management Consultant at Travelers Europe, studies data about losses in solicitor firms in an effort to identify such patterns which hopefully shines a spotlight on where risk management can help. Recently, he reviewed sets of solicitors’ data between October 2000 and September 2023 to gather a significant data set of large loss claims, which the insurers defined as being over £250,000. While that figure in 2001 would represent a much larger amount than it does in 2023, due to inflation, there are still some clear themes that emerged from the research. Specifically:

Large losses are persistent, becoming more costly, and happen for law firms of all sizes: Smith noted that there have been a high number of claims for large losses in recent years and the total severity of those claims has been trending up. While one might assume large firms are responsible for the largest losses, these claims tend to spread across all sizes of firm, not just the large or small firms.

The top five areas driving large losses in law firms appear consistently over time: From 2001-2023, commercial work represented 30% of claims notifications and 50% of damages claimed. The remaining four areas included commercial litigation, commercial property, residential property, and trust & probate. However, commercial work remains a clear outlier in the severity and frequency of its risks to firms.

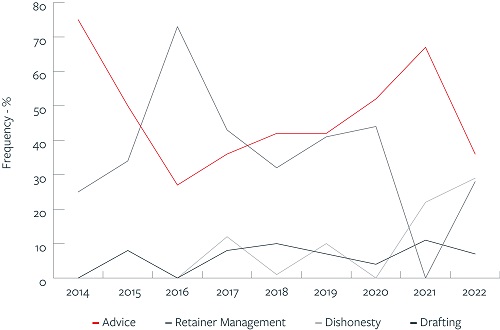

There are patterns in the kinds of errors that lead to claims for large loss: Firstly, large loss cases tend to involve more failures of advice than in the overall book. Secondly, the most frequently notified errors pertain to retainer management failure. These errors are often very simple, such as not following instructions, taking the wrong step in a process, or missing a time limit. Finally, dishonesty has been on an upward trajectory since 2020 and involves a mix of methods, such as identity theft, fraudulent sellers, or the interception of payments and the changing of bank details.

Trend chart of errors leading to claims

Mapping legal work areas onto errors reveals more specific risk management targets: Commercial work presents the main challenge for firms looking to reduce errors in retainer management, drafting and advice as all three areas are claim hotspots. Commercial property and commercial litigation generate claims in retainer management and advice. In residential conveyancing, claims involving dishonesty (whether the dishonesty is by an employee or a third party) are a hotspot where firms could focus their attention.

Hotspots matrix of work areas and errors

Mitigating large losses

Given the data above, what can law firms do to manage and mitigate the risk that errors will generate claims for large losses? Targeting some types of error could potentially present faster results than others.

Retainer management errors, for example, tend to be simple mistakes and tend to be the result of human error, such as distraction, in turn caused by stress, pressure or fatigue. Where slips and lapses in procedure occur, a firm should ask whether this is possibly a reflection of the culture of a firm as a whole and whether steps could be taken to address or improve the work environment. While many firms have taken steps to support the mental wellbeing of their employees, recent research has found that these changes haven’t gone deep enough. Indeed, while nearly three-quarters of law firms report having initiatives in place to support employees’ mental health, this year there has been a 24% increase in the number of people contacting LawCare, the mental health and wellbeing charity for legal professionals.

“Lawyers who are often tired and feel pressured to work are more likely to make mistakes,” Smith said. “Poor sleep disrupts our circadian rhythms – the changes in our body functions over a 24-hour cycle, governed by exposure to lightness and darkness. That disruption can have adverse effects on our physical and mental health. It can set the stage for distraction, as well as affecting our decision-making ability. In extreme cases, it can warp an individual’s moral compass”

The other error hotspots Smith identified may also have roots in the degree of physical support available to lawyers and the pressures this can generate for them. Lawyers tend to pride themselves on getting advice right, so if they are making advice errors, they may lack the support systems required to perform research and associated tasks properly. Dishonesty claims tend to involve poor systems particularly with regard to cyber security, or reduced awareness of the nature and scale of cyber threats, and can result when high work-related pressures combine with a lack of supervision.

“Law firms are inherently high-pressure environments and the pressures can present themselves in a range of forms,” Smith said. “These pressures can and do lead to large losses, and the firms that take a step back to assess the reasons for those losses, and make changes can strengthen their foundation against the economic headwinds that may debilitate other firms.”

The information provided in this article is intended for use as a guideline and is not intended as, nor does it constitute, legal or professional advice. Travelers does not warrant that the information in this article constitutes a complete and finite list of each and every item or procedure related to the topics or issues referenced herein. Travelers does not warrant that adherence to, or compliance with, any recommendations, best practices, checklists, or guidelines will result in a particular outcome.

About Travelers

We wrote the first auto insurance, the first aircraft liability insurance, and even the first personal accident cover for astronauts.

In today’s fast-changing world, this heritage of adventure really counts. With an extended network of underwriting, claims management, and industry experts in 125 countries, we’re here to insure your clients’ ambitions – no matter their size and scope. Our expertise and experience deliver policies that help them continue their journey.

With businesses facing ever more emerging and evolving issues, our suite of insurance products offers bespoke cover for each risk, and our commitment to genuine, caring partnerships means we’ll always be there to advise and support our clients and our broker partners, – whatever the future holds.

The Travelers Companies, Inc. (“TRV”) is a leading provider of property liability insurance for motor, home and business. The Group has more than 30,000 employees and operations in the United States, Canada, UK and Ireland.

The group has total assets of approximately $110 billion, shareholders’ equity of $26 billion and total revenue of $32 billion, as of December 31, 2019. Our European based operations offer our customers a wide range of coverage through Travelers Insurance Company Limited, Travelers Syndicate Management Limited (Syndicate 5000 at Lloyd’s), Travelers Underwriting Agency Limited and Travelers Insurance Designated Activity Company.