Travelers uncovers the risks driving solicitors’ professional indemnity claims

In a recent interview, James Graham, Managing Director of Professional Indemnity at Travelers, asked Paul Smith, Senior Risk Management Consultant at Travelers, to share his findings about the shifting Professional Indemnity claims landscape, as well as his thoughts about how firms can best manage their exposures.

Paul, you and a Travelers colleague have been studying long-term trends in Solicitors Professional Indemnity claims. What is your research telling you so far?

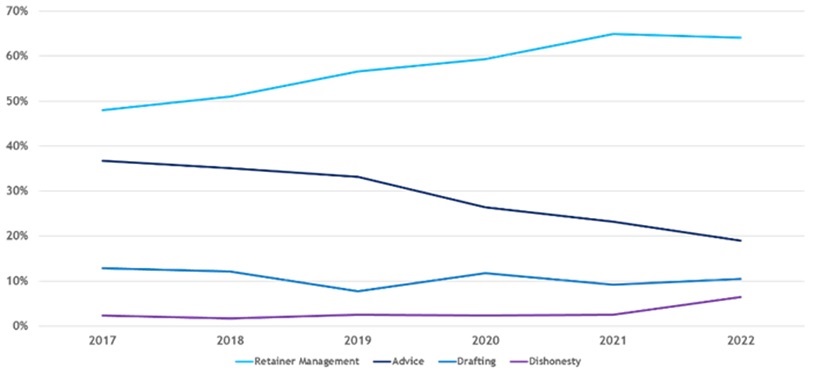

The main trend we’re seeing is a rise in retainer management issues and errors due to slips and lapses. These errors are often very simple – not following instructions, taking the wrong step in a process, or making a drafting error, for example. When these kinds of claims happen, they are not the result of a failure of advice but rather the result of distraction driven by stress, pressure and fatigue. If people are pushed, they will make mistakes. These claims have been scaling up rather remorselessly over the past five years – not just over COVID. They say a lot about the environment in which legal professionals work.

Claims trends: rising retainer management issues over the past five years (click on the image below to expand)

Source: Travelers Europe, 2023

It sounds like while COVID may have magnified the pressures legal professionals face, it didn’t create new ones. What do claim trends illustrate about the challenges of the profession – both during COVID and beyond it?

Lockdown was a massive experiment in behaviour: The stress, fatigue, illness, longer work hours, and struggles with working from home and home schooling created a breeding ground for retainer management failure. Indeed, during lockdown we saw three retainer management failure cases for every advice failure case. Pre-lockdown, the ratio was 2:1. While cases increased during COVID, the conditions that lead to these cases are inherent to the legal profession. Employees are going to work hard. They are going to deal with stressful situations. It’s an environment I remember well from my own experience working as a lawyer.

So, if this high-pressure environment is inherent to the profession, how can firms best manage the risks and pressures that accompany it?

If every hour is an opportunity to make money, people will work longer hours. The potential for slips or lapses in concentration from fee earners increases with fatigue, pressure and stress. This, in turn, can lead to retainer management failure – this might include errors in organising a matter, such as getting the client’s instructions or facts wrong, missing a deadline, missteps in progressing a matter, or, in other words, process errors.

More firms are taking steps to protect the mental wellbeing of employees – and regulations could be changing in this regard too. The Legal Services Board recently authorised the Solicitors Regulation Authority to explicitly require law firms to treat employees fairly and respectfully. Is this a meaningful sign that law firm culture is evolving?

Some law firms are concerned they will now face complaints about employees struggling with mental health and being treated differently. But it’s another sign that firms must act now to ensure their employees are fit to practise. If firms don’t work safely and deal with mental health issues, they are going to get claims. Employees are a firm’s most important asset. They need to be protected.

Aside from the retainer management issues you’re seeing, are any larger trends emerging in the Professional Indemnity space?

The Professional Indemnity market is linked to the economy. When times are good, you see more deals being made. In an economic downturn, you see an increase in litigation and claims related to that. So, the challenges we’re experiencing in the current economy will likely be reflected in the claims data we are studying. It’s something we’re watching as we help firms assess their business risk.

Authored by Travelers

The information provided in this document is for general information purposes only. It does not constitute legal or professional advice nor a recommendation to any individual or business of any product or service. Insurance coverage is governed by the actual terms and conditions of insurance as set out in the policy documentation and not by any of the information in this document. Travelers operates through several underwriting entities through the UK and across Europe. Please consult your policy documentation or visit Travelers online in the UK or Ireland or for full information.

About Travelers

We wrote the first auto insurance, the first aircraft liability insurance, and even the first personal accident cover for astronauts.

In today’s fast-changing world, this heritage of adventure really counts. With an extended network of underwriting, claims management, and industry experts in 125 countries, we’re here to insure your clients’ ambitions – no matter their size and scope. Our expertise and experience deliver policies that help them continue their journey.

With businesses facing ever more emerging and evolving issues, our suite of insurance products offers bespoke cover for each risk, and our commitment to genuine, caring partnerships means we’ll always be there to advise and support our clients and our broker partners, – whatever the future holds.

The Travelers Companies, Inc. (“TRV”) is a leading provider of property liability insurance for motor, home and business. The Group has more than 30,000 employees and operations in the United States, Canada, UK and Ireland.

The group has total assets of approximately $110 billion, shareholders’ equity of $26 billion and total revenue of $32 billion, as of December 31, 2019. Our European based operations offer our customers a wide range of coverage through Travelers Insurance Company Limited, Travelers Syndicate Management Limited (Syndicate 5000 at Lloyd’s), Travelers Underwriting Agency Limited and Travelers Insurance Designated Activity Company.