Planning and executing in periods of uncertainty

Authored by QBE Executive Director, UK Insurance, Cécile Fresneau

Many firms are struggling to forge a path forward amidst the continuing uncertainty of the Covid-19 crisis and its wider social and economic impacts. Even for those industries that have not borne the full brunt of the crisis, the impacts of the Covid-19 crisis have increased uncertainty exponentially.

Before the crisis our Unpredictability Index1 showed that 70% of businesses had not taken basic steps to plan for periods of uncertainty. The crisis has intensified this issue. Driven by everything from a perceived lack of information and tools to organisational inertia and outright fear, many firms have not been able to plan, or more importantly act, to protect their businesses or take advantage of emerging opportunities.

This article will explore steps you can take to drive more effective planning in these uncertain times to enable your business to move forward decisively.

Three things to understand about uncertainty

1. Uncertainty isn’t binary.

Business environments aren’t either certain or uncertain, but instead are impacted by wide range of variables, each with varying levels of uncertainty. While planning in high levels of uncertainty can be quite daunting, analysing the uncertainty at a more granular level can be a helpful place to start.

2. Uncertainty isn’t uniform.

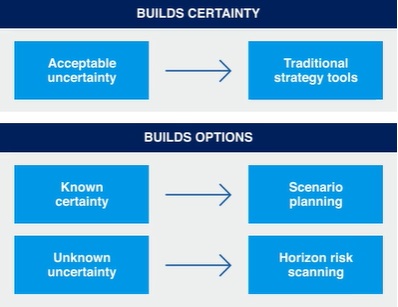

There are different types of uncertainty, each with its own unique characteristics. Ranging from acceptable variation in plans through to major unforeseen events, understanding the type of uncertainty you are facing is the first step in planning a way through it. These types of uncertainty can be broadly characterised as acceptable uncertainty, known uncertainty and unknown uncertainty.

3. The traditional way of doing things doesn’t work in periods of uncertainty.

The goal of traditional strategy development is to increase the certainty around a particular outcome using extensive analysis and sophisticated tools. It is usually linear in its outlook and seeks to minimize uncertainty rather than embrace it. In times of low uncertainty, the rigour of this approach can be very useful, but in times when that level of desired certainty can’t be obtained, it can grind decision making to a halt.

Armed with this understanding, firms can start to better grasp the uncertainty they are facing and begin to plot a course through it.

Categories of uncertainty

Acceptable uncertainty

The normal variation in plans or events within an acceptable tolerance.

Example

A 5 % increase in aluminium prices impacting the manufacturing costs and ultimate profitability of an auto parts supplier.

Known uncertainty

Major events that are known but have a range of unknown outcomes.

Example

A trade deal is yet to be agreed between the EU and the UK. Possible impacts could range from WTO tariff levels through to tariff free trade on different categories of goods.

Unknown uncertainty

Events that are both not expected or improbable and have an unpredictable outcome.

Example

A global pandemic is declared that shuts down major parts of the economy and sees different regions address the crisis in different and unpredictable ways.

Planning in uncertainty

Planning in uncertainty isn’t about determining what will happen, but instead what might happen and what you can do about it.

While traditional strategy development tools are focused on building certainty into plans and forecasts, uncertainty planning tools aim to uncover what might happen, how it will impact the business and what you can do to prepare for it

Whether used formally or more intuitively, the following more common approaches can be powerful tools in helping to identify future risks, assess your options and develop your strategy. More on these tools and others that can be used to help navigate uncertainty are included here.

Planning tools

Scenario planning:

Scenario planning involves developing different plausible representations of an organisations future (scenarios) based on assumptions about the forces driving the market9. In the current environment this will likely include scenarios about the speed of the recovery, the potential for further lockdowns and extended home working and the impact of extended political uncertainty and trade disruptions

Horizon risk scanning:

Horizon scanning is a systematic method for spotting and analysing potential causes of uncertainty and ensuring adequate preparation in order to build resilience and exploit emerging opportunities. As with scenario planning it is NOT about predicting the future, but instead about preparing for a range of possible outcomes. With our current focus on the Covid-19 crisis and its immediate impacts, it is even more important that a systematic approach is used to ensure the appropriate breadth of thinking.

Zero based strategy development:

Zero-based thinking (ZBT) is a decision-making process based on developing forward looking plans in isolation from legacy decisions or constraints. It is particularly useful in planning for a future that is expected to be considerably different than past periods. While the much echoed line of “If I had known this was coming I would have doubled down on digital” may not seem particularly helpful at this point, this thought process can be useful in establishing priorities and identifying “no regrets” actions.

Other tools for planning in uncertainty

Known uncertainty – A few discrete outcomes: Option value analysis, game theory, decision analysis

Known uncertainty – A range of possible outcomes: scenario planning, disruption and innovation forecasting, latent demand research

Unknown uncertainty - Pattern recognition, non-linear dynamic models, discovery driven planning

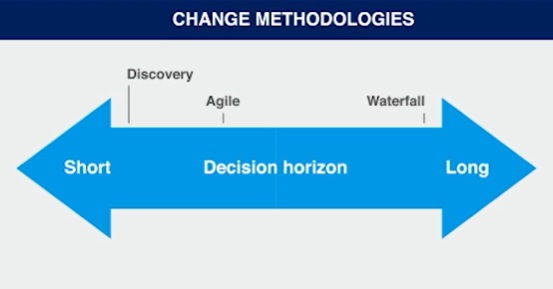

To mitigate this risk, many firms have adopted Agile or Discovery based approaches to better align decision making and investments horizons with different levels of uncertainty.

Delivering change in uncertainty

Traditionally in strategy and execution cycles, a periodic strategy development effort is usually followed by a longer period of execution. While execution plans are often tuned and realigned, the core strategy and objectives are rarely revisited. In times of uncertainty, this linear approach risks being out of step with changes in the market when much greater levels of feedback are required to test and guide decision making.

To mitigate this risk, many firms have adopted Agile or Discovery based approaches to better align decision making and investment horizons with different levels of uncertainty. These can be used both in the context of wider strategic options as well as in the delivery of specific change programmes.

"No regrets" action

While agile or discovery driven approaches are clearly more aligned to greater levels of uncertainty (and the related commitment to particular course of action of or investment requirement), regardless of the approach taken, it is important for firms to identify the “No Regrets”

actions they can take. These are actions that will either have a positive payoff in themselves or are required regardless of the strategic options taken forward. By identifying these actions, firms can maintain forward momentum, while minimising the risk of wasted effort or investment.

Change methodologies

Waterfall

The waterfall model is a breakdown of project activities into linear sequential phases ( e.g. analysis, design, development, testing, deployment and maintenance ).

Decision horizon

Decisions about the goal and how to reach the goal are determined at the outset.

Investment horizon

Programme lifecycle with review checkpoints made through out.

Agile

Agile methodology is a collection of development principles that value adaptability and small, incremental changes to improve quality and provide better responsiveness to changing business or customer needs.

Decision horizon

The goal and a high-level path are set at the outset, but detail about how to reach that goal is determined and tested through the journey.

Investment horizon

Broad estimates at the outset, with investment allocations aligned to the value delivered

Discovery driven

A delivery approach that stems from discovery driven planning approaches13. The approach systematically converts assumptions into knowledge as the programme progresses When new data are uncovered, they are incorporated into the evolving plan.

Decision horizon

Beyond high level return / viability parameters, both the goal and path are discovered through the process. Each further development is assessed independently.

Investment horizon

Aligned to the incremental value of each incremental activity.

Planning and execution cycle

The virtuous circle of understanding, strategy development, execution, and frontline feedback that is important in normal times, is critical in times of uncertainty. Not only does this include a robust market intelligence approach, but also a strong internal feedback mechanism that actively tracks the impact of the firm’s actions and activities.

Given their focus on active market testing, agile and discovery based implementation approaches can be useful in providing elements of this feedback loop, but firms should also look to formalise this feedback more broadly to ensure actions are aligned with changing conditions.

Lessons from the crisis

The initial shock of lockdown proved to be a galvanizing force for many firms as they focused on getting remote operations up and running. But, for many organisations that momentum slowed as the path ahead became less clear5. It was those firms that were able to quickly assess the fundamentals of their markets, fill gaps in their business model and maintain strategic direction that were better able to weather the storm and, in many cases, thrive. This even included businesses in the hardest hit segments with restaurants that pivoted to offer take away, health clubs switching to online offerings and in person sales forces moving to virtual meetings and digitally enabled sales.

In doing this, these firms demonstrated three characteristics critical to succeeding in periods of uncertainty:

1. The ability of leaders to ask the right questions about the fundamentals of their business, even when they did not have all the answers.

2. Real organisational agility and the ability to rapidly adapt the organisation as situations changed.

3. A realisation that financial resilience was more than cost cutting, but instead a focus on maintaining the firm as a going concern.

It was those firms that were able to quickly assess the fundamentals of their markets, fill gaps in their business models and maintain strategic direction that were able to weather the storm.

What should firms do now?

As firms look to navigate this period of heightened uncertainty, using a methodical approach is helpful in focusing attention on the critical issues. Rather than jumping to the “answers”, firms need to ask the critical questions to define and understand the uncertainty they are facing and uncover the options they have to deal with it.

Start with the fundamentals

What are the key drivers to my business? How am I positioned to compete and adapt to changing conditions?

• Who are my key customers / customer groups and how can I ensure that I can still serve them or deliver my product to them?

• Have their needs or requirements changed?

• Who are my critical suppliers?

• Are they still able to provide me with the services I need?

• Are my operations and manufacturing facilities still able to function?

• Has my competitive landscape changed?

• How are my competitors reacting?

• Have any substitutes emerged that fill the same need as my products or services?

• Which parts of my business can adapt quickly, and which parts will take more work?

What can I ground myself on

What fundamental factors have not changed in my market?

• Do my customers still need my products and services?

• Are supplies still readily available?

• Can I still manufacture/ produce my product or service?

What kind of uncertainty am I facing?

• Are there only a few possible outcomes I need to analyse, and can I use traditional decision analysis tools to review them?

• Are there a range of outcomes I need to prepare for, and can I use scenario planning to identify the critical points?

• Is the situation truly ambiguous?

• Are there any discovery6 activities I can initiate to reduce that uncertainty?

What options do I have to address these issues?

• Am I able to develop the relevant scenarios?

• Have they addressed the fundamental business issues?

• Are there common elements across each of my scenarios?

How can I prepare for future uncertainty?

• Am I thinking about the possible horizon risks to my business?

• Have I thought through how probable or severe they might be?

• Do I have up to date information to monitor my environment and how it is changing?

• Are there actions I can take now to mitigate these potential risks?

How do I move forward?

• Are there any “no regret” actions I can take?

• Are there any common elements across my scenarios I can start to move forward?

• Do I need to make any big bets?

• Can I reduce scope through identifying any interim implementation scenarios?

About QBE

QBE European Operations is part of QBE Insurance Group, one of the world’s leading international insurers and reinsurers and Standard & Poor’s A+ rated. Listed on the Australian Securities Exchange, QBE’s gross written premium for the year ended 31 December 2018 was US$13.7 billion.

As a business insurance specialist, QBE European Operations offers a range of insurance products from the standard suite of property, casualty and motor to the specialist financial lines, marine and energy. All are tailored to the individual needs of our small, medium and large client base.

We understand the crucial role that effective risk management plays in all organisations and work hard to understand our clients’ businesses so that we offer insurance solutions that meet their needs – from complex programmes to simpler e-trading solutions – and support them in minimising their risk exposures. Our expert risk management and rehabilitation practitioners focus on helping clients improve their risk management so that they may benefit from a reduction in claims frequency and costs.