How to build financial resilience

Authored by QBE UK Insurance Executive Director Cécile Fresneau

Covid-19 has been tough for businesses and has shown just how vulnerable many are to cash-flow problems. With the situation unlikely to change anytime soon, the key to survival will be learning how to live with it. Getting your financial basics right is a good place to start.

Three basics to live by

Financial resilience is about being able to weather market shocks long enough to adapt business models so you can keep going.

1. Cash is king – no news there, but the reality is a business can be unprofitable for a prolonged period, but it can only run out of cash once before the shutters have to close.

2. Keep your fixed costs as low as possible - there are two types of cost, variable i.e. those that rise and fall along with your level of turnover, and fixed i.e. costs you run up regardless of the level of sales. The lower your fixed costs, the better you can adapt to market conditions.

3. Stay nimble – the more agile your business operations, the quicker and easier you can adapt to what’s happening in the market.

Four question companies should ask now

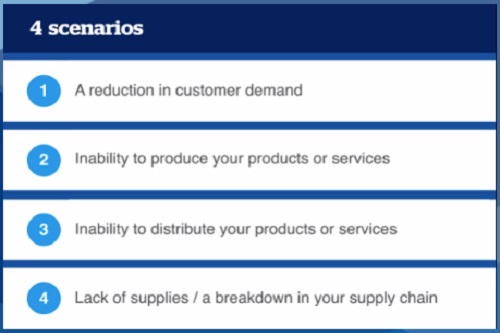

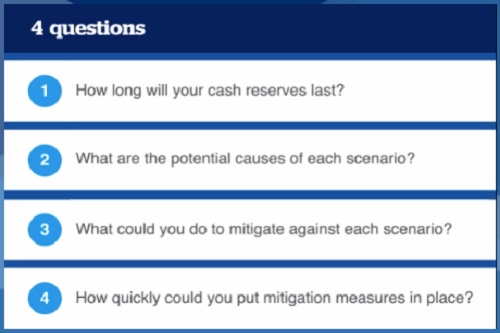

If you are not completely sure what will happen to your business’s cashflow in the event you are periodically forced to close or change how you operate for an indefinite amount of time, think about these four scenarios and ask yourself four questions.

Don’t leave it to the last minute to speak to your bank or other parties you owe money to, if you need assistance. You have more chance of getting the support you need if you have early and open dialogue with creditors.

Four ways to build financial resilience

Whether you are preparing for a crisis or in the middle of managing out of one there are several approaches and avenues of support you can take.

Rolling 13-week cash forecast

This is one of the most useful tools a business can use to manage its financial position. It is all about plotting how much money is coming into and going out of your business and when. The timing part is crucial as this will alert you to moments in the current quarter when cash could be running low so that you can take action before it becomes a problem.

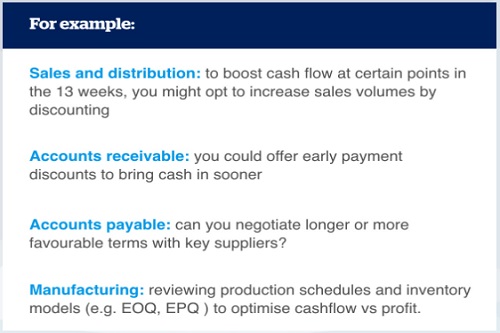

What that action is will depend on the nature of your business but another selling point for the 13-week forecast is that it can be a very practical tool for many parts of your business to adopt.

Talk to banks and other debt holders early

Don’t leave it to the last minute to speak to your bank or other parties you owe money to, if you need assistance. You have more chance of getting the support you need if you have early and open dialogue with creditors. If you leave it too late, to the point where you are breaching covenants or missing interest or capital payments there will likely be less options available to you.

Accounts receivable / Accounts payable financing

Getting money into the business quicker and delaying outgoing payments is one of the most straight forward ways of improving your cash position. While this may not be an option for many companies’ customers or suppliers (especially if they are facing similar market conditions), financing options exist that can enable just that. While accounts receivable factoring has long been a cost-effective way of accelerating payments, there are also firms that offer financing products for payables. These firms typically pay invoices on receipt (taking advantage of early payment discounts) while delaying the ultimate collection from the company for an extended period (e.g. 180 days).

Take advantage of government programmes

Throughout the pandemic many governments have offered and are continuing to offer programmes to assist companies through the crisis. These programmes have included payroll subsidies (e.g. furlough), deferral of tax liabilities (e.g. VAT) and covered loans to assist companies. Every little bit helps when you are trying to stay afloat .

[1] Economic order quantity (EOQ) is the ideal order quantity that a company should place for its inventory to minimize the total inventory costs by balancing the inventory holding cost and average fixed ordering cost

Economic production quantity (EPQ) model determines the quantity a company should produce to minimize cost of production, demand rate, and other costs

Lessons from the crisis

Agility makes all the difference

Many businesses, even those in sectors worst affected by Covid-19, found unique ways to keep the cash coming in. Whether it’s a high-end restaurant delivering home DIY kits for their signature dishes, an events company recreating corporate hospitality experiences virtually or a wholesale retailer doing home deliveries. They all have one thing in common; lateral thinking and the flexibility to put it into action. Take some time out to think about what you could do differently; it may be easier than you think.

Uncertainty isn’t always bad

As the first wave of Covid-19 hit Europe, many businesses were caught unawares and found themselves scrambling to implement practices that had previously eluded them. Prior to Covid, an average business would not have thought their entire workforce could work effectively from home for months on end. Before the pandemic, development projects with the luxury of time and the oversight of unwieldy committees often never got off the ground. Pre- corona, business opportunities requiring a step change in capabilities and approach were planned on the basis of sometimes multi-year implementation. The pandemic forced many initiatives through.

Necessity is the mother of all invention and many businesses will have gained long term benefits from this challenging time.

About QBE

QBE European Operations is part of QBE Insurance Group, one of the world’s leading international insurers and reinsurers and Standard & Poor’s A+ rated. Listed on the Australian Securities Exchange, QBE’s gross written premium for the year ended 31 December 2018 was US$13.7 billion.

As a business insurance specialist, QBE European Operations offers a range of insurance products from the standard suite of property, casualty and motor to the specialist financial lines, marine and energy. All are tailored to the individual needs of our small, medium and large client base.

We understand the crucial role that effective risk management plays in all organisations and work hard to understand our clients’ businesses so that we offer insurance solutions that meet their needs – from complex programmes to simpler e-trading solutions – and support them in minimising their risk exposures. Our expert risk management and rehabilitation practitioners focus on helping clients improve their risk management so that they may benefit from a reduction in claims frequency and costs.