Getting to grips with the financial strength of your supply chain

Authored by QBE Underwriting Manager, Credit & Surety Tom Hunt

With the UK economy finally emerging from lockdown on the 19th July, we will gradually see how businesses have been impacted. Some have fared well through the pandemic, but many UK companies will struggle in the coming months and years.

Overview

The end of furlough programmes and wider government stimulus efforts, (just as the economy is set to grow), will put further strain on firms that are struggling. Couple this with product and labour shortages alongside significant increases in cyber and fraud events and it is fair to say that it could be a very challenging time for you and your supply chain in the coming months and years.

What to watch for

Keeping a close eye on the solvency of your clients is key to avoiding unexpected loss from non-payment. However, assessing solvency and liquidity is no easy task and gaining access to the right information to make this assessment can be even more challenging.

There is always a lag in publicly reported information which is far from ideal, especially now - when keeping ahead of events that could adversely impact solvency or liquidity is more important than ever.

In essence – be inquisitive and question the reasoning for any change in behaviour from your clients. Any departure from the ‘norm’ could be a sign of distress, so enter regular dialogue with your clients and seek to understand what is driving any change in their normal trading behaviour.

Having a good understanding of your clients current working capital requirements and liquid resources available is key. Changes in these levels either way (see hidden perils below) can be an indication that a frank conversation is needed to ensure losses are mitigated and/or avoided.

There are some key warning signs of potential declining solvency and/or liquidity that you can look out for with your clients:

- Defaulting or slowing payments

- Requests to extend or reschedule payment terms (often with urgency).

- Request to increase credit lines substantially (especially over a short period of time).

- Sudden increases (or even decreases) in trade levels. Long periods of time between orders or quickly increasing frequency of orders.

Having a good understanding of your clients current working capital requirements and liquid resources available is key. Changes in these levels either way (see hidden perils below) can be an indication that a frank conversation is needed to ensure losses are mitigated and/or avoided.

So how do you access such information?

A credit insurance partner can obtain and assess this information and will insure you against the risk of non-payment from your buyers (clients).

Client information regularly obtained by Credit Insurers:

- Recent Management Accounts (rather than just waiting for outdated published accounts)

- Cashflow forecasts – a 13 week rolling forecast is especially insightful and predictive.

- Live payment performance data – Client payments slowing? Early warning signs.

A good Credit Insurer will also investigate and convey live issues impacting your clients such as:

- How your client plans to address any impending cashflow shocks

- How are they approaching the end of furlough?

- How will they bridge any gaps left by the end of other stimulus programmes?

- How are they addressing the wider issues in global supply chains such as raw materials shortages, increases in raw materials costs, longer delivery times, and how does this impact the type of contracts they enter? (Fixed cost or cost plus?).

- Does your client have other measures in place (such as a trade credit insurance policy) to mitigate issues in their supply chain?

Understand the hidden perils

In recent years, assessing a firm’s true working capital / debt position has been made more difficult by one issue: Supply chain finance (AKA SCF, reverse factoring / payables finance).

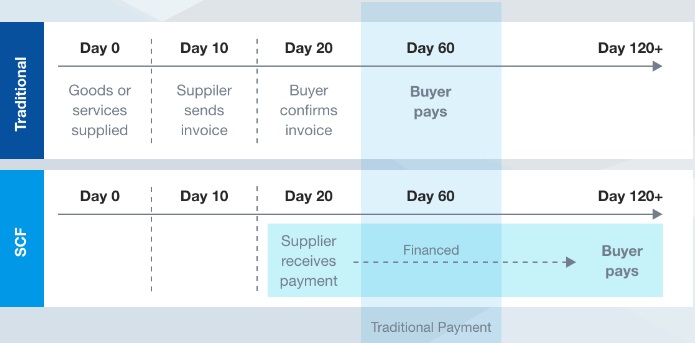

Supply chain finance (SCF) enables suppliers to receive payment early and buyers to pay later (see below):

In the main, SCF greatly benefits supply chain liquidity, but in some instances, it can create unexpected liquidity crises and a false sense of normality in terms of the timing of payments.

When used prudently, SCF can be a useful tool in managing working capital and increasing liquidity in a supply chain, but overreliance can create significant risk in the overall network. This risk is due to the distortion of the natural working capital requirements in an industry and the severe impacts on liquidity occurring if the facilities are withdrawn.

In severe circumstances, firms can go from a picture of health using traditional ratios to insolvent, virtually overnight when a SCF facility is withdrawn. Lack of disclosure in audited accounts often makes SCF facilities very difficult to identify (although new reporting standard requirements are expected to address some of this soon).

What can you do?

As with other supply chain risks, regularly updating your assessment of your stakeholders is the best preparation for potential shocks. This begins with thorough credit evaluation and continues with regular dialogue and monitoring – all of which a good Credit Insurer can undertake for you.

Key points to evaluate:

Thoroughly understand your client’s financial position and plans

A thorough and regularly updated understanding of their financial position and how they are approaching any impending issues

Include any exposures to “the hidden perils”

Active discussion about any off-balance sheet financing being used including Supply Chain Finance. In the case of supply chain finance, understanding any contingency plans in place to work through potential withdrawal of the facilities. How are your clients using the excess cash derived from SCF payments?

Don’t rely on history!

The warning “Historical results may not be an indicator of future performance” is particularly true as we work through the longer-term impacts of the pandemic. Relying purely on credit ratings based on 2019 or even 2020 financial results risks missing major issues in supplier financial position.

Ensure you are insured against any issues that do arise.

Ensuring you and even your extended network have trade credit insurance in place to cover any unexpected exposures can help ensure the cash owed for goods and services continues to flow even when issues do arise.

Be proactive and work with your suppliers

You, your suppliers, and your buyers form an important commercial network – you are part of the supply chain! Therefore, keeping the line of communication open and working with your suppliers/buyers to move through potential issues can often be the most expedient and least costly approach to dealing with supply chain shocks.

About QBE

QBE European Operations is part of QBE Insurance Group, one of the world’s leading international insurers and reinsurers and Standard & Poor’s A+ rated. Listed on the Australian Securities Exchange, QBE’s gross written premium for the year ended 31 December 2018 was US$13.7 billion.

As a business insurance specialist, QBE European Operations offers a range of insurance products from the standard suite of property, casualty and motor to the specialist financial lines, marine and energy. All are tailored to the individual needs of our small, medium and large client base.

We understand the crucial role that effective risk management plays in all organisations and work hard to understand our clients’ businesses so that we offer insurance solutions that meet their needs – from complex programmes to simpler e-trading solutions – and support them in minimising their risk exposures. Our expert risk management and rehabilitation practitioners focus on helping clients improve their risk management so that they may benefit from a reduction in claims frequency and costs.