Building supply chain resilience

Authored by QBE International Chief Financial Officer Chris Killourhy

The global web of tightly connected supply chains has changed global industry dramatically, but the recent crisis has exposed several risks such a tightly connected network presents.

Overview

While the COVID 19 crisis has been the largest shock in recent memory, it is far from the only one we have encountered. As highlighted in our unpredictability index, we are now operating in a world where disruption is a more and more regular occurrence. In fact, QBE research has shown that firms can expect to encounter a significant supply chain shock once every four years on average.

These shocks can take many forms and vary in both the severity and global reach of the event. They can severely impact your ability to produce your products or services or get them to market. The bottom-line impact of these shocks can also be dramatic, with the average firm losing over half a year’s net profit during significant shocks.

While many firms will have systems in place to address the more common shocks, the pandemic has taught us that preparing for tail events isn’t only prudent but, in many cases, vital.

Firms can expect to encounter a significant supply chain shock once every four years on average.

What is Supply Chain Resilience

Supply chain resilience is the ability to weather, bounce back from and adapt to supply chain and distribution shocks. Traditionally only thought of as the ability to weather the initial disruption and bounce back to normal production, in the face of more pronounced disruption, firms are increasingly viewing resilience as the ability to adapt and transform to address the changing landscape.

What to watch for

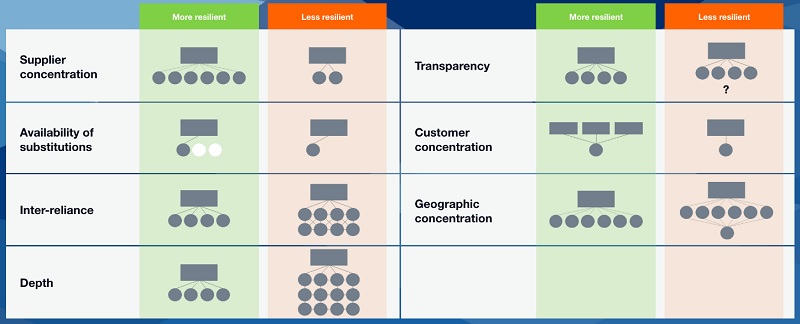

Understanding your vulnerabilities. This is the first step in building supply chain resilience including understanding your direct supply exposures and any secondary/ tertiary exposures you might have (e.g., the suppliers of your suppliers). While global supply chains can be quite complex and opaque, doing your homework to understand the network will pay dividends when planning your response to disruption.

Specific points to be aware of include:

Supplier / distributor structure and concentration: Limiting the list of suppliers can help make networks easier to manage and cost effective, but it also exposes the network to risk. This is also true of the structure of your supply chain, how connected it is and how reliant on other inputs it might be. Understanding your supplier and distributor concentration and structure of your supply chain is critical to preparing alternates and contingency plans.

Geographic concentration and reliance: Many sector supply-chains hold significant geographic concentrations, often without this being immediately visible. While final assembly and distribution may be regional, looking further up the value chain can highlight significant issues. For instance, in the pharmaceuticals industry, while manufacturing of end products often happens regionally, 50%3+ of all active pharmaceutical ingredients used in production in Europe are produced in India or China.

Inventory levels: Historically “Just in time” inventory concepts have focused on improving the efficiency and cost effectiveness of the extended supply chain. More recently firms have realised that this efficiency can come at a cost that far outweighs the benefits when exposed to even minor disruption. Understanding the likelihood, and impact, of disruptions in your supply chain is a key input to determining optimal inventory levels. This includes both major components and raw materials as well as any tools or other minor inputs.

Inherent vulnerabilities in your supply chain: Every sector will have supply chain risks inherent to the type of good or service they produce. This could be spoilage in the food and agriculture sectors to raw material concentration risks in mobile communication technologies. While these risks will likely be front of mind for supply chain managers, it is also important to understand the inherent risks to upstream and connected suppliers.

Supplier financial position: With most of the focus on physical threats to the supply chain, the importance of the financial health of the network should not be forgotten. With todays interconnected supply chains, the failure of one participant can have a dramatic impact on everyone else , both up and down stream. We explore this topic in more detail here.

What you can do

Understanding your vulnerabilities. Build a more transparent supply chain. These are the first steps in building greater resilience in your network. Couple this with the active monitoring of these risks and the state of your network, and you have a powerful tool to prepare for and react to any threats that may appear.

1. Minimise your exposure to shocks

a. Financial precautions: Ensuring you and your suppliers have sufficient coverage and/ or resources to weather a business failure in your network.

b. Balance just in time with just in case: Ensuring the cost of disruption is factored into your inventory planning.

c. Manage your cyber exposure: With cyber risks growing, ensuring your exposures are managed and minimised is critical.

d. Understand supplier alternatives (optionality): Building relationships with a wider set of suppliers / distributors to ensure availability in the event of shocks.

e. Explore regionalisation: Implementing greater regionalisation, particularly in areas that address customer requirements and the wider resilience agenda.

f. Be nimble: Be prepared to adjust production and reroute distribution in the event of shocks

g. Building resilience into production: Ensuring resilience in production capabilities whether at the plant level or more broadly via multiple sites

h. And finally, Be prepared: The greatest way to minimise shocks to your supply chain is being prepared for the worst. Whether you have the resources in place for full redundancy or not, the act of scenario planning different events will mean that when the shock occurs you will be prepared to act.

The greatest way to minimise shocks to your supply chain is being prepared for the worst.

2. Open communication lines with suppliers

Having an active dialogue with your suppliers is the best defence for unexpected shocks to the network. Whether this is informal or systematic, this information could prove invaluable providing advance warning before shocks appear.

3. Take a long term view

Uncertainty, and the resulting potential for business disruption, has become the norm rather than the exception. Taking the long-term view and working with suppliers through difficult periods will only strengthen your network in the long term.

To speak to someone at QBE about this article, CLICK HERE, leave a message and youTalk-insurance will pass your enquiry on.

About QBE

QBE European Operations is part of QBE Insurance Group, one of the world’s leading international insurers and reinsurers and Standard & Poor’s A+ rated. Listed on the Australian Securities Exchange, QBE’s gross written premium for the year ended 31 December 2018 was US$13.7 billion.

As a business insurance specialist, QBE European Operations offers a range of insurance products from the standard suite of property, casualty and motor to the specialist financial lines, marine and energy. All are tailored to the individual needs of our small, medium and large client base.

We understand the crucial role that effective risk management plays in all organisations and work hard to understand our clients’ businesses so that we offer insurance solutions that meet their needs – from complex programmes to simpler e-trading solutions – and support them in minimising their risk exposures. Our expert risk management and rehabilitation practitioners focus on helping clients improve their risk management so that they may benefit from a reduction in claims frequency and costs.