UK SMEs bank on credit to fund business insurance as Covid hits cash

- One in four firms are borrowing more with many relying on credit cards

- Premium Credit’s data shows 11% rise in commercial net advances last year

- Premium Credit Insurance Index is monitoring insurance buying and how it is financed

See Premium Credit Infographic HERE

Many SMEs and corporates are borrowing more to fund business insurance with owners most likely to rely on credit cards, new research from the UK’s leading premium finance company, Premium Credit, shows.

The nationwide study among SME owners and managers found that of those who use credit to pay for insurance premiums, nearly one in four increased the amount they borrowed in the past year, with average additional credit coming to nearly £1,300. Around three out of four (73%) SME bosses interviewed who use credit to pay for insurance premiums say the impact of COVID-19 is the main reason for increased borrowing but premium rises from insurers were also blamed by 36% of firms.

Premium Credit’s Insurance Index shows SME cash balances are being squeezed – around one in three firms (33%) say cash reserves have fallen during the COVID-19 crisis, while 7% say their firm has no cash reserves. Just 13% say they have seen a rise in cash reserves.

Most of the additional borrowing is going on credit cards with 60% of SME bosses putting it on plastic, while 40% are taking finance from insurers and/or are using premium finance. Some 24% are turning to personal or business loans.

Premium Credit’s own data2 reveals its premium finance net advances for commercial insurance increased by 11% in 2020 compared with the previous year, even though the number of policies only rose marginally.

Premium Credit is advising SMEs to consider premium finance, which for a small charge, enables them to pay monthly for cover instead of in a lump sum and is conducting regular research through its Insurance Index to monitor insurance buying and how it is financed.

Owen Thomas, Chief Sales & Marketing Officer at Premium Credit said: “SMEs have demonstrated their resilience and adaptability through the COVID-19 crisis and that has included making good use of credit to ensure they can maintain business critical insurance.”

“Now they are starting to see the light at the end of the COVID-19 tunnel it is important that they plan for the future and it is worrying that so many are relying on credit cards, which can be an expensive way to pay for insurance if you only make the minimum monthly payment. Their insurance broker will be able to advise on how best to fund the appropriate level of cover for their business.”

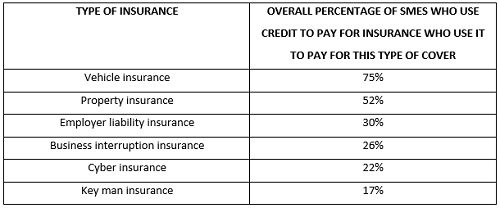

The table below shows the percentage of SMEs who use credit to buy insurance and which products they use it for.

Premium Credit’s research shows the impact of not having insurance or being underinsured – nearly one in ten (9%) firms have suffered damage to property or belongings over the past five years and were unable to claim for this because they didn’t have insurance or because they were underinsured. Average losses as a result were around £2,000.

Steve White, Chief Executive, British Insurance Brokers’ Association commented: “Premium Credit’s research underlines how important credit is in ensuring companies can continue to afford business- critical cover and the role of brokers in supporting firms. Insurance brokers can advise on suitable insurance and discuss premium finance should they want to spread the cost of their policies.”

Authored by Premium Credit

About Premium Credit

We are the leading provider of premium finance in the UK and Ireland, and the only company endorsed by BIBA.

We are authorised and regulated by the Financial Conduct Authority, and work with over 3,000 producers of all sizes. We serve over 2.1 million customers, process 24 million direct debits and receive advances of £3.5 billion.

For over 30 years, we’ve led the market through thought leadership, innovation and technology and have helped our partners offer finance compliantly to their customers through face-to-face, telephony and online channels.

We continue to invest to ensure we provide a quality service and support that helps you grow your business and commission. From the delivery of a seamless customer journey, which includes real time decisioning for financing and 24/7 account servicing, to consultation that improves the offer of finance to customers, we are committed to growing the premium finance market.

Our Specialist Lending division also provides finance to pay other annual costs, such as professional fees, membership subscriptions, commercial service charges, golf clubs and school fees.