Insurance customers increase borrowing to afford vital cover

Customers paying for single or multiple insurance policies with credit increase borrowing by nearly £600 in a year

COVID-19 crisis and the lower cost of borrowing help drive the increase

Insurance customers are increasing the amount they borrow so they can continue to afford cover as the COVID-19 crisis squeezes household finances, new research from the UK’s leading premium finance company, Premium Credit, shows.

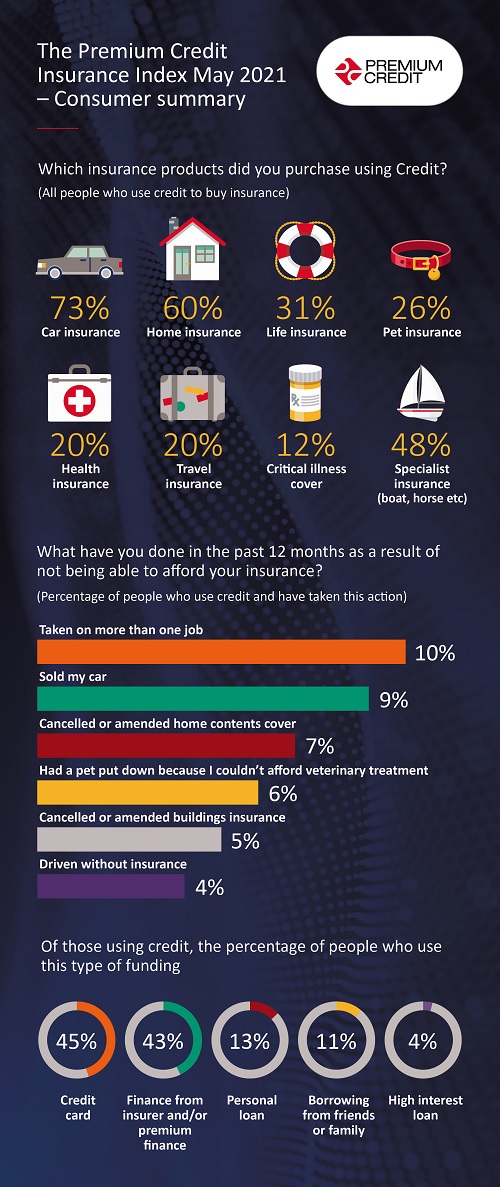

Premium Credit’s research found (see useful infographic) that over the past year, 16% of people have borrowed more to help pay for their insurance cover, compared to 6% who have taken on less credit or the same amount. Of those people using credit, on average they have borrowed £598 extra over the previous year to pay for their insurance needs, Premium Credit’s Insurance Index study found.

Some customers have been unable to afford to continue with insurance – nearly one in ten (9%) of those who borrow to fund insurance have had to sell their cars. That is three times more than the 3% who had sold cars when Premium Credit asked the same question2 in March last year. Around one in twenty (5%) of those who use credit to buy cover have cancelled or amended buildings insurance because they can’t afford the total cost of their insurance, compared with 6% previously, and 7% have cancelled or amended contents insurance compared with 9% previously.

The Index, which monitors insurance buying and how it is financed, found a major driver for the rise in borrowing is the impact of the COVID-19 crisis; with one in five (19%) who have borrowed more say it is because they were furloughed.

But it is not the only reason for the increased borrowing – nearly a fifth (19%) of those who have borrowed more this year to help pay for their insurance say it is because their total insurance premiums have increased while 21% say credit is so cheap it makes sense to borrow money to fund insurance. That is partly reflected in how customers are borrowing the money to pay for insurance – around 45% relying on credit to help buy their insurance are using credit cards, while 43% say they are using finance from their insurer and/or premium finance. Some 11% are borrowing money from friends and family, and nearly one in twenty (4%) admit to taking out high interest loans.

Premium Credit is advising customers to consider premium finance which, for a small charge, enables them to pay monthly for cover instead of in a lump sum. Spreading payments in such a way can help ease cash flow challenges and make paying for vital insurance simpler.

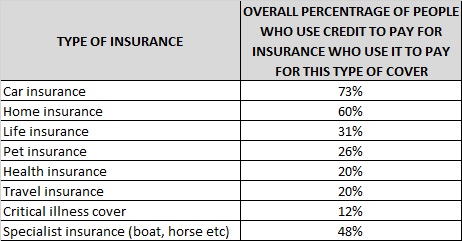

Premium Credit’s study shows widespread use of credit by consumers, as the tables below shows.

Adam Morghem, Premium Credit’s Strategy & Brand Director said: “Premium finance is specifically designed for insurance buyers. Using the right credit to maintain important insurance policies is sensible. Looking to spread the cost of an annual policy into more manageable monthly payments works for many consumers and businesses.”

Owen Thomas, Chief Sales & Marketing Officer at Premium Credit added: “Premium finance has become a very cost-competitive means for consumers to buy insurance and better manage their finances through spreading payments. At a time when insurance is becoming more expensive it can be a good alternative to other forms of credit.”

Ian Hughes, CEO of Consumer Intelligence said: “Premium finance is a crucial enabler, especially in this environment as we come out of lockdown, it allows people to get the vital protection they need if they can’t afford an upfront payment. The continued demand for premium finance shows that this is a crucial part of the service that insurers provide to consumers.”

Around 13% of those questioned in Premium Credit’s survey say they have found it more difficult to secure credit since the COVID-19 crisis started and 15% say they have been rejected for a credit card. The crisis has not been financially bad for all – around 35% questioned said their savings had increased as a result.

See Premium Credit infographic

About Premium Credit

We are the leading provider of premium finance in the UK and Ireland, and the only company endorsed by BIBA.

We are authorised and regulated by the Financial Conduct Authority, and work with over 3,000 producers of all sizes. We serve over 2.1 million customers, process 24 million direct debits and receive advances of £3.5 billion.

For over 30 years, we’ve led the market through thought leadership, innovation and technology and have helped our partners offer finance compliantly to their customers through face-to-face, telephony and online channels.

We continue to invest to ensure we provide a quality service and support that helps you grow your business and commission. From the delivery of a seamless customer journey, which includes real time decisioning for financing and 24/7 account servicing, to consultation that improves the offer of finance to customers, we are committed to growing the premium finance market.

Our Specialist Lending division also provides finance to pay other annual costs, such as professional fees, membership subscriptions, commercial service charges, golf clubs and school fees.