IGI reports Q4 & Full Year 2020 condensed and unaudited financial results

International General Insurance Holdings Ltd. (“IGI” or the “Company”) (NASDAQ: IGIC) has reported condensed and unaudited financial results for the fourth quarter and full year 2020.

Highlights for the fourth quarter and full year 2020 include:

- See Note (1) in the “Notes to the Condensed Consolidated Financial Statements (Unaudited)” below.

- See “Supplementary Financial Information” below.

- See Note (3) in the “Notes to the Condensed Consolidated Financial Statements (Unaudited)” below.

- See the section titled “Non-IFRS Financial Measures” below.

IGI Chairman and CEO Mr. Wasef Jabsheh said, “2020 has been a successful year for IGI on many levels. Our strong financial performance, achieved during a year of significant distraction and disruption as well as during our first year as a public company trading in the U.S., clearly demonstrates the agility, discipline and focus of our teams and our ability to execute and deliver on our strategy.”

“We broadened our footprint by entering new territories and lines of business and increased our market share, with gross premiums up more than 33% in 2020 compared to 2019, while maintaining underwriting profitability at a combined ratio below 90%. We expect to continue on this path in 2021, although likely at a more measured pace, and with the same careful approach to risk selection and portfolio balance.”

“With the first quarter of 2021 almost completed, the indications on price momentum remain very positive, and we are continuing to see exciting opportunities to build and diversify our business. We will continue to be cautious in managing our net exposures to minimize our overall risk profile so that we maintain our long-term track record of generating strong value for our shareholders.”

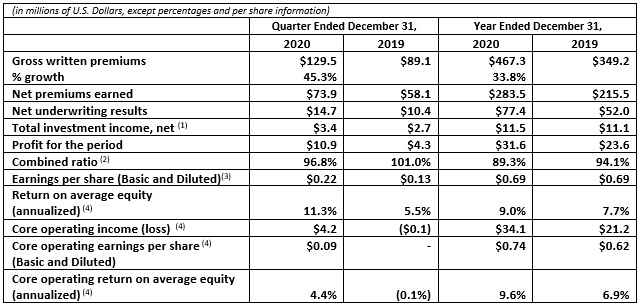

Results for the Quarters and Years ended December 31, 2020 and 2019

Net profit for the quarter ended December 31, 2020 was $10.9 million, up from a net profit of $4.3 million for the quarter ended December 31, 2019. Net profit for the year ended December 31, 2020 increased significantly to $31.6 million compared to a net profit of $23.6 million for the prior year.

Core operating income, a non-IFRS measure defined below, was $4.2 million for the fourth quarter of 2020 compared to a core operating loss of $0.1 million for the comparable quarter in 2019. Consequently, core operating return on average equity (annualized) was 4.4% for the quarter ended December 31, 2020, compared to (0.1%) in the same period of 2019.

The increase in core operating income to $34.1 million for the year ended December 31, 2020 compared to $21.1 million for the year ended December 31, 2019, was primarily the result of a higher level of underwriting income during 2020. While total equity increased by 26.4% due to the capital injection from the Business Combination with Tiberius Acquisition Corp. (“Tiberius”) as well as growth in retained earnings during the year, core operating return on average equity also increased to 9.6% for the year ended December 31, 2020 compared to 6.9% for the same period in 2019.

Underwriting Results

Gross written premiums were $129.5 million for the quarter ended December 31, 2020, an increase of 45.3% compared to $89.1 million for the quarter ended December 31, 2019. For the year ended December 31, 2020, gross written premiums were $467.3 million, up 33.8% compared to $349.2 million for the year ended December 31, 2019. The increase in gross written premiums was the result of new business generated across virtually all lines, as well as improved renewal pricing. While market conditions remained positive, the Company also continued to further refine its existing portfolio, achieving improved terms and conditions.

The claims and claims expense ratio was 59.8% for the quarter ended December 31, 2020, an improvement of 2.7 points over the corresponding quarter in 2019. This included current accident year net catastrophe losses of $6.3 million or 8.5 points for the quarter ended December 31, 2020, compared to $8.3 million or 14.3 points for the quarter ended December 31, 2019. Prior year development on loss reserves was unfavourable amounting to $5.4 million or 7.3 points for the quarter ended December 31, 2020 driven by deterioration in prior year loss reserves in both the Long-tail and Short-tail segments which were impacted by foreign exchange, specifically the strengthening of the Pound Sterling, the Company’s major transactional currency, against the U.S. Dollar. This compares to favourable development of $1.7 million or 3.0 points for the quarter ended December 31, 2019. Catastrophe losses during the fourth quarter of 2020 were driven primarily by Hurricane Laura, a Category 4 storm which caused significant damage in the mid-western U.S., and is included in the Short-tail Segment.

The claims and claims expense ratio was 53.5% for the year ended December 31, 2020, an improvement of 1.3 points compared to the year ended December 31, 2019. This included current accident year net catastrophe losses of $13.5 million or 4.8 points for the year ended December 31, 2020, compared to $16.2 million or 7.5 points for the year ended December 31, 2019. Catastrophe losses for the year ended December 31, 2020 were driven primarily by the storms that damaged cranes at the Jawaharlal Nehru port in Mumbai, India and property damage and business interruption losses resulting from Hurricane Laura, both of which are included in the Short-tail Segment. Favourable development on loss reserves from prior accident years for the year ended December 31, 2020 was $6.1 million or 2.2 points, reduced by the impact of foreign exchange, specifically the strengthening of the Pound Sterling, the Company’s major transactional currency, against the U.S. Dollar. This compares to favourable development of $6.3 million or 2.9 points for the year ended December 31, 2019, which was also impacted by strengthening of the Pound Sterling.

The combined ratio for the quarter ended December 31, 2020 was 96.8%, compared to 101.0% for the same quarter in 2019. The combined ratio for the year ended December 31, 2020 improved 4.8 points to 89.3% compared to 94.1% for the same period in 2019, primarily due to the benefit of increased pricing per unit of exposure.

Segment Results

The Long-tail Segment, which represented approximately 43% of the Company’s gross written premiums for the full year 2020, includes all professional and financial lines written by the Company, including D&O, professional indemnity, financial institutions, legal expenses, as well as surety, marine liability, and general third-party liability (casualty), all of which are non-U.S. exposures.

Net written premiums for the quarter ended December 31, 2020 in the Long-tail Segment were $47.6 million, compared to $37.2 million in the comparable quarter in 2019, primarily driven by growth in the financial and professional lines. The net underwriting result for this segment was a loss of $2.4 million for the fourth quarter of 2020, driven by higher incurred losses in financial and professional lines, compared to a profit of $4.7 million in the fourth quarter of 2019.

Net written premiums for the year ended December 31, 2020 in the Long-tail Segment were $164.3 million, compared to $119.9 million in the comparable period in 2019 driven by growth in the financial and professional lines. The net underwriting result for this segment increased by $7.1 million to $23.5 million for the full year 2020, compared to $16.4 million for the full year 2019, again driven by the financial and professional lines.

The Short-tail Segment, which represented approximately 53% of the Company’s gross written premiums for the full year 2020, includes energy, property, general aviation, ports and terminals, marine trades, marine cargo, construction and engineering, and political violence.

Net written premiums for the quarter ended December 31, 2020 in the Short-tail Segment were $39.7 million, compared to $22.4 million in the comparable quarter in 2019, driven by increases in most lines, as well as the growth of the new U.S. Excess & Surplus business. The net underwriting result for this segment was $14.5 million for the fourth quarter of 2020, up from the $7.6 million recorded in the fourth quarter of 2019, driven by growth in most lines in the Short-tail Segment.

Net written premiums for the year ended December 31, 2020 in the Short-tail Segment were $154.8 million, an increase of $40.6 million compared to $114.2 million in the comparable period in 2019, primarily the result of increases in most Short-tail lines as well growth of the new U.S. Excess & Surplus business. The net underwriting result for this segment improved to $44.4 million for the full year 2020, compared to $35.4 million in the full year 2019, supported by 35.5% growth in net written premiums which was partially offset by a $ 12.7 million increase in net claims and claims adjustment expenses driven by higher incurred losses recorded in the Ports & Terminals, Energy, and Property lines in the Short-tail segment.

The Reinsurance Segment, which represented approximately 4% of the Company’s gross written premiums for the full year 2020, comprises the Company’s inwards reinsurance portfolio.

Net written premiums for the quarter ended December 31, 2020 in the Reinsurance Segment were $2.8 million, compared to $2.9 million in the comparable quarter in 2019. The net underwriting result for this segment was a profit of $2.6 million for the fourth quarter of 2020, compared to a loss of $1.9 million in the fourth quarter of 2019, due to a lower level of claims and claims adjustment expenses in the fourth quarter of 2020.

Net written premiums for the year ended December 31, 2020 in the Reinsurance Segment were $19.3 million, compared to $18.0 million in the comparable period in 2019. The net underwriting result improved to $9.5 million for the full year 2020, compared to $0.2 million for the full year 2019, primarily due to a lower level of claims and claims adjustment expenses.

Investment Results

Total investment income was $4.5 million during the fourth quarter of 2020, compared to $2.9 million in the fourth quarter of 2019. Total investment income, net (which excludes realized and unrealized gains and losses, expected credit losses on investments, and the share of loss from associates) was $3.4 million and $2.7 million for the quarters ended December 31, 2020 and 2019, respectively. This resulted in an annualized investment yield of 1.8% for the fourth quarter of 2020, compared to 1.9% for the corresponding period in 2019.

For the full year 2020, total investment income was $8.5 million, compared to $13.0 million for the full year 2019. Total investment income, net was $11.5 million and $11.1 million for the full years 2020 and 2019, respectively. This resulted in an investment yield of 1.7% for the full year 2020, compared to 2.0% for the full year 2019.

Cash, cash equivalents and term deposits totaled $305.6 million at December 31, 2020, representing 39.4% of the total investments and cash portfolio, compared to $312.2 million at December 31, 2019, when it represented 51.6%. The total investment and cash portfolio is comprised of cash, cash equivalents and term deposits (cash portfolio), investments, investment in associates, and investment properties.

Other

Gain on foreign exchange for the quarter ended December 31, 2020 was $6.2 million compared to $2.5 million for the fourth quarter of 2019. The gain in the fourth quarter of 2020 was primarily driven by strengthening of the Pound Sterling, Euro and Australian Dollar against the U.S. Dollar from September 30, 2020 to December 31, 2020, coupled with greater exposure to Pound Sterling-denominated cash and insurance receivable balances, supported by increased business in the Specialty Long-tail Segment when compared to the corresponding period of 2019.

Gain on foreign exchange for the year ended December 31, 2020 was $2.5 million compared to $5.7 million for the full year 2019. The gain in 2020 was primarily driven by strengthening of the Pound Sterling, Euro and Australian Dollar against the U.S. Dollar from December 31, 2019 to December 31, 2020, coupled with greater exposure to Pound Sterling-denominated cash and insurance receivable balances, supported by increased business in the Specialty Long-tail Segment.

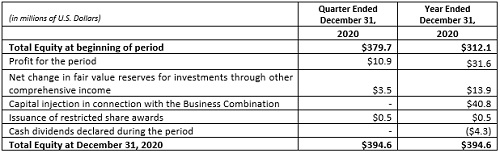

Total Equity

Total equity at December 31, 2020 was $394.6 million, representing an increase of 26.4% compared to $312.1 million at December 31, 2019. The movement in Total Equity during the quarter and year ended December 31, 2020 is illustrated below:

Authored by IGI

About IGI

Established in 2001, International General Insurance (IGI) is a global privately-owned specialist commercial insurer and reinsurer. Our vision is to be the company of choice for clients and brokers through market-leading service and our reputation for stable management and capital security.

A diverse and highly experienced team of underwriters operates our office in London. We also have offices in Dubai, Amman, Casablanca and Kuala Lumpur.

Our diverse portfolio of specialty lines includes Energy, Property, Construction & Engineering, Ports & Terminals, Financial Institutions, Aviation, Professional Indemnity, Political Violence, Legal Expenses, D&O, Casualty, Forestry and Treaty Reinsurance.

Standard and Poor’s upgraded our financial strength rating to “A- “, with a Stable outlook. A.M. Best rated the company A- (Excellent), with a Positive outlook, stating, “the revised outlook reflects IGI’s consistent record of very strong operating performance and the continuous improvement in its enterprise risk management framework.”

We take pride in providing proactive claims management, coupled with open communication, leading to the efficient handling of claims. We endeavour to act fairly and honourably in our relations with clients and brokers.