To what extent is climate change driving the global flood protection gap?

FloodFlash climate change series...

So far in our climate change series, we’ve delved into what climate change is, and how it affects flooding. In this article, FloodFlash Catastrophe Risk Analyst Henry considers how man-made climate change is driving the global flood protection gap. He also considers what else is contributing to the rising disparity between total and insured losses.

What is the global protection gap?

The global protection gap is the amount of risk that is not insured or underinsured. It is the difference between the total economic losses resulting from various risks, such as natural disasters, health crises, or other events, and the proportion of those losses covered by insurance. The protection gap varies depending on the country and the type of risk. According to PwC, the global protection gap could reach US$1.86tn by 2025. Aside from the financial impacts this has, the protection gap comes with a human cost – compounding the impacts on lives and livelihoods affected by events that weren’t their fault.

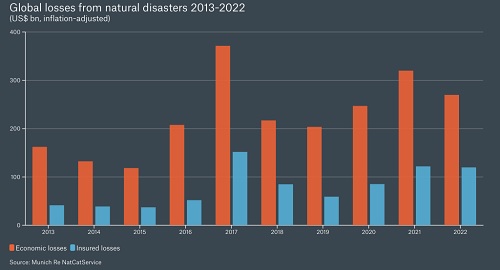

Natural disasters contribute a significant amount to the protection gap. In 2022, economic losses reached an estimated US$313bn, 4% above the 21st Century average, according to Aon’s ‘Weather, Climate and Catastrophe Insight’ report. Insured losses are also growing. Last year, insured losses reached $132bn, 57% above the 21st Century average, accounting for 42% of the total losses. As insured losses are increasing faster than total losses, this may suggest that the protection gap is steady, or even decreasing.

Global economic losses and insured losses caused by climate change are on an upwards trajectory. (Source: Munich Re)

Global economic losses and insured losses caused by climate change are on an upwards trajectory. (Source: Munich Re)

However, 2022 featured the second costliest natural disasters for insurers on record – Hurricane Ian, which cost insurers around US$50bn. Due to this, the US accounted for 75% of global insured losses. As developed countries typically have higher rates of insurance, the protection gap can fluctuate significantly depending on the countries impacted. For example, insurance covered around 42% of losses from Hurricane Ian, compared to almost nothing in the Pakistan floods.

Hurricane Ian was responsible for more than a third of overall losses, and roughly half of insured losses worldwide. The protection gap for flooding is one of the highest among natural disasters – around 80% of the world’s catastrophic flood losses are uninsured. This leaves people, businesses, and governments around the world exposed to bills that can ruin lives. And the problem is getting worse. This represents a huge opportunity for insurers looking to enter new markets, or cover the risks that others can’t.

What factors affect the global flood protection gap?

Many factors affect the global flood protection gap. In essence, flood risk is rising, increasing total losses. At the same time, traditional insurers are increasingly unwilling to offer flood in at-risk areas, reducing insured losses. To understand this, first we need to break down what we mean by risk.

Traditionally, when an insurer considers risk, it involves a combination of three components – hazard, vulnerability, and exposure:

- Hazard – how intense and frequent events are. For example, how much rainfall there is, what depth a flood reaches, and how often an area floods. The frequency and severity of flooding impacts the potential for harm, loss, and damage.

- Exposure – how many people, properties, or assets are close to the hazard. People and properties in areas close to rivers, coasts, or other bodies of water have a higher exposure to flooding.

- Vulnerability – how bad the impact is of a hazard is. The susceptibility of people, property, and the environment to damage, harm, or loss from a flood depends on land-use, building codes, and resilience measures. People and properties in lower-income countries are often more vulnerable to floods, due to fewer regulations and resilience measures.

How is man-made climate change affecting the global flood protection gap?

"While it is very difficult to prove the exact contribution of man-made climate change to any one event, scientists are increasingly certain man-made climate change is contributing to more extreme weather. A recent study in the journal Nature Water confirmed the frequency and intensity of rainfall is increasing, with a strong link between these and global mean temperatures. On top of this, man-made climate change is likely to cause rainfall patterns to change and become less predictable. You can read more about how man-made climate change is impacting flooding in last month’s blog.

Climate change is taking an increasing toll. The natural disaster figures for 2022 are dominated by events that, according to the latest research findings, are more intense or are occurring more frequently. In some cases, both trends apply."

Thomas Blunck, member of the Board at Munich Re

More intense and frequent flooding brings with it a higher potential for harm, loss, or damage – therefore driving the hazard component of risk. To cope with the rising costs, insurers impose excesses or raise premiums. Worse still, insurers often have no choice but to decline properties in the most high-risk areas. These measures allow insurers to continue to operate. However, they also mean many individuals and businesses are underinsured, or not insured at all, against flooding.

All of this leads to increased total losses and lower insured losses – driving the global insurance gap wider. However, framing the global flood protection gap as a ‘hazard’ problem overshadows other factors, including vulnerability and exposure. These components of risk are considered by some experts to contribute more to the growing flood risk, and hence the growing flood protection gap, than hazard.

What else is driving the global flood protection gap?

Even without man-made climate change, the risk we face from disasters like floods will continue to rise. The campaign ‘No Natural Disasters’ suggests that nature is not the problem, regardless of whether humans keep warming it through emissions. Instead, they place the blame on people’s door, and highlight that many of the impacts of natural hazards are preventable.

Exposure and the global flood protection gap

One problem is that we keep building homes, developing cities, and growing livelihoods where disasters always happen. We build on flood plains, near coastlines, in wildfire-exposed forests, near active volcanoes – increasing our exposure to these hazards.

Humans have always chosen to settle in ‘high-risk’ areas, increasing exposure to hazards, including floods. Coastal and riverside areas have always been attractive for individuals and businesses. For example, flood plains are naturally fertile, providing benefits for agriculture, while coasts provide easy access to trade routes.

However, as the global population continues to grow and urbanisation continues to dominate, the number of people and properties exposed to hazards is getting worse. The percentage of the global population at risk from flooding has risen by almost a quarter since 2000. This is partly due to population increase, but also because people continue to move into flood prone areas rather than away from them. In England, one in 10 of all new homes built since 2013 are on land with a high flood risk, exposing more and more people and properties to where flooding is already a hazard. In the US, recent analysis suggests population growth and shifts dominate average annual loss changes for hurricanes since the 1970, far outstripping the impacts of man-made climate change.

"Global population increased by over 18% between 2000 and 2015, but in areas of observed flooding, the population increased by 34%" BBC, 2021

While man-made climate change will expose more people to flooding, this will only compound an already significant issue. Increases in exposure increase the total costs of a flood as more people and property are affected. As outlined above, insurers decline, raise premiums, or impose excesses in high-risk areas. As these areas are often densely populated, more individuals and businesses are underinsured. Rising exposure therefore plays a key part in driving the global protection gap.

Vulnerability and the global flood protection gap

Land-use, building codes, and resilience measures, all factor into individual and societal vulnerability to natural hazards, like flooding. For example, buildings in urban areas are far more vulnerable to flooding due to impermeable surfaces, like concrete, meaning surface water builds up quicker. Building codes are also important. For example, many buildings in existing flood zones in the US are required to be raised or to be built with specific construction materials and methods, lowering these properties’ vulnerability to floods. In fact, analysis shows that building improvements in the US have offset increases in average annual hurricane losses.

To reduce a society’s vulnerability to flooding, flood barriers and dams are often built. The Thames Barrier is a good example. The barrier was built in response to significant flooding in 1953, which sparked concerns for the city. Without it, many areas of London, including the Houses of Parliament and the O2 would be under flood water, and far more would be more vulnerable to flooding. These measures work well to reduce an area’s current flood vulnerability. However, as man-made climate change continues to make rainfall more intense, these resilience measures may be insufficient. For example, during Hurricane Harvey in 2017, the Houston dam became overwhelmed, and spilled over for the first time.

In recent years, there has been a shift in flood management strategies – natural flood management. It aims to work with the natural processes of the river and floodplains, rather than against them. Measures include creating floodplains, the restoration of meanders and wetlands, and rewilding. These measures have numerous environmental, economic, and social benefits compared to those that aim to contain and control the water. However, in some areas these approaches are simply unfeasible.

People and societies prepare for the hazards they know of – reducing their vulnerability. As hazard patterns change, it will expose people who will likely not be prepared for this new risk. These individuals will have a low perception of their new risk, meaning they are less likely to install flood resilience measures. They will also be less likely to take out flood insurance – leading to an increasing the global protection gap.

It is clear that hazard, exposure and vulnerability all play a role in the global flood protection gap. The way they interact can compound this role. As man-made climate change impacts the intensity, frequency, and patterns of flooding, more people, who are often more vulnerable, will become exposed to the potential harm, damage and losses flooding can cause.

Where does FloodFlash fit in?

Flood insurance reduces overall financial risk of a flood. While this does not directly reduce vulnerability, it does help to deal with the impacts of a flood. It is also clearly critical to the global flood protection gap. As floods become more intense and frequent, and as society becomes more vulnerable and exposed, the uncertainties for flood insurers increase. This makes flood risk harder to place, meaning traditional insurers are forced to reduce or refuse cover to more individuals and businesses.

FloodFlash provides certainty to underwriters and clients. We minimise the uncertainties involved in writing flood risk by only focussing on the hazard component of risk – potentially the most certain of the three components. This allows us to offer insurance to those who can’t find insurance anywhere else, while ensuring our business is sustainable.

FloodFlash clients choose a trigger depth and payout that they would need in the event of a flood, reducing the uncertainty at claim. We then install a FloodFlash sensor at their property, which measures flooding at the property. When the sensor alerts us that flood water has reached the client’s trigger depth, we start the claim. We don’t need loss adjusters or claims teams, reducing costs and time. In fact, we often pay out within days. Our fastest claim time was 3 hours 50 minutes. That’s less than 4 hours after flood water reached the client’s trigger depth, the payout was in their account.

Our mission is to help more people recover from catastrophe using parametric insurance. By offering terms for at-risk properties, and by paying quickly, we help improve businesses’ resilience to floods, and reduce the flood protection gap.

Authored by FloodFlash

About FloodFlash

FloodFlash is a new type of rapid-payout flood insurance. It uses the latest data modelling and connected tech to bring parametric insurance to the mass market for the first time. The result is fast, easy and flexible cover that pays claims within days of a flood.

FloodFlash is parametric or `event-based` insurance. When buying the cover, the client chooses the depth of flooding they wish to insure against and how much they’d receive when that flood happens. When the FloodFlash sensor installed at the property detects flood water at the selected depth, the claim is paid in full. No waiting. No haggling.

FloodFlash rapid-payouts were put to the test in February 2020 when Storm Ciara swept across the UK. Claims related to the storm were paid in full within a single day. That speed of claims payment remains the fastest and best proof of mass-market parametric insurance to date gaining acclaim at industry awards and recognition from The Times, The Telegraph and the BBC.

FloodFlash operates across Britain, is headquartered in London. Floodflash is a registered coverholder at Lloyd`s of London and is authorised and regulated by the Financial Conduct Authority.