The FloodFlash annual magazine: the smart sensor and our rapid claims

What makes the FloodFlash sensor smart?

FloodFlash uses three core pieces of technology – our pricing algorithm, our cloud platform, and our IoT sensor. Head of Hardware and former Dyson engineer Pete Codling designed the FloodFlash sensor alongside co-founders Adam and Ian to specifically facilitate parametric flood policies. The sensor measures flooding at every policy and is the key to our rapid payouts.

Head of Hardware Pete Codling designed the FloodFlash sensor to facilitate our parametric policies.

The sensor has several features that make it the perfect parametric trigger measurement for flood insurance:

- High resolution flood measurement: the sensor uses sound waves to measure how much water there is in the sensor, giving us a millimetre accurate view of flood depth at the client’s property.

- Mobile connectivity: the sensor sends the depth readings to FloodFlash HQ via the mobile networks. If there’s flooding at a sensor, we’ll get the data in seconds.

- 10-year life: ultra-low power consumption and battery means the sensor doesn’t require any external power and lasts up to 10-years.

- Storm-proof: the sensor is tested in storm and flood conditions, so we know it is up to the task of protecting any property from catastrophic flooding.

- Memory chip: if the networks go down, the sensor doesn’t stop recording. It stores all readings on a memory chip. When the networks recover, the sensor sends us all the historical data so we don’t miss a single reading.

- Fraud-resistant: live data monitoring feeds into a robust fraud prevention process.

10,152

This is the total number of flood alerts we’ve received from our sensors at the time of publishing this report.

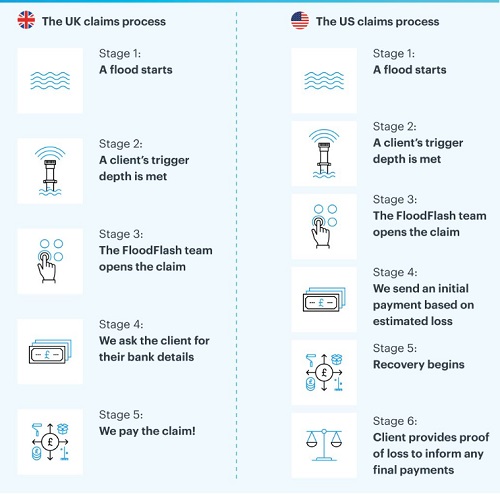

How do FloodFlash claims work?

Our mission is to help more people recover from catastrophe using parametric insurance. One of

the reasons businesses don’t survive a flood is the delay in receiving their claim. A longer claim results in prolonged business interruption which can be devastating to any business. What’s more, many businesses don’t have the ability to pay for clean-up, replacement stock and other flooding costs before their claim is paid.

We pride ourselves on rapid payouts. We paid most of our clients within 48 hours of water hitting their trigger depth. In fact, between February 2020 and October 2022, we paid 67% of our claims within 48 hours. With a quick claim, recovery can begin faster. This has several positive knock-on effects. Clients get a head-start on booking recovery services, whether that’s dehumidifiers, skips or anything in between.

3 hours 50 minutes

The time it took to pay our fastest ever claim, from the client’s trigger depth being met to the payout reaching the client’s bank.

A quick payout also means secondary impacts like mould and damp are less likely to set in – reducing the total cost of recovery.

Our smart sensor and parametric principles help our claims process to be quick, allowing clients to focus on recovery.

What do brokers and clients say about FloodFlash claims?

We pride ourselves on our outstanding claims service. But don’t just take it from us – here’s what some of our FloodFlash brokers and clients have had to say after a claim:

“Our client was very happy. Our claims team was very happy. I was very happy.” -Colin M., FloodFlash broker

“FloodFlash was truly exceptional.” - Joe C, FloodFlash broker

“When we needed their support, they were there. I could not believe how quickly [the payout] happened.” - Alan F., FloodFlash customer

“It’s the best and easiest [claim] by far.” - Ian P., FloodFlash broker and customer

In the event of a flood, FloodFlash clients benefit from a rapid payout that speeds up their recovery. Our simple process also reduces the time and workload for our broker claims teams.

According to Business in the Community, 40% of businesses don’t reopen after a flood. We’re proud that 100% of the businesses who’ve claimed with us remain open.

About FloodFlash

FloodFlash is a new type of rapid-payout flood insurance. It uses the latest data modelling and connected tech to bring parametric insurance to the mass market for the first time. The result is fast, easy and flexible cover that pays claims within days of a flood.

FloodFlash is parametric or `event-based` insurance. When buying the cover, the client chooses the depth of flooding they wish to insure against and how much they’d receive when that flood happens. When the FloodFlash sensor installed at the property detects flood water at the selected depth, the claim is paid in full. No waiting. No haggling.

FloodFlash rapid-payouts were put to the test in February 2020 when Storm Ciara swept across the UK. Claims related to the storm were paid in full within a single day. That speed of claims payment remains the fastest and best proof of mass-market parametric insurance to date gaining acclaim at industry awards and recognition from The Times, The Telegraph and the BBC.

FloodFlash operates across Britain, is headquartered in London. Floodflash is a registered coverholder at Lloyd`s of London and is authorised and regulated by the Financial Conduct Authority.