FloodFlash visit flood resilience partners M3 Floodtec

Authored by FloodFlash

Earlier this year, a few of the FloodFlash team got up especially early to visit one of our partners – flood resilience experts M3 Floodtec. We spoke about flood insurance in the UK, and how flood resilience plays an important role in protecting commercial properties.

Who are M3 Floodtec?

M3 Floodtec are one of the UK’s leading flood resilience companies. They offer full turnkey solutions from design through to commission, or bespoke elements to an overall flood mitigation project.

M3 Floodtec have an extensive range of solutions available. These include:

- Flood Doors – a 100% waterproof door with a patented sealing system.

- Anti-flood airbricks – bricks with an internal self-activating gate that automatically shut off in the event of a flood.

- Non-return valves – valves that only allow water to travel one way, preventing water from travelling up through underground pipes and drains.

- Flood barrier – barriers installed across doorways or other openings before a flood.

- Wall treatment – water-repellent treatment that creates a protecting waterproof seal on above ground walls.

They also have a state-of-the-art research and development facility. This allows them to continually test their products and ensure they are up to scratch.

The Flood House and testing facility

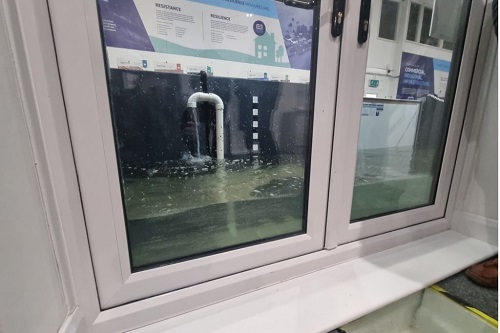

After speaking about the flood insurance and flood resilience industry, the FloodFlash team were eager to get more hands-on with some of their flood resilience products. M3’s testing facility and Flood House demonstration centre provide visitors with the opportunity to do just that.

We stepped into the house and shut the doors firmly behind us, waiting for the flooding to begin. The pumps released 30,000 litres of water in just 10 minutes. The water reached a heigh of over 50cm before the pumps were turned off and the water could lower again.

The £500,000 facility is BSI approved. It is open to visits from industry stakeholders, property owners, community flood groups, and the media. Flood mitigation manufacturers can use the facility to test their own products. This is revolutionary for the industry, as testing costs amount to £40,000, nearly half the cost of launching a new resilience product.

How flood resilience interacts with flood insurance

Putting resilience measures in place can be expensive. It can be hard to justify the costs of flood gates, flood doors, air bricks, non-reverse valves and other measures, especially if you are already paying for flood insurance.

Putting resilience measures in place reduces the costs associated with a flood. However, with traditional insurance, these measures rarely result in reduced premiums. This makes the significant costs of resilience measures even less justifiable. Factors contributing to traditional insurers being reluctant to offer premium reductions include:

- The uncertainty around the costs that floods may cause, and the impact resilience measures has on such costs

- A lack of trust in the installation and maintaining of resilience measures

- A lack of trust in the human element involved in implementing resilence measures, for example, putting up flood gates when a flood warning is received.

At FloodFlash, we use parametric insurance, with flexible trigger depths and payout amounts. The flexibility of a policy means having resilience measures can significantly reduce premiums – by choosing higher first trigger depths or by reducing payouts at lower depths.

For example, a small business owner in a high flood risk area may want trigger depths at 20cm, 30cm, and 50cm. If they have 50cm flood gates, they could raise the first trigger to 50cm – the height those gates would be breached. This would significantly reduce their premium, as the chance of a 50cm flood is much less than a 20cm one. Alternatively, they could keep the 20cm trigger depth to account for business interruption during a small flood, but lower the payout amount.

Why we partner with M3 Floodtec

Our belief is that everybody should be able to recover from catastrophe. Our parametric insurance helps people to do just that by providing financial resilience. However, pairing insurance with the physical resilience measures discussed means a business has even higher chances of a quick recovery.

This statistic shows the importance of physical flood resilience measures, even simple flood gates. When coupled with parametric insurance, like FloodFlash, physical resilience allows higher trigger depths to be set, meaning lower premiums. Our hope is that the two can create truly flood resilient properties at an affordable price, enabling more businesses to survive flooding.

About FloodFlash

FloodFlash is a new type of rapid-payout flood insurance. It uses the latest data modelling and connected tech to bring parametric insurance to the mass market for the first time. The result is fast, easy and flexible cover that pays claims within days of a flood.

FloodFlash is parametric or `event-based` insurance. When buying the cover, the client chooses the depth of flooding they wish to insure against and how much they’d receive when that flood happens. When the FloodFlash sensor installed at the property detects flood water at the selected depth, the claim is paid in full. No waiting. No haggling.

FloodFlash rapid-payouts were put to the test in February 2020 when Storm Ciara swept across the UK. Claims related to the storm were paid in full within a single day. That speed of claims payment remains the fastest and best proof of mass-market parametric insurance to date gaining acclaim at industry awards and recognition from The Times, The Telegraph and the BBC.

FloodFlash operates across Britain, is headquartered in London. Floodflash is a registered coverholder at Lloyd`s of London and is authorised and regulated by the Financial Conduct Authority.