FloodFlash share the key findings of their 2022 Commercial Risk Report

Authored by FloodFlash

In our final blog from our Autumn campaign, we outline some of the key findings from our landmark risk report earlier this year. This year’s report was the biggest yet, and the latest edition includes a forward from Emma Hardy MP. Get in touch with brokers@floodflash.co to request your copy of the report, chock full of flood insights.

The underinsurance problem

80% of the world’s catastrophic flood losses aren’t insured. That’s $58bn of uncovered damage, and it’s getting bigger each year due to climate change, population growth, and urbanisation.

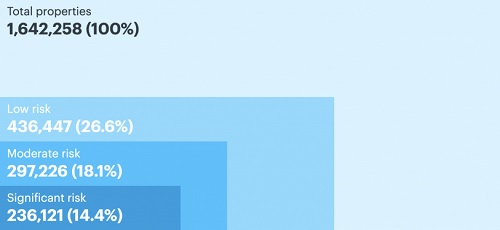

In Britain, over 436,000 commercial properties in Britain have at least a low flood risk. That’s over a quarter (27%) of all commercial properties. It’s bad news for business owners as commercial properties are 2x more likely to be at risk from flooding compared to the average property in Britain.

Over a quarter of commercial properties in Britain have at least a low flood risk.

The good news is that businesses are generally aware of and engaged with their flood risk. Of the businesses we surveyed, only 8% claimed to have no measures to mitigate flooding.

However, one of the most worrying aspects of the report came from the lessons on flood insurance availability. Over half of businesses agreed with the statement ‘flood cover is hard to come by’. Brokers we work with are reporting that flood is being excluded from main policies more and more. When flood is included, excesses and premium rises can leave clients with unaffordable cover.

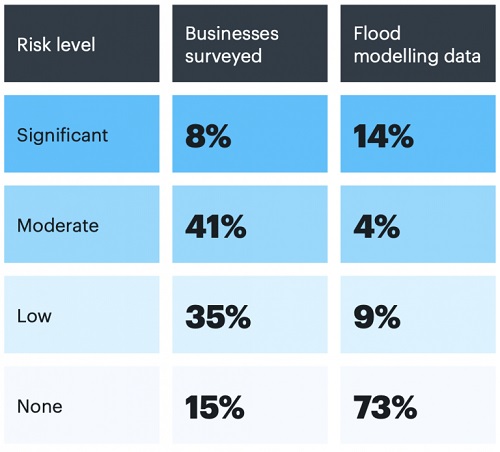

Knowing your risk: there is a discrepancy between the perceived and actual flood risk amongst British businesses.

The issues with acquiring flood cover

The report revealed that 13% of the businesses we surveyed don’t have comprehensive flood insurance. Lack of cover isn’t the only thing that threatens business survival. In fact, according to Business in the Community 40% of SMEs close for good after catastrophic loss from flooding. Two key reasons for this statistic are the length of time that most traditional claims take, and the lack of business interruption cover.

Most flood claims take months. By the time a business receives their claim payment, they will often have had to pay for clean-up and stock replacement, equipment and business interruption. For many small businesses, this is simply not possible.

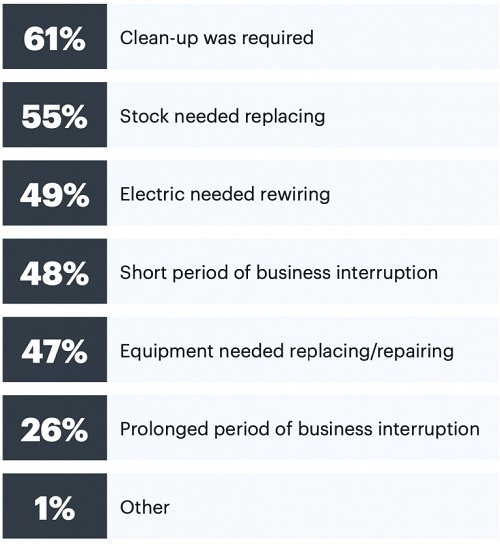

We asked businesses the impact that flooding had on their business. Reminder: a FloodFlash policy can be used to cover any costs caused due to flooding.

Most flood insurance is based on the principle of indemnification. Reimbursement typically aims to restore conditions to the way that they were before. Accounting for business interruption can be difficult, and our broker success team has reported an increase in business interruption exclusions. However, nearly half of the businesses surveyed reported at least a short period of business interruption.

When covers that a client needs aren’t available through the typical routes, knowing the alternative risk transfer solutions like FloodFlash that are available helps brokers secure cover that better suits customer needs.

The technology-based solution

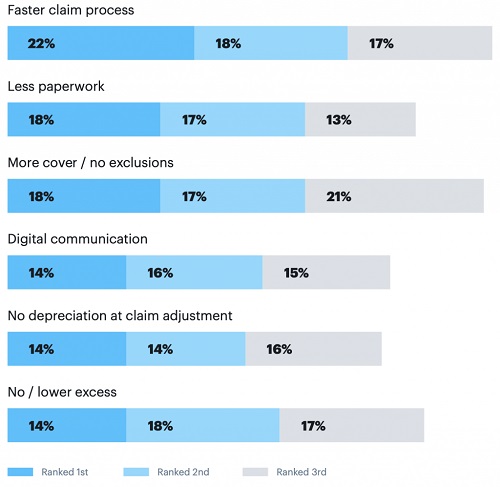

Unsurprisingly, speed and simplicity top the client wish list. A quick and simple claim process reduces the stress involved and means businesses can minimise disruption after a flood.

While there are some tech- sceptics, 8 in 10 of those surveyed would use more technology if it reduced the premium. 75% would use technology if it made the product better. Great news for FloodFlash fans and news that will fuel for efforts as we hope to use our unique parametric insurance to protect more of the businesses represented in our report.

Keep an eye out for the next edition in February 2023.

About FloodFlash

FloodFlash is a new type of rapid-payout flood insurance. It uses the latest data modelling and connected tech to bring parametric insurance to the mass market for the first time. The result is fast, easy and flexible cover that pays claims within days of a flood.

FloodFlash is parametric or `event-based` insurance. When buying the cover, the client chooses the depth of flooding they wish to insure against and how much they’d receive when that flood happens. When the FloodFlash sensor installed at the property detects flood water at the selected depth, the claim is paid in full. No waiting. No haggling.

FloodFlash rapid-payouts were put to the test in February 2020 when Storm Ciara swept across the UK. Claims related to the storm were paid in full within a single day. That speed of claims payment remains the fastest and best proof of mass-market parametric insurance to date gaining acclaim at industry awards and recognition from The Times, The Telegraph and the BBC.

FloodFlash operates across Britain, is headquartered in London. Floodflash is a registered coverholder at Lloyd`s of London and is authorised and regulated by the Financial Conduct Authority.