FloodFlash pays Storm Christoph claims on the day of the flooding

Parametric specialists smash all previous records for catastrophe claim payments

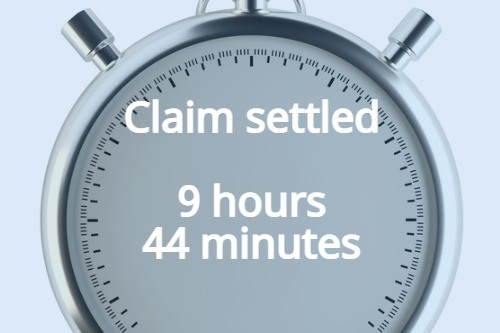

FloodFlash, an insurTech offering rapid-payout insurance at-risk businesses, has set new catastrophe claims records during Storm Christoph. The fastest claim took just 9 hours and 44 minutes from the property flooding to the client receiving the full settlement in their account.

Storm Christoph is the third named storm of the year, bringing widespread rain, snow and flooding across the UK. Over 350 live flood alerts were issued during the peak of the storm, whilst PwC estimate that losses will range between £80m - £120m.

FloodFlash uses parametric cover to provide payouts. When taking out cover, the client selects a depth of flooding and a payout. FloodFlash install an internet-connected sensor that measures flood depths at the insured property and wirelessly sends it to FloodFlash HQ. When flood depths reach the pre-agreed amount, FloodFlash organise the payment.

FloodFlash IoT sensors began to detect floods on Wednesday 20th, triggering claims across the country. FloodFlash quickly validated the claims using the data provided by the sensors, paying them soon after. This resulted in clients receiving the money on the same day that their property flooded – a world first in catastrophe insurance.

The benefits of this new approach aren’t limited to fast claims. There is no loss adjustment with parametric insurance. FloodFlash claims happen remotely, removing the risk of COVID transmission from the site visits that are required for traditional flood claims.

The previous record for fastest property flood claim was 26 hours and 15 minutes – set by FloodFlash during Storm Ciara in February 2020.

FloodFlash Co-founder Adam Rimmer added: “During a time of great financial stress for businesses everywhere thanks to COVID, getting cash to clients quickly has never been more important. FloodFlash is setting the standard for fast, transparent claim payments. We reduce the time it takes to pay a catastrophe claim from months down to hours. In doing so we reduce client uncertainty, claim values and insurer costs. This is the future of insurance”.

Authored by FloodFlash

If you would like to FloodFlash about their parametric solution for commercial businesses, CLICK HERE, leave a message and youTalk-insurance will pass your enquiry on

About FloodFlash

FloodFlash is a new type of rapid-payout flood insurance. It uses the latest data modelling and connected tech to bring parametric insurance to the mass market for the first time. The result is fast, easy and flexible cover that pays claims within days of a flood.

FloodFlash is parametric or `event-based` insurance. When buying the cover, the client chooses the depth of flooding they wish to insure against and how much they’d receive when that flood happens. When the FloodFlash sensor installed at the property detects flood water at the selected depth, the claim is paid in full. No waiting. No haggling.

FloodFlash rapid-payouts were put to the test in February 2020 when Storm Ciara swept across the UK. Claims related to the storm were paid in full within a single day. That speed of claims payment remains the fastest and best proof of mass-market parametric insurance to date gaining acclaim at industry awards and recognition from The Times, The Telegraph and the BBC.

FloodFlash operates across Britain, is headquartered in London. Floodflash is a registered coverholder at Lloyd`s of London and is authorised and regulated by the Financial Conduct Authority.