Everything you need to know about parametric insurance

Your guide to this exciting form of insurance.

Most of us are familiar with how traditional insurance works: you buy a policy from your insurer, who agrees to reimburse you for the cost of any damages if something bad happens. This is called the principle of indemnification. Someone might come around to check what has happened, and then you get your money. It is the way that things have always been and it works well in most cases.

Despite this, there are still huge numbers of people who can’t get insurance, and they often face serious threats such as hurricanes, typhoons, flooding or earthquakes. Parametric insurance works differently and is growing in popularity as a way for customers to buy cover from their insurers, not least with FloodFlash and our rapid-payout insurance.

The global protection gap is growing, more than doubling in real terms between 2000 and 2018.

To help you understand how parametric insurance can help, and why it is growing, this article will answer the following key questions:

- What is parametric insurance?

- How does parametric insurance work?

- What are the benefits of parametric insurance?

- How is parametric insurance different to indemnity insurance?

- Why is parametric insurance gaining momentum now?

- What does the future hold for parametric insurance?

What is parametric insurance?

It sounds like jargon (and the Wikipedia page doesn’t help), but parametric insurance is simpler than traditional cover. It is also known as event-based insurance, because parametric insurance makes a payout based on the event itself, instead of compensating for the damage which might be caused.

How does parametric insurance work?

A parametric insurance policy provides a payout immediately following the occurrence of a (pre-defined) event. The policy uses agreed triggers (or parameters, hence parametric). When these limits are reached the settlement is paid out. The process can be broken down into three simple steps:

- Select – the customer chooses the trigger event they want to insure against, and the payout value they think those triggers are worth

- Measure – the insurer and customer agree on what measurements they will use to decide when that trigger is reached. It could be anything from flood depth, wind speed, or even online sentiment for insuring a brand’s value.

- Settle – when the trigger is reached the insurer pays out.

The process for all parametric policies is very similar, if not identical to this but with different levels of complexity depending on what the limits are and how they are being measured.

“Any time you can meaningfully connect risk to a given data set, there’s an opportunity to employ parametric insurance” Michael W. Elliott, Senior Director of Knowledge Resources, The Institutes

What are the benefits of parametric insurance?

Customers and insurers are turning to this new method in increasing numbers. To understand why, it’s worth looking into the main advantages of parametric cover.

1. Covers risks traditional insurance can’t

Parametric insurance can insure risk that was previously viewed as uninsurable. The growing, global protection gap is major issue within the world of insurance. Flooding has proved to be very difficult for traditional insurance to cover. Taking the US as an example, “nine out of ten American homeowners have no flood insurance despite half of the population living near water”. For those at risk, or who have been previously hit by catastrophe, traditional insurance can only offer cover with exorbitant premiums or in many cases no cover at all. The risk involved for them is just too high. By insuring against the likelihood of an event happening as opposed to the damage it causes, parametric insurance reduces the cost and uncertainty of providing insurance and enables those who have previously been excluded to get cover.

2. Transparent claims process

With traditional insurance policies, customers often don’t receive a payout until a loss adjustor assesses the damage to the property and its contents. On top of this, they have to work through laboured claims documents to establish what their insurer will cover. A parametric insurance policy uses a pre-agreed payout so there is no haggling when a claim is made. Provided the insurer and insured agree that the trigger has been met, the payout is made. This makes the claims process quicker and far more transparent.

3. The customer is in control

Parametric policies are all about choice. Catastrophe insurance often comes with huge uncertainty about damages and payout values – setting your payout ahead of time removes that uncertainty for the insurer and insured together. Using FloodFlash as an example, the customer decides the trigger depth and payout amount they want. The quote can be tailored to meet the customers budget so they know exactly what money they’ll have to recover if the worst happens. Because the payouts aren’t directly attached to damages, there are often very few restrictions on how the customer uses the money, meaning it can be used on unforeseen costs that traditional insurance doesn’t factor in.

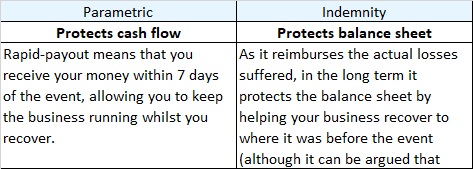

How does parametric insurance protect my business compared with indemnity insurance?

Although the best solution would be to have a combination of both, sometimes that isn’t possible. The table shows how the two types of cover differ from one another, an can cater to different financial objectives.

Is it too good to be true?

Traditional insurer’s costs are greater as they incur costs that parametric insurers don’t. These can be paying loss adjustors, claims teams, legal support or other costs. Parametric insurance does not require this support, meaning providers have smaller costs. Traditional insurance is also more exposed to uncertainty. It’s impossible to know the true value of damage caused by a disaster ahead of time, this uncertainty is often reflected in increased premiums. Parametric insurance pays a set value, so there is much less uncertainty ahead of a claim. The combination of lower costs and less uncertainty means that parametric policies are more efficient, resulting in more affordable insurance.

Removing some of the cost and uncertainty from traditional insurance means that parametric premiums can be significantly lower in some cases.

Why is parametric insurance gaining momentum now?

Parametric insurance isn’t a new approach, in some form or another it’s been in use for thousands of years. In its modern form, parametric insurance has been around for decades. The reason for its relative obscurity is that until recently it has only been available to governments and large corporations.

One of the earliest examples of some form of parametric insurance were bottomry contracts. These were used by merchants of Babylon as early as 4000-3000 BCE and were widely available in ancient Greece and Rome. They became standard following the age of discovery, getting its name from the Dutch word bodemerij, meaning hull of a ship. Under a bottomry contract, if a merchant was granted a loan, they could pay an additional fee so that in the event the ship was lost, the loan was cancelled.

So why is parametric insurance gaining momentum now?

What has changed in recent years to bring it to the forefront of the industry? There are a number of circumstances to consider:

- New technologies have enabled vastly superior data collection and analysis methods do be developed

- The growing, global protection gap has resulted in a swathe of uninsurable risk that can now be covered

- Investors have recognised its potential, rapidly increasing their investment in insurTech’s

What does the future hold for parametric insurance?

Parametric insurance is rapidly becoming a major part of the insurance industry, complementing and providing an alternative to traditional forms of cover insurance. We may be the first to pioneer parametric flood insurance, we’re certainly not the only ones to be pioneering parametric insurance. Companies such as:

- Jumpstart Recovery in California, who provide parametric earthquake insurance

- World Cover who protect farmers against loss of yield by using satellites to monitor rainfall

Parametrix who create policies based on external software downtime

It’s not just start-ups who are embracing this type of cover. Giants such as Swiss Re, Axa and the World Bank are seeing the potential of parametric insurance. With new technological innovations, methods for data collection and analysis are only going to improve, meaning the possibilities of parametric insurance are only just being realised.

Authored by FloodFlash

If you would like to talk to FloodFlash and find out more abotu their proposition Click Here, leave and message and youTalk-insurance will pass your enquiry on

About FloodFlash

FloodFlash is a new type of rapid-payout flood insurance. It uses the latest data modelling and connected tech to bring parametric insurance to the mass market for the first time. The result is fast, easy and flexible cover that pays claims within days of a flood.

FloodFlash is parametric or `event-based` insurance. When buying the cover, the client chooses the depth of flooding they wish to insure against and how much they’d receive when that flood happens. When the FloodFlash sensor installed at the property detects flood water at the selected depth, the claim is paid in full. No waiting. No haggling.

FloodFlash rapid-payouts were put to the test in February 2020 when Storm Ciara swept across the UK. Claims related to the storm were paid in full within a single day. That speed of claims payment remains the fastest and best proof of mass-market parametric insurance to date gaining acclaim at industry awards and recognition from The Times, The Telegraph and the BBC.

FloodFlash operates across Britain, is headquartered in London. Floodflash is a registered coverholder at Lloyd`s of London and is authorised and regulated by the Financial Conduct Authority.