‘Absolutely excellent’: Parametric claims uncovered

Authored by FloodFlash

An insurance policy is only as good as the claims that come with it. Claims are the “the proof of the pudding”, “where the rubber hits the road”. Whatever your phrase of choice, they are why we do what we do. This week we explore everything in terms of FloodFlash claims, including how they work, how we’ve done in the past and taking on a few of the questions we hear most frequently when it comes to our sensor-based parametric approach.

Traditional insurance claims

Traditional insurance claims often take months to resolve, which leads to additional uncertainty and stress for businesses.

The reason for this is because insurers need to establish the cost of damage before paying out. That involves loss adjustors, repair quotes, and receipts before a claim amount is agreed and paid.

When a disaster hits, people and businesses cannot afford to wait. Whether it’s paying staff, repairing essential equipment, or getting back up and running to service customers and contracts, a fast claim can make a huge difference to a business’ chance of recovery.

Sensor-based claims – just add water

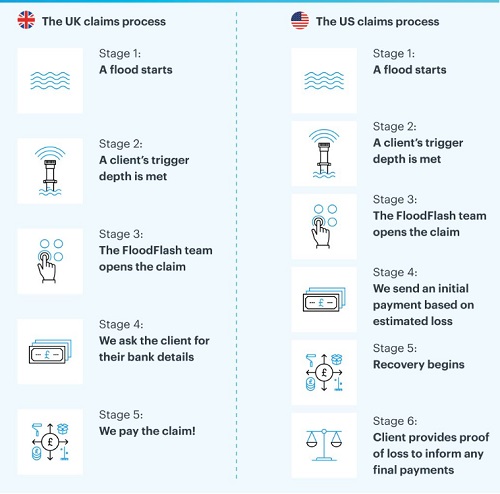

One of the main benefits of parametric insurance is the simplicity and speed with which claims are paid. When flood water reaches a trigger depth, we begin the claims process. This process varies a little for our US and UK clients.

US claims

In the US, we ask for an estimate of loss which informs an initial payment so that businesses can get started with their recovery as soon as possible.

We then provide a proof of loss form. The business must complete this within six months with their (approximate) actual loss sustained. If the actual loss is lower than the initial estimate, they must refund the difference. In the more likely scenario where actual losses are higher than the initial estimated losses we pay the difference up to the maximum payout available for that trigger.

FAQ: how does the proof of loss work?

The proof of loss is a two-page form that declares the values that add up to your claim (take a look at how simple it is here). It is a declaration that doesn’t need masses of detail and is a far cry from loss adjustment. The claimant simply confirms that the money they received in the claim was used to fund their flood recovery. The great news is that they can include anything related to their recovery on the proof of loss.

FAQ: how restrictive is the proof of loss?

FloodFlash claims can be used for any costs associated with flooding. Building and inventory costs, external damage and vehicles, non-tangible costs including business interruption, rebuild compliance, contract breaches or reputation damage can all be included within the proof of loss. It’s entirely up to the claimant.

UK claims

In the UK, the process is even simpler. When water reaches the pre-agreed trigger, we confirm the event, carry out some anti-fraud checks and then ask for the client’s bank details.

FAQ: what if the sensor doesn’t work

e have a memory chip that records data even if the networks go down. When the networks recover the sensor sends the historical data automatically. We can even collect the data manually if issues persist. If the sensor is totally destroyed by floating debris, then the data it has sent up to that point can be used to validate the claim. If these two events coincide (networks are down and sensor is destroyed – this hasn’t happened to date) then we can use alternative, more traditional means of validating the claim such as satellite data, nearby sensors and local flood gauge data. This may mean claims take a little longer, but the policy is safe.

Our claims process varies between markets, but their speed and simplicity does not.

FloodFlash claims – tried and tested

FloodFlash has paid claims to businesses through five major named storms and more minor storms. Sensors have triggered 100s of times providing us with the data we need to manage claims in the time it takes to send a text message. Thanks to that sensor technology, all our claim times are measured within weeks not months, and every single business that claimed recovered soon after. That’s the power of parametric insurance.

In fact, our fastest claim was in November 2022 in the UK. Just 3 hours and 50 minutes after water met the client’s trigger depth, the payout was in their bank account.

The result of these fast claims? Clients can focus on recovery, and brokers can focus on their more complex claims in a flooding event. Take a look at one of our testimonial videos to hear from clients who have experienced a FloodFlash claim.

The result of these fast claims? Clients can focus on recovery, and brokers can focus on their more complex claims in a flooding event. Take a look at one of our testimonial videos to hear from a client who experienced a FloodFlash claim during Storm Franklin.

Some of the other client praise for our claims includes: “this is unbelievable”, “you can’t compare”, “absolutely excellent” and “it’ll be the best thing you’ve done in the last five years”.

About FloodFlash

FloodFlash is a new type of rapid-payout flood insurance. It uses the latest data modelling and connected tech to bring parametric insurance to the mass market for the first time. The result is fast, easy and flexible cover that pays claims within days of a flood.

FloodFlash is parametric or `event-based` insurance. When buying the cover, the client chooses the depth of flooding they wish to insure against and how much they’d receive when that flood happens. When the FloodFlash sensor installed at the property detects flood water at the selected depth, the claim is paid in full. No waiting. No haggling.

FloodFlash rapid-payouts were put to the test in February 2020 when Storm Ciara swept across the UK. Claims related to the storm were paid in full within a single day. That speed of claims payment remains the fastest and best proof of mass-market parametric insurance to date gaining acclaim at industry awards and recognition from The Times, The Telegraph and the BBC.

FloodFlash operates across Britain, is headquartered in London. Floodflash is a registered coverholder at Lloyd`s of London and is authorised and regulated by the Financial Conduct Authority.