Why prompt motor claims reporting is crucial in the current economic climate

Reporting a motor claim as promptly as possible is always recommended. It allows our claims team to initiate liability and indemnity investigations, provide a smoother customer experience for both policyholder and broker and contain costs. With the industry still experiencing high levels of claims inflation, not reporting swiftly could end up being more costly for policyholders than they might think…

Our claims team take a look at the factors still contributing to motor claims inflation, the impact this has on policyholders, and how the prompt reporting of claims can help us combat it.

The Impact of the Current Economy

There are many factors fuelling claims inflation, including:

- The statutory charges for the recovery, removal, storage and disposal of vehicles in England and Wales after an accident increasing by 28%, as of 1st April 2023.

- An ongoing lack of access to vehicles and parts meaning a third-party that’s hit may need to make use of a hire car for a longer period. As a result, daily credit hire costs can rack up for policyholders.

- Labour shortages and supply chain issues are making for more costly claims processes and longer wait times for resolutions.

What DCL are doing to tackle these challenges

- We can offer a cheaper, police-approved, vehicle recovery alternative when we are contacted directly from the roadside, keeping incurred positions to a minimum.

- When our claims team are contacted at the scene, we can engage in effective third-party intervention both at the scene and following-up via email/post. We contact the third party involved to ensure they are offered the best daily rates for a hire vehicle. We don’t use credit hire.

- Policyholders have access to our dedicated repair network which sees average repair times down by 3 days. We also encourage the use of green parts, where agreed, to counter supply chain issues.

As ever, our efforts to tackle these challenges can be greatly assisted with policyholders’ help!

Don’t delay, report today!

While we all navigate these wider industry issues, there are a few things policyholders can do to keep claims costs down. The sooner drivers report an incident, the more swiftly we can act and save on costs. Here are our 3 simple steps for successful claims reporting:

When drivers act fact, policyholders save cash – Drivers should all be made aware that they must report any new claim directly to our FNOL (First Notification of Loss) team, immediately. No later than 24 hours from the incident date is ideal.

Speak up to save money – By encouraging drivers to be proactive at the scene we can get as much detail about the incident as possible. Drivers should take down a phone number, the name and vehicle registration of the third party involved, and take plenty of photos (if it’s safe to do so). A DCL bump card can also be shared.

Make us aware if dash-cams were there – Swift notification that this kind of evidence exists can be vital in assisting with liability and helping us protect against fraud.

When taking these steps, not only does it ensure we can contain costs as effectively as possible, but when a driver is involved in a serious incident (where police are involved) and they report swiftly from the roadside, we can appoint a legal representative to provide immediate assistance at the scene to ensure any account provided has the benefit of legal advice.

What success looks like

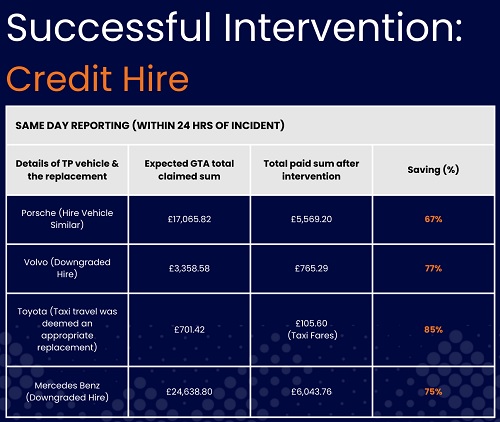

When claims reporting is done promptly, our team can intervene successfully. Here’s just one example of how our claims team are able to make crucial assessments of the third party’s needs and offer appropriate solutions that avoid credit hire costs.

Comparatively, when there are delays in reporting, this can have a direct effect on policyholders’ pockets too:

Authored by Direct Commercial

About DCL

Established in 2002, Direct Commercial Ltd (DCL) is a market leading Insurance Underwriter specialising in Commercial Motor for the UK and Ireland.

DCL's proven track record in the Commercial Motor market combined with the backing and security of some of the world's highest rated insurers provides the market with a selection of premier, all-inclusive Motor Fleet products.

If you are a FCA registered Insurance Broker and you would like to take advantage of any of our offerings please do not hesitate to contact us via our website or email us directly at enquiries@directcommercial.co.uk