An employee's guide to redundancy

DAS Law Senior Associates Hayley Marles and Simon Roberts look at what an employee needs to know about redundancy and how legal expenses insurance can help.

If you find yourself in a legal dispute, legal expenses insurance could cover your legal costs, even if your case goes to court.

In the UK, legal expenses insurance is typically bought as an optional ‘add-on’ to other types of insurance such as home and motor, so you don’t generally see it priced as a product on its own (there are also different versions for businesses).

As well as covering your legal costs, our legal expenses insurance can also give you access to a legal advice helpline where you can get support from a team of legal professionals who will be able to guide you through any personal legal issue, help you understand your rights, and offer advice on taking any further steps.

In order to see whether you have it, the obvious thing to do is to check your insurance policies – in particular home contents insurance, buildings insurance, and car or motorcycle insurance. Also, it’s possible that you may have elements of this cover included in other packaged products, or as benefits of employment contracts through your work. It may be a slightly arduous task but it’s important to check all of these documents as it could end up saving you money on your legal bills.

Should you eventually be taken to an employment tribunal, however, commercial legal expenses insurance could also provide cover for legal costs. There are some things that we don’t cover though. Our policy wordings have a full list of exclusions but here are a few examples:

- Claims that do not arise directly in connection with the insured business;

- Legal problems that start before the date cover begins;

- Civil cases where the lawyer we appoint for you does not believe that they will be more likely than not to win their case;

- Costs incurred without our expressed acceptance.

If you are considering making people redundant, or believe that you will soon be facing redundancy, the first thing to do is to call our Legal Advice helpline (the number will be in your policy wording) as we will hopefully be able to mitigate the issue and avoid the need for a claim. The legal advisers can help provide guidance on how to manage the situation which could help avoid a formal dispute, while our DAS Businesslaw & DAS Householdlaw online resources provide access to customisable legal documents that can also help avoid a legal battle. Nevertheless, if the situation has already reached the formal stage then our helpline can also advise on the steps you have taken so far and what to do next.

Redundancy: what you need to know

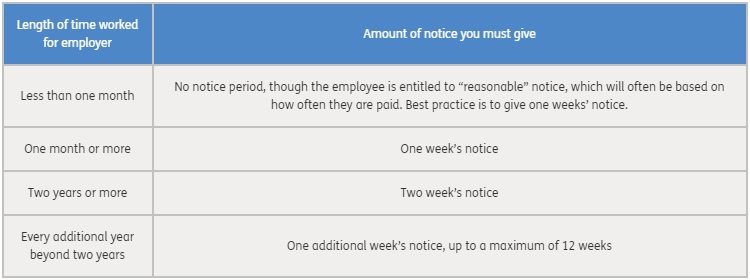

How much notice should your employer give?

They must give you sufficient notice before dismissing you. Notice periods are often contained within an employment contract, but if not, you are entitled to a minimum statutory notice period, based on your length of service, as detailed below (these minimum notice periods also apply to staff on probation):

Fair reasons for dismissal

Your employer must abide by certain rules for a dismissal to be considered fair in the eyes of the law. If they do not dismiss someone in a fair manner then you could make a claim for unfair dismissal. If you have two years of continuous service, you are eligible to bring a claim for unfair dismissal.

Your employer must abide by certain rules for a dismissal to be considered fair in the eyes of the law.

Whether a dismissal is fair or unfair depends on the reason for the dismissal, and how the dismissal is carried out. To establish a fair dismissal they must have a potentially fair reason for dismissing an employee. Reasons which can serve as grounds for a fair dismissal include:

- The employee is incapable of doing the job to the standard required (capability);

- Their conduct has been questionable (conduct);

- Redundancy (see below);

- There are legal reasons why they are unable to do the job, such as losing a driving licence (illegality);

- If it is no longer possible to continue employing the person, for example because a customer of the business refuses to work with that person (known as ‘some other substantial reason’).

Unfair reasons for dismissal

There are a number of reasons for dismissal which are known as ‘automatically unfair’. For example, you cannot be dismissed fairly because:

- You are pregnant or on maternity leave, or any reason related to this;

- You take time off for family reasons;

- You act as an employee representative, trade union representative or occupational pension scheme trustee;

- You have joined or not joined a trade union;

- You are working part-time or on a fixed-term contract;

- You assert certain statutory rights for example relating to pay and working hours;

- You report on wrongdoing at work (whistleblowing).

Dismissing an employee for any of these reasons will automatically be deemed unfair without the employee needing to be employed for any particular length of time (see below).

For a dismissal to be fair the employer must act ‘reasonably’ throughout the process and (if there is one), the preceding disciplinary process.

In the case of employees taking strike action, it is automatically unfair to dismiss an employee for taking official strike action within 12 weeks of the action commencing, or if it has lasted more than 12 weeks and the employer hasn’t taken reasonable steps to resolve the dispute.

A fair dismissal process

For a dismissal to be fair the employer must act ‘reasonably’ throughout the process and (if there is one), the preceding disciplinary process. While reasonable behaviour in this context is not defined in any statute, for an employment tribunal to find that an employer has acted fairly they must ensure:

- They have a reasonable belief that the reason for the dismissal was established;

- They have carried out proper investigations when appropriate (in conduct matters in particular) and best practice is to carry out an investigation meeting;

- Minutes are taken of all meetings and shared with the employee;

- That the employee is given all of the documentation that has been gathered during the course of the investigation and the process including minutes of meetings, witness statements and emails;

- They have followed the relevant policies and procedures including any procedures in their own handbook, employment contract and as a minimum the Acas Code of Practice;

- They have provided you with reasonable notice ahead of any meetings to allow you time to prepare;

- That reasonable adjustments to the process are considered for any employees that are disabled or suffering with mental impairments;

- That they inform you as to why you are being considered for dismissal and listen to your views on the matter before arriving at a decision;

- You are allowed to be accompanied at any hearings by a colleague or a trade union representative. In some cases, an employee with a disability or a particularly sensitive issue may request to be accompanied by a friend or family member. There is no legal requirement here but it can be considered;

- They have given you the chance to appeal.

The organisation’s disciplinary and dismissal policy should at the least accord with the Acas code of practice for disciplinary and grievance procedures. These are not legally binding, but are the best practice guide that an employment tribunal will expect an employer to follow.

If an employer does not follow the code and is unsuccessful in defending the claim, a tribunal has discretion to increase the level of compensation awarded to the employee.

Dismissing a member of staff on sickness grounds

Your ability to do your job may be affected by a long-term illness. It is important your employer works with you to ascertain whether there are any alternatives to dismissal. They should try to help you back to work by:

- Asking you for a medical report from your GP to gain a better understanding of your condition, symptoms and limitations;

- Arranging an occupational health assessment;

- Determining whether you are considered disabled under the Equality Act 2010 and making reasonable adjustments to help you carry out your role;

- Consider a reduced working pattern, a change to working hours, a change in the location or department if this would assist. Is there any equipment that could be provided to support you?

If reasonable adjustments cannot help you to do your job, it may be fair for them to dismiss you, even if you are categorised as disabled under the Equality Act 2010. However, they must still ensure that a fair procedure is followed and they must follow their own policies when it comes to managing ill health at work.

If the employment tribunal finds that an unfair dismissal has taken place then they can order the employer to reinstate the employee to their old job or to find a new job for them at the company.

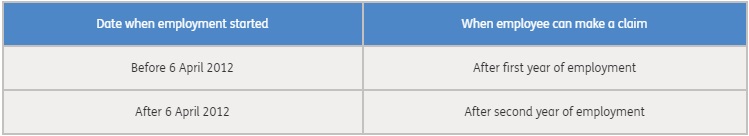

Claims for unfair dismissal

If you believe you have been dismissed unfairly, you can lodge a claim at an employment tribunal, who will make a judgment on whether the dismissal was fair or unfair.

Unless you were dismissed for an automatically unfair reason as mentioned above, you have worked for you for a minimum amount of time in order to be eligible to do so. This is shown in the table below.

Certain groups of people are not eligible to claim unfair dismissal. These are:

- The self-employed

- Independent contractors

- Members of the armed forces

- Employees who have already reached a settlement about the dismissal with their employer through ACAS

- Those employed under an illegal contract

- Taking part in official industrial action, unless the reason is automatically unfair (see above)

- Police staff, except in cases relating to health and safety or whistleblowing

- Those who have signed a settlement agreement with their employer

- Workers on fishing boats who are paid out of the profits made by the boat.

If the employment tribunal finds that an unfair dismissal has taken place then they can order the employer to reinstate the employee to their old job, or to find a new job for them at the company, though in practice this is rare.

The employment tribunal can also order compensation to be paid. This will be made up of a basic award and a compensatory award. The amount of the basic award depends on factors such as the employee’s age, gross weekly pay and length of service. The basic award is the equivalent to a statutory redundancy payment.

An employee who is dismissed for gross misconduct generally forfeits their right to notice or a notice payment.

The compensatory award compensates the employee for the money lost due to losing their job, and is capped at £86, 444, for dismissals that took place after 6 April 2020. If the employee was dismissed between 5 April 2019 and 6 April 2020, the cap was £88,519 or a year’s salary, whichever is lower. These limits do not apply to cases relating to health and safety and whistleblowing. Compensation for dismissals here are uncapped.

Constructive unfair dismissal

Even if you resigned from your company, you may still be able to make a claim against them if they feel that your actions have forced you out or made their position untenable. This is known as constructive dismissal. Examples of situations which may lead to a claim for constructive dismissal include:

- Non-payment or late payment of wages;

- Changing working conditions without asking the employee;

- Harassment or insulting language.

Wrongful dismissal

Your employer may be guilty of wrongful dismissal if they dismiss you in breach of your rights under your contract of employment. This most commonly occurs when the employee is not given the notice stated in their contract or the procedure laid down in the contract for dismissal is not followed properly.

Even if no notice period is stated in your contract, you may still be able to base a claim on your statutory right to notice as set out above. An employee who is dismissed for gross misconduct generally forfeits their right to notice or a notice payment.

Redundancy

Redundancy is when an employee is dismissed because a company no longer needs anyone to carry out that particular work perhaps due to changes in the business such as a restructure or a downturn. If the role that an employee did is no longer available, or the workplace closes down, this will usually lead to a redundancy situation.

You have certain rights in relation to redundancy. As well as possibly being entitled to redundancy pay (both statutory and contractual), you have the right to reasonable time off to look for a new job or arrange training and to not be unfairly selected for redundancy.

If they select someone for redundancy for any of the following reasons, then they may face a claim for unfair dismissal and/or discrimination:

- Gender

- Marital status

- Sexual orientation

- Race

- Disability

- Religion or belief

- Age

- Membership or non-membership of a trade union

- Health and safety activities

- Working pattern (e.g. part-time or fixed-term employees)

- Maternity leave, birth or pregnancy

- Paternity leave, parental or dependants leave

- Their exercise of their statutory rights

- Whistleblowing (e.g. making disclosures about wrongdoing)

- Taking part in lawful industrial action lasting 12 weeks or less

- Taking action on health and safety grounds

- Doing jury service

- Being trustee of a company pension scheme.

Even if they can show that the reason for the redundancy is genuine, they will also have to show that they have followed a fair procedure when they selected the employees for redundancy. Common fair ways of selecting employees for redundancy include:

- Firstly asking for volunteers;

- Consider the pool of roles that are to be considered for redundancy;

- Devise an objective selection criteria to help them select employees for redundancy and one that is relevant to the pool;

- Provide guidance to accompany the selection criteria to ensure consistency is applied;

- Use previous appraisals, 1-1 evidence, assessments and supervisions as well as management feedback and indicators to assist with scoring against the selection criteria;

- Consider whether there have been any previous disciplinary issues;

- Consider skills, qualifications and experience as criteria.

Consultations

Any member of staff that they choose to make redundant will be entitled to consultation on the matter, where you can discuss the reasons for their selection and any alternatives. If a selection criteria and scoring exercise have been carried out, they should share your performance with you.

If they are making more than 20 employees redundant then the consultation should take place with a representative, either from the trade union or elected from the workforce. There is also an obligation to report the redundancies to the Secretary of State for BEIS where more than 20 employees will be made redundant.

For the length of the consultation, the following minimums exist:

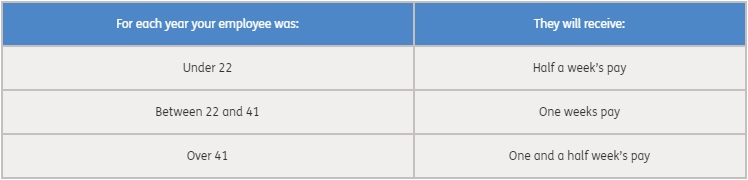

Certain caps do however apply to redundancy pay. Length of service is capped at 20 years, while the maximum redundancy pay per week is £538 (from 6 April 2020). A maximum amount of a statutory redundancy payment is £16,140.00 from 6 April 2020).

The GOV.UK website offers a helpful employee redundancy calculator. However, they will not have to pay this to you if they offer to keep you on or find you suitable alternative employment.

Notice periods

As an employer they are obliged to give employees a minimum notice period before redundancy takes effect (see above). These are known as statutory notice periods and depend on your length of service with the company.

Payment in lieu of notice

Instead of asking an employee to work during the notice period, it is possible for an employer to dismiss the employee immediately and make a payment to them for the notice period, providing there is a provision for this in their contract.

Settlement agreements

Upon the dismissal of an employee, that employee and their employer can enter into what is known as a Settlement Agreement. Through a settlement agreement the two parties can settle any employment claims that may be made by the employee after they leave or reach an agreement in contemplation of any claims being brought.

By entering into a settlement agreement the employee waives their right to make any claims, such as unfair dismissal.

Settlement agreements can be much simpler and stress-free to arrange than a claim that has to go through the courts or an employment tribunal. It is advisable to issue a settlement agreement where a substantial redundancy payment is being made or where a sum in excess of the legal requirement is being made to the employee.

Before reaching a settlement agreement with you, they must ensure that you have received legal advice from an independent adviser first. This adviser should be a qualified lawyer, a trade union representative or an advice centre representative.

By entering into a settlement agreement the employee waives their right to make any claims, such as unfair dismissal.

You should acquire a certificate from the adviser confirming that they have given advice to you on the terms and effect of the agreement. The advice will also confirm that the adviser has the necessary insurance.

Whilst not a legal requirement, is expected practice for an employer to provide a reasonable contribution to the cost of the employee’s legal fees. What is deemed reasonable is dependent on the seniority of the employee and the nature of the business. The contribution typically ranges from £350.00 - £750.00 plus VAT.

Examples of terms that a settlement agreement may contain include:

- An amount of compensation offered to the employee;

- Assurances given by both the employer and employee;

- Confidentiality;

- The parties refrain from making disparaging and/or derogatory remarks about the other whether in writing or orally;

- Indication that all terms have been accepted by the employee and that they will not take legal action in future;

- A letter of reference which can be used by the employee in future job applications;

- An agreed announcement in some cases;

- A ‘non-compete’ clause which places some restriction on the type of jobs the employee is able to apply for in the future and an extension of the contract of employment;

- Payment of tax.

Confidentiality clause – i.e. that the employee cannot disclose some or all of the details of the agreement or the termination of their employment to anybody.

Taking time off to find a job

If, by the time your employment ends, you have been working for the company for at least two years, you have the right to take a reasonable amount of time off in your notice period, in order to look for a new job or to sign up for training which will help you find employment.

What is considered ‘reasonable’ will vary on a case-by-case basis; there are no rules covering this, and you will have to reach an agreement with your employer.

Unless your employment contract states otherwise, they only have to pay you 40% of one week’s wage for any time you take off to find a job during your notice period. So, if you usually work five days a week and take six days off during your notice period for job-hunting, you will only be paid for two of those days – 40% of the five-day working week.

About DAS Group

The DAS UK Group comprises an insurance company (DAS Legal Expenses Insurance Company Ltd), a law firm (DAS Law), and an after the event (ATE) legal expenses division.

DAS UK introduced legal expenses insurance (LEI) in 1975, protecting individuals and businesses against the unforeseen costs involved in a legal dispute. In 2018 it wrote more than seven million policies.

The company offers a range of insurance and assistance add-on products suitable for landlords, homeowners, motorists, groups and business owners, while it’s after the event legal expenses insurance division offers civil litigation, clinical negligence and personal injury products. In 2013, DAS also acquired its own law firm – DAS Law – enabling it to leverage the firm’s expertise to provide its customers with access to legal advice and representation.

DAS UK is part of the ERGO Group, one of Europe’s largest insurance groups (the majority shareholder in ERGO is Munich Re, one of the world’s largest reinsurers).