Brokers turn to collaboration and networks in the face of hard market conditions

Insurance brokers turn to collaboration and extended networks to remain buoyant in the hard market conditions of commercial insurance

- Brokers predict the hard market in commercial insurance will last for another 15 months

- 88% brokers are broadening their client portfolio into new customer sectors

- 35% brokers collaborated with each other to work around a lack of capacity

- Early engagement, proactive data use and risk management advice all used by brokers to work around a lack of capacity

British insurance brokers are collaborating and reaching into new customer markets to trade within the commercial insurance hard market, Aviva’s Broker Barometer shows.

Aviva’s research into UK broker attitudes shows an acceptance that hard market conditions are likely to continue on average for 15 months. A total of 38% of brokers predict the hard market will last between 12 and 18 months. Only 4% of brokers reported that they “were not seeing the issues typically found in a hard market”.

Brokers demonstrated adaptability in response to the hard market with 88% diversifying into alternative sectors and customer groups. Brokers said new customer markets included financial services (25%) real estate (22%), the public sector and transport & distribution (both 21%). The move to targeting financial services customers was driven by national and regional brokers (32% and 30%, respectively) while local brokers focussed on real estate with 21% reporting a shift in focus to property.

Collaboration between brokers was a key means to overcome a lack of capacity in the market, with 35% of brokers saying they had worked with other brokers or had created networks. Almost half (46%) of regional brokers reported collaboration as a key tactic to address capacity, higher than national brokerages (38%) and local brokers (33%).

Data and Risk Management drive client support

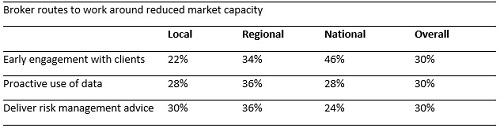

Brokers also worked proactively to support clients in countering the effects of reduced market capacity. Early client engagement, the proactive use of data and delivering risk management advice were all reported by 30% of brokers as a way to work around a lack of capacity.

Different levels of brokers tackled the issue in a variety of ways with 46% of national brokers more likely to engage clients early. Regional and local brokers favoured risk management or proactive data use, with 36% of both groups citing both approaches.

Gareth Hemming, Aviva’s Chief Distribution Officer, said; “The hard market conditions we are seeing across commercial insurance have made for a really tough trading environment for brokers and are likely to continue for some time. It is no surprise that brokers have found new ways to work around these conditions, as they have during the past 18 months of the pandemic. Our key focus has been to work with our broker partners to support them in doing so and to remain buoyant with varied trading conditions

“We have delivered a wealth of content to help brokers work proactively around the reduction in capacity. This ranges from risk management guidance on our Aviva Risk Management Solutions site, to publishing a library of loss prevention standards that address a range of risks, from Covid-19 to protecting your people, property and business.

“We have also developed a market-leading Commercial Intelligence Tool (CIT) which brings together our own data with open databases, AI and input from our data scientists. The result is a tailored, personalised view of the customer, enabling brokers to deepen their understanding of them and build long-term relationships. CIT also helps customers make informed decisions about their level of cover and any gaps that may exist. Brokers can access this information at half year review, renewal or any other time they choose.

“We will continue to develop these services so that brokers can keep supporting long-standing customers as well as new customers in new sectors, helping British businesses as the UK continues to open up.”

Authored by Aviva

About Aviva

Aviva Insurance Limited is one of the UK’s leading insurance companies, part of the Aviva group with 34 million customers Worldwide. Aviva Insurance has been in the insurance business for more than 300 years.

In UK commercial, the insurance market remains challenging for insurance brokers and customers, due to the ongoing economic conditions. Aviva Insurance are focusing on improving our processes to ensure Aviva provide commercial customers with insurance cover at an acceptable price. Insurance brokers also recognised our excellent customer service by voting us Insurance Times General Insurer of the Year in 2012, for the second year running. youTalk-insurance sharing Aviva insurance news and video.