Brokers optimistic about future, but industry-wide recruitment issues threaten growth

- Brokers remain optimistic about their future, with 43% expecting growth in 2022

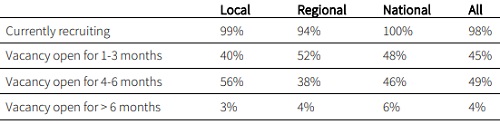

- 98% of brokers currently have a vacancy; 53% of vacancies open for four months or more

- Recruitment driven by business growth (34%) and staff migrating to home-based roles (29%)

- Recruitment for junior roles driven by brokers looking to plug retirement exodus

- One in four brokers (23%) pay ‘considerably more than expected’ for new hires

British brokers’ optimistic growth expectations are being hampered by recruitment issues, which are impacting insurance brokers of all sizes, Aviva research shows.

Aviva’s annual Broker Barometer research shows brokers are optimistic about growth prospects, with close to half (43%) expecting their own businesses to grow, compared with 23% who expect to see their business shrink. Brokers also had similar expectations for their clients, with 45% expecting to see growth while 19% expected to see their client’s business shrink.

Help wanted

However, inflation and an intensifying race for talent could impact brokers’ ability to capitalise on their growth expectations. Brokers cited rising inflation (16%) as their top concern about future changes in the market. This was followed by regulatory changes, with both commission disclosure and compliance changes highlighted by 15% of brokers as a concern.

The more immediate issue that could hinder brokers’ ability to grow is recruitment. When asked if they were currently recruiting for a role in their business, 98% of brokers confirmed that they were, with more than half (53%) reporting a vacancy that had been open for four months or more. This is highest for local brokerages (59%), followed by national brokers (52%) and regional brokers at (42%).

The average length a broking vacancy has been open is 4 months. This length of time is in contrast to a recent report by TotalJobs in Q4 2021, which reported that the average time to hire in the UK was 4.3 weeks.

Brokers are recruiting at all levels. Aviva’s data shows that 52% of brokers are recruiting for mid-management professionals, followed by senior management (41%), while one-third of brokers (33%) are looking to fill a role at a more junior level.

Growth and homeworking drive vacancies

The demand for new staff is being driven by a number of different factors. Growth was cited by one-third of brokers (34%), an encouraging trend that was highest in nationally-focussed brokers at 50%, followed by 30% of local brokers and 24% of regional brokers. This was followed by 29% of brokers who had vacancies as a result of staff leaving for more home-based roles, a trend that was highest in local brokerages (31%) followed by regional (31%) and national (25%).

An additional trend the research uncovered was the proportion of vacancies occurring as a result of staff retiring – cited by almost one-fifth of brokers (19%). Further analysis of the data shows that where a vacancy exists due to retirement, the recruiting brokers are most likely to be looking for a junior member of staff to join the team (36%), rather than for a colleague in a mid-management role (20%) or at a senior management level (12%).

The volume of vacancies may also be driving up the cost of recruitment, particularly if vacancies outnumber the candidates available. In fact, 42% of brokers said they had to pay a new hire more than they had planned to, with 24% saying that they paid ‘considerably more’. One-third (33%) of national brokers paid considerably more than expected, followed by 29% of regional brokers and 19% of local brokers.

Gareth Hemming, Aviva’s Chief Distribution Officer, said; “It is good to see continuing optimism for growth in the market despite inflationary pressures- a factor we will all have to face into. However, the volume of brokers telling us that they have had an open vacancy for 4 months or more will be a significant headache – particularly when brokers are looking to capitalise on growth opportunities while contending with an evolving regulatory landscape.

“The number of experienced brokers who are retiring emphasises the need to bring the next generation through. Our Aviva apprenticeship programme supports brokers to do exactly this - and has done since 2020 when we identified a need following discussions with our broker partners. I am proud to say that recruitment for our third cohort is underway and I look forward to seeing how they develop.

“The data also suggests that we need to consider how brokers of the future expect to work, rather than expecting them to operate the same way as previous generations. In this case, culture and ways of working become even more important. Today’s workforce is more dynamic and mobile as post-pandemic changes to the way businesses operate continue to influence how and where brokers choose to work.”

Aviva has developed a range of programmes to help deliver the next generation of broking talent and leadership. The Aviva Future Leader programme for independent brokers and the Aviva Broker apprenticeship programme are both available to Brokers via the Aviva Broker website.

Authored by Aviva

About Aviva

Aviva Insurance Limited is one of the UK’s leading insurance companies, part of the Aviva group with 34 million customers Worldwide. Aviva Insurance has been in the insurance business for more than 300 years.

In UK commercial, the insurance market remains challenging for insurance brokers and customers, due to the ongoing economic conditions. Aviva Insurance are focusing on improving our processes to ensure Aviva provide commercial customers with insurance cover at an acceptable price. Insurance brokers also recognised our excellent customer service by voting us Insurance Times General Insurer of the Year in 2012, for the second year running. youTalk-insurance sharing Aviva insurance news and video.