Aviva research shows 86% of SMEs have no Cyber cover

- 86% of SMEs have no cyber cover despite increases in cyber fraud and breaches

- Up to 41% of SMEs made digital changes to their business during the pandemic with 96% or more planning to keep their digital changes

- Only 12% SMEs updated their cover to reflect the digital changes they had recently made

- As few as 3% of SMEs in some UK regions have cyber cover

The majority (86%) of British small to medium enterprises (SMEs) do not have any cyber insurance cover in place, research from UK insurer Aviva shows.

EG Action Fraud reported a 400% increase in cyber-related fraud in March 2020 and 46% of businesses experienced a breach during 2020, yet many SMEs are leaving their livelihoods at risk by not selecting cyber insurance.

Aviva’s SME Pulse Survey found that this lack of insurance protection comes at a time of rapid digitisation. The survey showed that 41% of SMEs updated their website in response to the pandemic, and 39% moved online or improved their online offering. Nearly all (96% )of those who made a change confirmed that they would keep the changes. However, despite increasing their digital presence, only 11% updated their cyber cover at the time.

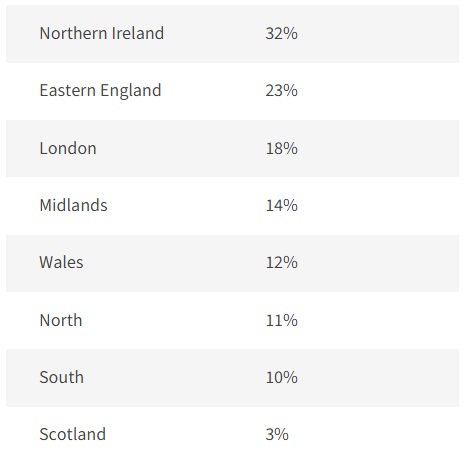

Only 14% of SMEs said they had any cyber cover, with significant regional variances. Just 3% of Scottish SMEs had cyber cover in place, compared to 32% in Northern Ireland.

UK Regions with specific cyber cover

Alana Muir, Senior Cyber Underwriter at Aviva, said, “Customers will often have cover for ‘tangible’ risks like fire, flood and theft, but the impacts on a business of a cyber breach extend beyond the initial costs. They also result in loss of revenue and damage to both reputation and trust.

“The pandemic has accelerated digital adoption across all businesses, meaning cyber insurance has quickly moved from a perceived luxury to an absolute must-have. Cyber cover doesn’t just protect businesses against an attack, but it also ensures they have fast access to expert specialists, so they can return to normal as quickly as possible in the event of a cyber incident.

“We know from our Aviva Risk Insights report that cyber-attacks are one of the biggest issues faced by SMES. This gives us a perfect storm where cyber attacks are increasing while businesses leave themselves exposed through lack of cover. So it is important that businesses make sure they are not just staying on top of their digital admin but they are also covered if they are one of the increasing number being targeted by online criminals.”

Top tips for business owners:

- If you are unclear about your digital risk, contact your insurance broker to understand the risks to your business and what protection you may need.

- Always use individual identification and passwords to access your computer equipment and change default or manufacturers passwords.

- Back up all data every 7 days or less and store backups securely and away from the data or programs they relate to.

- All personal and business data must be stored and disposed of in a secure manner. Remember the definition of ‘personal data’ includes information you hold on suppliers, business emails, and employee data.

- Install any updates for firmware, operating systems, software, or programs within 14 days of release where the updates address a vulnerability described by provider as critical, important, or high.

- Ensure that any equipment connected to the internet or other network is protected by a suitable firewall and ensure it is updated automatically or at intervals of a month or less.

Authored by Aviva

About Aviva

Aviva Insurance Limited is one of the UK’s leading insurance companies, part of the Aviva group with 34 million customers Worldwide. Aviva Insurance has been in the insurance business for more than 300 years.

In UK commercial, the insurance market remains challenging for insurance brokers and customers, due to the ongoing economic conditions. Aviva Insurance are focusing on improving our processes to ensure Aviva provide commercial customers with insurance cover at an acceptable price. Insurance brokers also recognised our excellent customer service by voting us Insurance Times General Insurer of the Year in 2012, for the second year running. youTalk-insurance sharing Aviva insurance news and video.