Aviva produces step-by-step guide for digital mid-term adjustments

Authored by Aviva

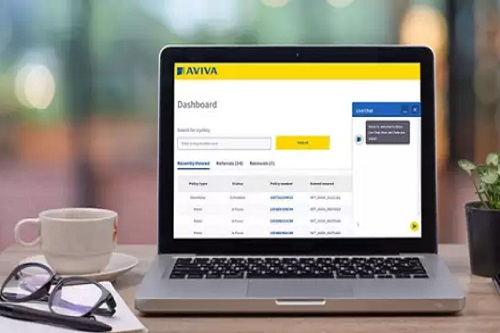

Last year, we launched a new self-serve tool on Aviva Broker for your regionally-traded business.

This was in response to what we believe is a shared ambition. We know access to our underwriters is paramount in supporting your ambitions and helping to find the right solution for your clients. But at times, their expertise is being taken away from where it’s needed by simple and repetitive tasks.

This also means you’re waiting longer than you should be for straightforward requests to be completed.

By building a digital solution, we’re giving you control to make mid-term adjustments (MTAs) on regionally-traded Commercial Motor and renew or lapse across Motor and non-Motor policies. Not only does this allow you to process requests when it best suits you, it should help to improve service levels and give your underwriter more capacity to work with you on those complex cases that require their attention.

Your step-by-step guide

We appreciate getting to grips with a new process can take some time. That’s why we’ve made the tool as simple and straightforward to use as possible.

To help you along the journey, we’ve developed a new step-by-step guide you can save and use as a reference point for your next MTA, renewal or lapse online.

The guide shows you exactly how to:

- Add or remove a vehicle for regionally-traded Commercial Motor policies.

- Renew an eligible policy.

- Lapse an eligible policy.

This digital solution is now our preferred and recommended way to deal with these requests moving forward. And with plans to expand the capability further, now is a good time to explore how quickly you can process these changes online.

For more information about the self-serve tool, including how to request access, visit our page on Aviva Broker here.

Continued investment

Being able to self-serve MTAs on regional Commercial policies is just one of the examples of how we’re looking to enhance our digital and underwriting proposition.

Our recent investment is helping to identify underinsurance, provide quicker service through automatic triaging and prioritising against appetite, ongoing developments for our number one digital trading proposition1 and digitising our claims offering by introducing the ability to track claims data online. We’ll continue to invest in our network and in our digital channels to provide the best possible trading and underwriting experience.

To download Aviva’s step-by-step guide CLICK HERE

About Aviva

Aviva Insurance Limited is one of the UK’s leading insurance companies, part of the Aviva group with 34 million customers Worldwide. Aviva Insurance has been in the insurance business for more than 300 years.

In UK commercial, the insurance market remains challenging for insurance brokers and customers, due to the ongoing economic conditions. Aviva Insurance are focusing on improving our processes to ensure Aviva provide commercial customers with insurance cover at an acceptable price. Insurance brokers also recognised our excellent customer service by voting us Insurance Times General Insurer of the Year in 2012, for the second year running. youTalk-insurance sharing Aviva insurance news and video.