Why is index linking so important to customers?

Authored by Allianz

“You had to have been hiding in a cave for the last few months not to have yet noticed that the price of parts, of labour, of utility and energy supply are all increasing.” Says Nick Hobbs, chief distribution and regions officer. “Inflation is at its highest level for thirty years and, within that, material prices are the highest they have been for over forty years.

Given that context, index linking for residential and commercial buildings has never been more relevant. Either that or regular and disciplined sums insured reviews. Buildings need to be insured for the correct amount if the client is to avoid underinsurance and the potential for an ensuing claim shortfall, existential business threat and difficult conversation with their broker partners.”

Current influences on inflation

There are multiple reasons for the current high rate of inflation, inevitably related to the dual impact of Brexit and the pandemic. Inflationary pressures on materials and labour have continued to increase costs throughout the post pandemic period, which causes significant industry issues and has an impact on claims inflation. The economy is now reopening with consumers spending the money they couldn’t during the lockdown restrictions, resulting in demand outstripping supply across many areas. The rising cost of materials and stock coupled with global supply chain challenges has further compounded the issue.

Below we look at some key areas influencing inflation.

Materials and parts

Materials are currently in demand and increasingly expensive. According to data from the Department for Business, Energy and Industrial Strategy (BEIS), prices for raw materials (including bricks, cement and concrete blocks) increased month on month during 2021.

Further, the price of some imported timber rose by 23% between June and July 2021.3 Long lead times have compounded the issue, due in part to Covid-19 and Brexit related supply chain delays.

Construction materials costs have reached their highest for 40 years (Royal Institute of Chartered Surveyors)

Labour and skill shortages

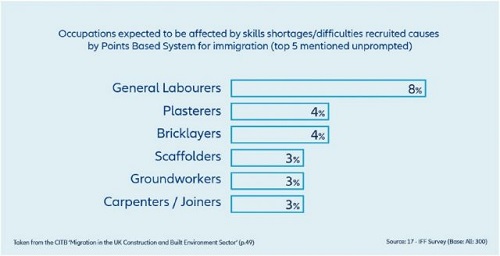

The manufacturing and construction markets have been heavily impacted, with the most recent Labour Market Outlook showing these industries struggling to fill vacancies.4 Existing challenges with a lack of skilled workers have been exacerbated by both the pandemic and new restrictions regarding the end of EU freedom of movement. Between 2019 and 2020, the proportion of migrant construction workers aged under 25 fell from 9% to 3%.5

In October 2021, a lack of Heavy Goods Vehicle drivers made UK headlines. Despite some signs that the situation may be improving, partly due to pay rises for drivers, many haulage and logistics firms are still reporting a shortage in drivers.

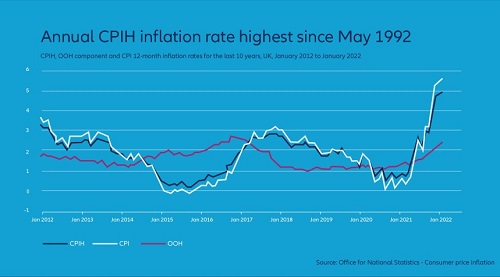

Rate of inflation

The Bank of England has advised that it expects the inflation rate to reach around 8% in Spring, and average 7.4% for the majority of 2022

Whilst inflation rates remain high, customers can expect a commensurate rise in their premiums for index linked policies. Ultimately this is a safeguarding measure, to ensure that the customer receives a fair settlement in the event of a valid claim.

Detailed information about the UK’s economic outlook can be found in the Bank of England’s Monetary Policy Report.

What's the reason for index linking?

Index linking is applied by insurers to ensure that an asset’s insured value is adjusted in line with changes in inflation, deflation and the cost of living. It’s commonly used in buildings insurance to calculate the difference between the sum insured and a property’s rebuild value. However index linking is not limited to buildings. Changes and developments in the macroeconomic environment can affect the value of other assets, such as stock, materials and parts, as mentioned earlier in this article.

Insurers use various indices to calculate index linking, including the Consumer Price Index (CPI) and Retail Price Index (RPI). For both residential and commercial buildings insurance many insurers refer to information provided by the Building Cost Information Service (BCIS), which operates under the Royal Institute of Chartered Surveyors (RICS). The BCIS uses a number of factors in their calculations including the cost of labour, materials and professional fees.

Index linking is undertaken to protect against the risk of underinsurance, where a policyholder may find they are responsible for a percentage of the total loss due to their asset not being insured for its full value. By applying index linking, the sum insured is automatically updated (usually increased) in line with economic changes when the policy renews. Whilst the policyholder will only see a price change at renewal, most policies are index linked on a monthly basis.

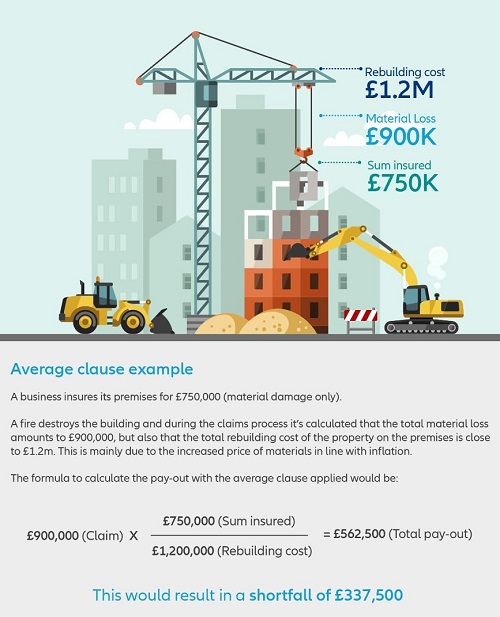

Underinsurance and the 'average' clause

Where a customer is underinsured, there can be several consequences. The settlement may be reduced and the ‘average’ clause applied. This means if the insurer finds the business has taken out inadequate insurance, it can reduce the settlement by the same percentage by which the asset is underinsured.

Allianz reviews showed that almost 50% of policies had a buildings sum insured that was less than 80% of the rebuilding estimate.

Another potential repercussion of being underinsured is the threat of disruption to business, perhaps whilst rebuilding takes place or due to delays with replacing stock and materials. This in turn could result in loss of customers and damage to reputation.

The importance of the right valuation

Customers should be aware of obtaining the right type of valuation for property insurance purposes.

Insurers require a reinstatement cost valuation by a RICS qualified valuer for insurance purposes, which calculates the cost of rebuilding a premises from the ground up should it be destroyed (e.g. by a fire). This is different from a market valuation which represents the likely amount a building would sell for on the market at the time the valuation is made. Similarly, a mortgage valuation is not an eligible valuation for insurance purposes since this is conducted by mortgage lenders to check that the property will be suitable security for the loan applied for and generally, they specifically state it is not suitable for insurance purposes.

A reinstatement cost valuation should be carried out by a professional, whether in person or as a desktop valuation assessment; the latter is completed using information which is publicly available, plus any data the surveyor may already have regarding the premises and/or area.

Ways to avoid underinsurance

Some recommended measures for customers include:

- using brokers who are ideally placed to provide advice and guidance to their customers on the risk of underinsurance

- regularly reviewing their sums insured

- ensuring their declared values to insurers are index linked annually; however it's not recommended to rely on index linking alone, because the index used represents an average so may not be reflective of increases required on all buildings. This can vary depending on the nature of construction materials and/or specialist labout requirements

- considering re-evaluations of all their insured property, compiled by a professional member of the Royal Institute of Chartered Surveyors (RICS) or some other suitable valuer as agreed by the insurer, at no more than three year intervals

- discussing with their broker the possibility of extending their policy coverage to waive the insurer’s condition of Average. It’s important to note that where an insurer agrees to this, they’re likely to require a professional valuation of all property insured at regular intervals to be agreed with the insurer

- considering whether a desktop valuation may be possible. Some insurers, including Allianz Insurance plc, will now consider desktop valuation surveys

- considering taking out a longer indemnity period, taking into account all external economic factors and current influences on inflation which could delay the repair, reinstatement or rebuild of their property

- ensuring non recoverable VAT is included in any Buildings Declared Value(s) declared to the insurer.

Summary

Index linking is one way to combat the risk of underinsurance but it’s important for customers to be informed of other steps they can take to safeguard their assets. Measures such as engaging and ensuring the right type of professional valuation (i.e. for insurance purposes) is carried out at regular intervals (no more than every three years), alongside reviewing their policy coverage with brokers, can all ensure that policyholders are adequately protected in the event of a claim.

About Allianz

Allianz Insurance is one of the largest general insurers in the UK and part of the Allianz Group, a leading integrated financial services provider and the largest property and casualty insurer in the world.

The mission of Allianz Insurance is to be the outstanding competitor in our chosen markets by delivering products and services that our clients recommend, being a great company to work for and achieving the best combination of profit and growth. We aim to achieve this by putting the customer at the heart of everything we do.

Allianz is able to offer customers a wide range of products and services including home and motor and commercial insurance with full range of products and service for sole traders' right up to large commercial organisations.

Allianz Insurance employs over 4,500 people across a network of 20 offices in the UK and the company’s Head Office is situated in Guildford, Surrey. Our heritage and financial strength help make Allianz what it is today; a safe and trusted partner. Over 40 FTSE100 companies partner with Allianz. youTalk-insurance sharing Allianz Insurance news and video