Light commercial vehicles - managing the safety and technology gap

Authored by Allianz

Demand for vans grew in 2021, with the Society of Motor Manufacturers and Traders (SMMT) reporting a 21.4% uptick in registrations on the previous year, far outstripping the 1.0% increase seen for cars. While this is in line with a shift in work trends, there are concerns that technology and safety lag in the light commercial vehicle sector.

After a slow start in 2022, as supply issues hit the market, the SMMT reported signs of recovery towards the end of the year, with registrations in the light commercial vehicle market up by 10.8% in September . Registrations for electric vans were particularly buoyant, with a 70% increase in September giving this type of vehicle a 4.4% market share.

Driving demand

Several different factors are driving this shift towards vans. Strong demand has come through from sectors such as home delivery and construction and, with fewer perk vehicles being offered in the corporate space, we’ve also noted a slight shift in our books towards more vans.

The move towards electric vans is understandable too. Purchase incentives through the plug-in van grant, lower taxation and cheaper running costs have made these vehicles attractive. Additionally, as more zero and low emission zones are introduced, the appeal of electric vehicles will increase ahead of the ban on sales of new petrol and diesel vans in 2030.

Switching to an electric vehicle can also send out a positive message to customers, underlining the business's commitment to reducing emissions. There’s also much more choice now, as manufacturers look to meet this growing demand for electric vans.

Safety concerns

There are plenty of positives behind the growth in van registrations, especially those powered by battery, but concerns remain around the safety technology fitted in light commercial vehicles. Thatcham Research warns that as the safety technology on vans lags behind that of passenger cars, there is a huge safety deficit .

Its research found that on average there are 12 standard safety features in cars, including autonomous emergency braking, speed assistance and lane keep assist, vans generally only have one safety feature – a driver airbag.

This deficit results in some alarming road traffic accident statistics. Per mile travelled, vans and light commercial vehicles are involved in more deaths of other road users than any other vehicle type.

The risk of injury or death for other road users is higher if they are involved with a van than with a car. For car occupants, the risk is 40% higher if in collision with a van or light commercial vehicle, while, for cyclists, it’s 12% higher. Van occupants themselves are 7% more likely to suffer serious injury or death than car occupants.

Improving standards

To address this safety deficit and give other road users the protection they need, Thatcham Research is calling on van manufacturers to fit robust advanced driver assistance systems. Alongside this, and to highlight the good and bad performers in the van space, it’s also launched its Commercial Van Safety Ratings.

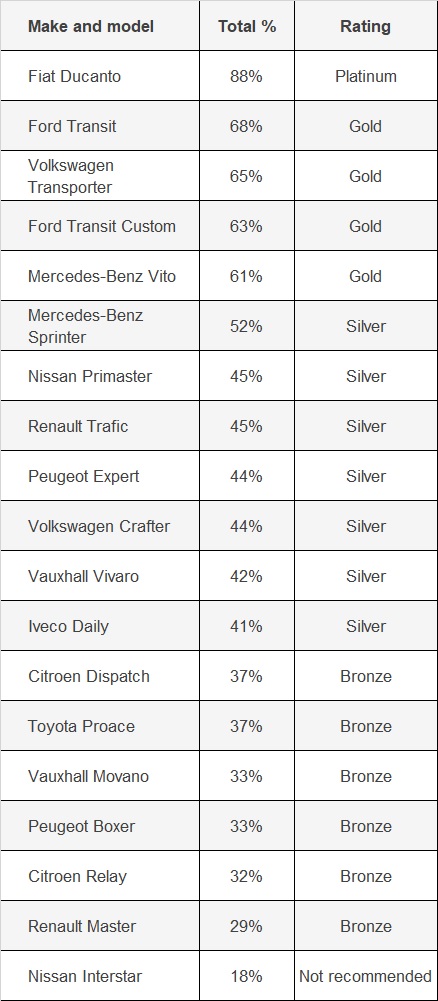

These ratings assess the safety-critical equipment fitted on new vans, giving scores ranging from ‘platinum’ to ‘not recommended’, based on the fitment rate and performance of active safety and anti-collision technology.

The 2022 ratings show that there’s plenty of room for improvement in van safety. Just one van – the Fiat Ducato – achieved the platinum rating, with four others, including Britain’s best-selling van, the Ford Transit Custom, getting a gold rating. The worst performer is Nissan’s Interstar, which received a not recommended rating.

Thatcham Research commercial van safety rating 2022

About Allianz

Allianz Insurance is one of the largest general insurers in the UK and part of the Allianz Group, a leading integrated financial services provider and the largest property and casualty insurer in the world.

The mission of Allianz Insurance is to be the outstanding competitor in our chosen markets by delivering products and services that our clients recommend, being a great company to work for and achieving the best combination of profit and growth. We aim to achieve this by putting the customer at the heart of everything we do.

Allianz is able to offer customers a wide range of products and services including home and motor and commercial insurance with full range of products and service for sole traders' right up to large commercial organisations.

Allianz Insurance employs over 4,500 people across a network of 20 offices in the UK and the company’s Head Office is situated in Guildford, Surrey. Our heritage and financial strength help make Allianz what it is today; a safe and trusted partner. Over 40 FTSE100 companies partner with Allianz. youTalk-insurance sharing Allianz Insurance news and video