Brokers call for more support to help fight insurance fraud

Four in five brokers see increased instances of insurance fraud, yet only a third feel confident to deal with the rise

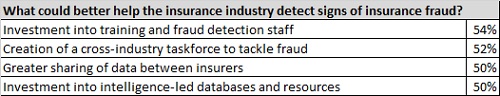

Over half of brokers believe internal investment and cross-industry collaboration will help identify the signs of fraud

The insurance industry is facing a significant issue with fraud, with growing concern among brokers on increasing levels of insurance fraud, according to the results of the latest Broker Pulse from RSA Insurance.

The study of 200 brokers across the UK shows a rise in fraudulent claims over the past year with 83% of brokers having reported seeing an increase in instances of fraud. While the vast majority (86%) are confident that they can detect the signs of fraud, more than three quarters (76%) say they needed to increase resources to deal with fraudulent claims.

With the ongoing cost-of-living crisis likely to exacerbate this issue, only 32% of brokers responded that they are ‘very confident’ that their business is equipped to deal with this rise.

When asked about the best options to help the industry counteract this rise, brokers pointed to solutions involving internal investment and greater cross-industry collaboration to tackle the ever-evolving crime of insurance fraud. Over half of brokers (54%) plan for further investment in training for employees and fraud detection staff, 52% are calling for the creation of a cross-industry taskforce, while a further half (50%) recognise the benefits from greater sharing of relevant data across the industry. This would allow organisations to enhance and modify their current processes to better identify fraudulent claims.

Adele Sumner, Head of Counter Fraud Strategy & Financial Crime at RSA said: “The findings of our latest Broker Pulse indicates that brokers are seeing a rise in fraudulent claims, which is concerning, but unfortunately not a surprise. In times of economic hardship, like the one we are currently going through, fraudulent activity does tend to increase and in certain instances individuals and businesses can feel they need to do things that were previously unthinkable.

“What is encouraging is that brokers have the confidence to detect the signs of fraudulent activity. We’re keen to continue collaborating with brokers and share strategic intelligence on the trends of fraudsters. By keeping a sharp focus on the issue and taking appropriate action, we can more effectively safeguard the interests of customers.”

Authored by RSA

About RSA

With a 300-year heritage, RSA is one of the world’s leading multinational insurance groups.

Today, RSA employ around 23,000 people, serving 17 million customers in around 140 countries. While RSA's origins lie in London, RSA is a global company with businesses in both mature and emerging markets. RSA have major operations in the UK, Ireland, Scandinavia, Central and Eastern Europe, Canada, Asia, the Middle East and Latin America. youTalk-insurance sharing insurance news and video.