UK homes are host to £46 billion of hobby equipment

UK homes are host to almost £46 billion* of hobby-related equipment, according to a study from Aviva.

A survey of 2,000 UK residents finds 93% of people take part in regular hobbies, with the vast majority requiring specialist equipment.

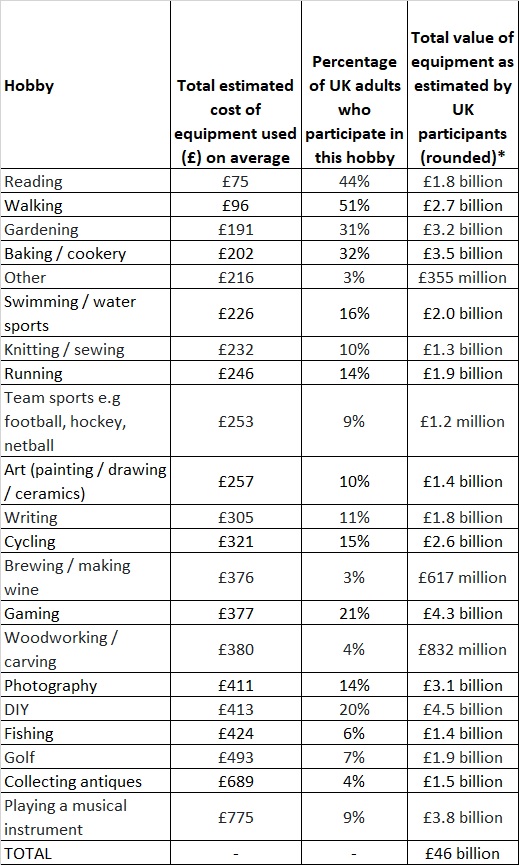

According to the insurer’s research, playing a musical instrument, collecting antiques and playing golf are among the activities requiring the most expensive equipment on average, while reading and walking are believed to be cheaper pursuits.

Respondents suggested they owned equipment with the following values, based on their chosen activity:

However, while participants estimate the value of their hobby “kit” typically between £75 (reading) and £775 (playing a musical instrument), Aviva suggests this figure could be much higher.

Insights from the insurer suggest that hobbyists may vastly underestimate the cost of replacing their equipment, should the worst happen. For example, while the survey finds anglers estimate the value of their equipment at £424, Aviva claims information reveals fishing equipment cost £1,873 on average to replace in 2022.

Similarly, those with a golf hobby estimate the value of their equipment to be £493 – while Aviva paid out £1,693 on average for golf equipment claims last year. Cyclists too estimate they use equipment typically worth £321, while Aviva claims for bicycles were valued at £1,413 on average in 2022.

The survey also reveals where people store their hobby equipment – highlighting a few potential pitfalls. While 61% say they keep their equipment in their home, 17% store hobby items in their shed, 15% in their garage, while 7% keep theirs in their vehicle.

Aviva urges customers to be mindful that policy limits for thefts from outbuildings and vehicles can often be lower than in the main home.

People should also be aware if they have valuable hobby items, they should check the definition and the limit for “valuables” under the contents section of their policy. They would also need to specify anything worth more than the single item limit, normally around £2,000. This may be of interest for people who enjoy collecting antiques, stamps or medals, for example.

If the hobby involves taking items away from the home - for example golf, sports, fishing and photography - people may wish to consider personal belongings as an add-on to their home insurance. More expensive items will need to be specified separately, so it’s important to be aware of the single article limit for personal belongings. Pedal cycle cover will also be required to cover cycles whilst away from home.

Notably, six per cent of hobbyists say they own an activity-related item worth more than £1,000.

Kelly Whittington, UK Property Claims Director, Aviva, says: “As a nation, we clearly love our hobbies! Our study finds nine out of 10 UK homes are host to hobby items. The good news is, in the vast majority of cases, this equipment is likely to be covered under home contents cover, in the event of a major incident such as a flood, fire or burglary.

“However, our research suggests that many people may be underestimating the value of their hobby equipment, so we’d urge people to make sure their cover is appropriate and adequate for their needs. People may also wish to think about accidental damage cover, an optional add-on to home contents cover, which provides protection against damage caused by unexpected drops and spills etc.

“We’d also encourage people to think about where they store their items as outbuildings and cars tend to have lower theft cover levels than the main address – and can sometimes be easier to access. When items are insured and secured, people can have peace of mind to enjoy their hobbies.”

About Aviva

Aviva Insurance Limited is one of the UK’s leading insurance companies, part of the Aviva group with 34 million customers Worldwide. Aviva Insurance has been in the insurance business for more than 300 years.

In UK commercial, the insurance market remains challenging for insurance brokers and customers, due to the ongoing economic conditions. Aviva Insurance are focusing on improving our processes to ensure Aviva provide commercial customers with insurance cover at an acceptable price. Insurance brokers also recognised our excellent customer service by voting us Insurance Times General Insurer of the Year in 2012, for the second year running. youTalk-insurance sharing Aviva insurance news and video.