Insurance Broker NewsIn association with BIBA

-

Financial services under scrutiny as clock ticks on new sexual harassment prevention laws

25 Apr 2024 -

Lockton announces senior promotions in Crisis Management team

25 Apr 2024 -

97% rise in organised insurance fraud being facilitated by stolen identities

23 Apr 2024 -

WF Risk Group buys Dublin based broker

23 Apr 2024 -

Video footage and appearance on The Jeremy Kyle show helps to convict £500k fraudster

18 Apr 2024 -

The Clear Group appoints Mandy Hunt as MGA Managing Director

18 Apr 2024 -

WTW Risk & Broking boosts leadership team with new Global Head of Claims

18 Apr 2024 -

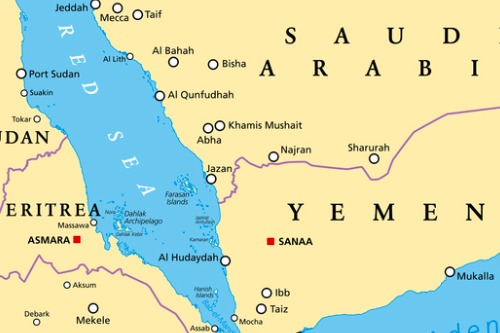

Howden launches first of its kind Red Sea cargo war risk facility

18 Apr 2024 -

Quoted motor insurance premiums up 56.4% in a year

18 Apr 2024 -

Howden Ireland acquires Curran Connolly & Company (Drogheda) Ltd

15 Apr 2024 -

Seventeen Group acquires Jannard Quadrant Insurance Brokers

15 Apr 2024 -

Ardonagh Advisory buys northwest England based broker

11 Apr 2024 -

PIB Group enters new market with latest broker acquisition

11 Apr 2024 -

Aon and ReliaQuest announce collaboration to help organisations manage cyber risk

11 Apr 2024 -

Miller appoints Nick Rnjak to build out dedicated global Power offering

11 Apr 2024 -

Howden UK&I announces new Chief Placement Officer role

9 Apr 2024 -

Howden accelerates growth in France with broker acquisition

9 Apr 2024 -

David Whittaker joins Thomas Carroll Group as Chief Operating Officer

8 Apr 2024 -

Jensten acquires specialist broker Henry Seymour & Co

3 Apr 2024 -

Experienced underwriters launch new MGA Devonshire Underwriting specialising in transactional risk

3 Apr 2024

Pages