The Ardonagh Group has announced its results for the six months ended 30th June 2019.

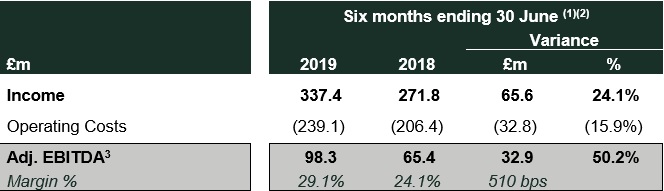

Income grew by 24.1% to £337.4m in the first half of the year, largely driven by the acquisition of Swinton which is performing ahead of plan.

This growth and the delivery of transformation and cost control programmes contributed to a 50.2% rise in H1 Adjusted EBITDA to £98.3 million and Adjusted EBITDA margin improvement to 29%.

Chairman John Tiner said: “With more than four million policies under management, and placing £3 billion gross written premium, The Ardonagh Group enjoys extraordinary reach encompassing personal lines through to international wholesale.” “These strong results reflect the Group’s ability to execute substantial integration projects while remaining agile and able to seize accretive growth opportunities.”

Group financial highlights

In Insurance Broking, income growth of 7.4% was underpinned by 3% organic growth due to an improvement in client retention rates and the growth of emerging risk insurance such as cyber and terrorism. The successful execution of the transformation programmes has improved client service. All advisory sites are now on the Acturis platform and 78% of those have now completed their full annual renewal cycle using Acturis.

Organic growth in Q2 2019 was highest in Specialty, where transformational hires in Price Forbes and Bishopsgate have driven 9.5% organic growth. Ardonagh has line of sight on an additional £15-£20 million of incremental annual income per year as these key hires reach full income maturity.

New business policies written in Retail grew by 8.7% in Q2, predominantly through digital channels. This segment now has 1.7 million policies under management.

A strategy to focus on niche specialist business in Ardonagh’s MGA has delivered 2.2% organic growth in Q2 2019. The improved underwriting performance from this approach contributed to a 8.5% loss ratio improvement. Across the Group, operating cash conversion was 77% in Q2 2019, significantly improved versus prior year and resulting in positive Free Cash Flow4 of £24 million.

Ardonagh CEO David Ross said: “The insurance broking transformation project coming to an end is a moment we have long looked forward to. The Group is now ideally placed at a time where our industry is consolidating around distribution and specialisms. Comprised of a unique portfolio of leading platforms, Ardonagh has emerged as a true leader in the market with unparalleled breadth and scale.

“People across The Ardonagh Group deserve enormous recognition for what we have collectively achieved. We were delighted to be chosen by 3,000 leading industry professionals as The Best of the Best Broker in the British Insurance Awards, a fitting acknowledgement of what we are creating.”