Millions of UK SMEs are missing out on cyber insurance

A significant number of the UK’s SME remain dangerously exposed to a cyber-attack, according to new joint research1 from specialist insurance provider CFC Underwriting and the UK’s leading premium finance company, Premium Credit.

The study found that a third of businesses which have been offered cyber insurance have decided not to invest in the cover. The biggest objection is the belief that a business is too small to be targeted – 30% of firms which don’t have cover say cyber security is not a big enough concern for them.

In addition, nearly a quarter (23%) of businesses believe cyber insurance is not fit for purpose and nearly one in five (19%) say they do not understand what it covers. Just 10% say they cannot afford it. The findings of the study come as Government figures2 show nearly a third (31%) of small businesses have suffered cyber-attacks in the past year at an average cost of £3,650.

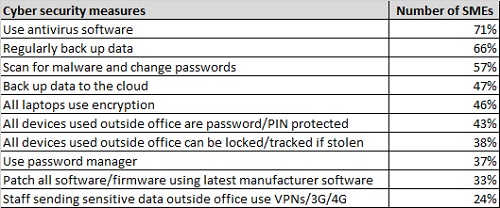

CFC Underwriting and Premium Credit’s research shows many SMEs are taking some action to improve cyber security – just 3% of those questioned have done nothing to protect themselves. Some 71% say they have installed antivirus software while around two-thirds (66%) regularly back up data and 57% regularly scan for malware and change passwords.

The research also found that 63% (1 and 3) of SME owners say their organisation has never been offered the cover.

Pat Brice, Distribution Director at CFC Underwriting, said: “What this research shows is that we all must do better at articulating the value of this increasingly important cover. It is becoming apparent that businesses are far more likely to fall victim to cybercrime than they are to traditional crime, yet they routinely don’t have the cyber protection they need. Insurance providers and brokers need to work together to make sure they are encouraging businesses in all industries to complement good cybersecurity with cyber insurance in case the worst happens.”

Adam Morghem, Premium Credit’s Strategy & Brand Director said: “Cyber security is a growing risk. The Federation of Small Businesses data estimates SMEs are subject to around 10,000 attacks a day costing as much as £4.5 billion a year. Cyber insurance is now a critical cover to every business, and the penetration needs to increase. Premium finance can support customers to ensure they can afford the right level of cover.

Authored by Premium Credit

About Premium Credit

We are the leading provider of premium finance in the UK and Ireland, and the only company endorsed by BIBA.

We are authorised and regulated by the Financial Conduct Authority, and work with over 3,000 producers of all sizes. We serve over 2.1 million customers, process 24 million direct debits and receive advances of £3.5 billion.

For over 30 years, we’ve led the market through thought leadership, innovation and technology and have helped our partners offer finance compliantly to their customers through face-to-face, telephony and online channels.

We continue to invest to ensure we provide a quality service and support that helps you grow your business and commission. From the delivery of a seamless customer journey, which includes real time decisioning for financing and 24/7 account servicing, to consultation that improves the offer of finance to customers, we are committed to growing the premium finance market.

Our Specialist Lending division also provides finance to pay other annual costs, such as professional fees, membership subscriptions, commercial service charges, golf clubs and school fees.