IGI reports second quarter and half-year 2020 financial results

International General Insurance Holdings Ltd has announced financial results for the second quarter and first six months of 2020.

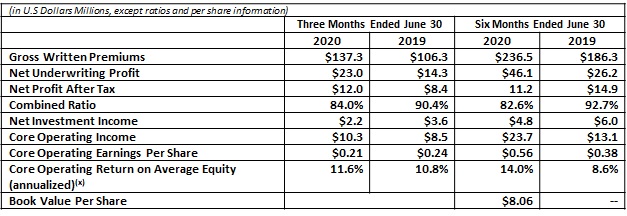

Highlights for the second quarter and first six months of 2020 include:

IGI Chairman and CEO Mr. Wasef Jabsheh said, “We are very pleased with our strong performance in the second quarter and first half of 2020, particularly as we, along with the rest of the world, continue to navigate the effects of the COVID-19 pandemic. While we are hearing and reading of new lockdown measures in some of the jurisdictions where we operate, our view of the financial impact of the COVID-19 pandemic on IGI currently remains unchanged.

Our underwriting results, reflected in a combined ratio of 82.6% for the half year, clearly demonstrate the strength of our technical capabilities and our ability to respond quickly to firming rates and conditions, particularly in those markets that are seeing the most significant changes. As expected, we continued to see rate increases in virtually every line of business we write during the second quarter, culminating in an overall average rate improvement of more than 19% across our book of business, enabling us to make further refinements to our existing portfolio while writing new business, including our new U.S. E&S portfolio.

I am very proud of all our IGI colleagues whose hard work, focus and commitment over the past several months have enabled us to continue to execute our strategy seamlessly, while delivering excellent service to our clients and partners.

You will have seen the announcement, made separately, that our Board of Directors has declared a common share dividend of $0.09. IGI has a long track record of delivering shareholder value, and we look forward to continuing to generate long-term value for our new shareholders.”

Underwriting Results

Gross written premiums were $137.3 million for the quarter ended June 30, 2020, an increase of 29.2% compared to $106.3 million for the quarter ended June 30, 2019. The increase in gross written premiums during the quarter was the result of new business generated across virtually all lines, as well as improved renewal pricing. Given firming market conditions, the Company also took the opportunity to further refine its existing portfolio, achieving improved terms and conditions.

For the first six months of 2020, gross written premiums were $236.5 million, up 27% compared to $186.3 million for the first half of 2019.

The claims and claims expense ratio represents net claims and claims adjustment expenses as a percentage of net premiums earned. Claims and claims expense ratios were 48.1% and 52.5% for the quarters ended June 30, 2020 and 2019, respectively. The claims and claims expense ratios included current accident year net catastrophe losses of $1.8 million, or 2.6 points, for the quarter ended June 30, 2020, and current accident year net catastrophe losses of $2.2 million, or 4.0 points, for the quarter ended June 30, 2019. Favourable development on loss reserves from prior accident years was $1.2 million or 1.7 points for the quarter ended June 30, 2020 compared to unfavourable development of $5.4 million or 9.9 points for the quarter ended June 30, 2019.

Claims and claims expense ratios were 47.2% and 53.5% for the six months ended June 30, 2020 and 2019, respectively. The claims and claims expense ratios included current accident year net catastrophe losses of $2.6 million, or 1.9 points, for the six months ended June 30, 2020, and current accident year net catastrophe losses of $5.8 million, or 5.6 points, for the six months ended June 30, 2019. Favourable development on loss reserves from prior accident years was $11.2 million or 8.2 points for the six months ended June 30, 2020, compared to unfavourable development of $1.3 million or 1.2 points for the six months ended June 30, 2019, respectively.

The combined ratio is the sum of the claims and claims expenses ratio and the expense ratio. The combined ratio for the quarter ended June 30, 2020 was 84.0%, compared to 90.4% for the same quarter in 2019. The improvement in the combined ratio was the result of a number of factors: improvement in the claims and claims expense ratio driven by positive loss experience on prior accident years when compared to the same period in 2019, significant growth in net earned premiums, and lower policy acquisition expenses.

The combined ratio for the six months ended June 30, 2020 was 82.6%, compared to 92.7% for the same period in 2019.

Segment Results

The Long-tail Segment, which represented approximately 35% of the Company’s gross written premiums for the first six months of 2020, includes all professional and financial lines written by the Company, including D&O, professional indemnity, financial institutions, surety, marine liability and general third-party liability, all of which are non-U.S. exposures.

Net written premiums for the quarter ended June 30, 2020 were $37.8 million, compared to $31.9 million in the comparable quarter in 2019. The net underwriting result for this segment was $6.4 million for the second quarter of 2020 compared to $4.3 million in the second quarter of 2019.

Net written premiums for the six months ended June 30, 2020 were $70.5 million, compared to $56.2 million in the comparable period in 2019. The net underwriting result for this segment was $19.5 million for the first six months of 2020, compared to $8.8 million in the first six months of 2019.

The Short-tail Segment, which represented approximately 60% of the Company’s gross written premiums for the first six months of 2020, includes energy, property, general aviation, ports and terminals, construction & engineering, and political violence.

Net written premiums for the quarter ended June 30, 2020 were $49.1 million, compared to $38.6 million in the comparable quarter in 2019. The net underwriting result for this segment was $13.3 million for the second quarter of 2020 compared to $8.6 million in the second quarter of 2019.

Net written premiums for the six months ended June 30, 2020 in the Short tail Segment were $88.7 million, compared to $70.2 million in the comparable period in 2019. The net underwriting result for this segment was $21.4 million for the first six months of 2020, compared to $14.9 million in the first six months of 2019.

The Reinsurance Segment, which represented approximately 5% of the Company’s gross written premiums for the first six months of 2020, includes the Company’s treaty reinsurance portfolio.

Net written premiums for the quarter ended June 30, 2020 in the Reinsurance Segment were $4.5 million, compared to $3.9 million in the comparable quarter in 2019. The net underwriting result for this segment was $3.2 million for the second quarter of 2020 compared to $1.4 million in the second quarter of 2019.

Net written premiums for the six months ended June 30, 2020 in the Reinsurance Segment were $11.4 million, compared to $10.9 million in the comparable period in 2019. The net underwriting result for this segment was $5.2 million for the first six months of 2020, compared to $2.4 million in the first six months of 2019.

Investment Results

Investment results for the second quarter of 2020 showed some positive recovery in mark-to-market and foreign currency adjustments from the impact of market turbulence related to the COVID-19 pandemic during the first quarter of 2020. The fixed income and equity portfolios both benefitted by $7.5 million and $1.3 million, respectively, during the second quarter of 2020. The combined benefit of foreign currency and investment valuation recoveries during the second quarter of 2020 was $12.0 million to Shareholders’ Equity at June 30, 2020.

Including an unrealized mark-to-market gain of $1.0 million, total investment income was $4.7 million during the second quarter of 2020. This compares to total investment income of $3.7 million in the second quarter of 2019. Excluding realized and unrealized gains and losses, total investment income, net, was $2.2 million and $3.6 million for the quarters ended June 30, 2020, and June 30, 2019, respectively, and resulting net investment yields were 1.4% for the second quarter of 2020, and 2.8% for the corresponding period in2019

For the first six months of 2020, including an unrealized mark-to-market loss of $3.6 million, total investment income was $2.7 million, compared to total investment income of $7.4 million in the first six months of 2019. Excluding realized and unrealized gains and losses, total investment income, net, was $4.8 million and $6.0 million for the six months ended June 30, 2020, and June 30, 2019, respectively, and resulting net investment yields of 1.5% for the first half of 2020, and 2.3% for the corresponding period in 2019.

Cash and cash equivalents and term deposits totaled $318.7 million at June 30, 2020, representing just under 46.5% of the total investment and cash portfolio, compared to $312.2 million at June 30, 2019, when it represented 51.3%.

Other

Net profit after tax for the quarter ended June 30, 2020 was $12.0 million compared to a net profit after tax of $8.4 million for the quarter ended June 30, 2019. Net profit after tax for the six months ended June 30, 2020 was $11.2 million compared to a net profit after tax of $14.9 million for the quarter ended June 30, 2019.

Core operating income was $10.3 million and $8.5 million for the quarters ended June 30, 2020 and June 30, 2019, respectively. The increase in core operating income during the second quarter of 2020 was primarily the result of the lower combined ratio, which was 6.4 points better in the second quarter 2020 when compared to the second quarter in 2019. Core operating income was $23.7 million and $13.1million for the six months ended June 30, 2020 and June 30, 2019, respectively.

Core operating return on average equity (annualized) was 11.6% for the quarter ended June 30, 2020, compared to 10.8% for the quarter ended June 30, 2019. Core operating return on average equity (annualized) was 14.0% for the six months ended June 30, 2020, and 8.6% for the six months ended June 30, 2019.

Book value per share was $8.06 at June 30, 2020, representing a marginal increase from March 31, 2020.

Authored by IGI

About IGI

Established in 2001, International General Insurance (IGI) is a global privately-owned specialist commercial insurer and reinsurer. Our vision is to be the company of choice for clients and brokers through market-leading service and our reputation for stable management and capital security.

A diverse and highly experienced team of underwriters operates our office in London. We also have offices in Dubai, Amman, Casablanca and Kuala Lumpur.

Our diverse portfolio of specialty lines includes Energy, Property, Construction & Engineering, Ports & Terminals, Financial Institutions, Aviation, Professional Indemnity, Political Violence, Legal Expenses, D&O, Casualty, Forestry and Treaty Reinsurance.

Standard and Poor’s upgraded our financial strength rating to “A- “, with a Stable outlook. A.M. Best rated the company A- (Excellent), with a Positive outlook, stating, “the revised outlook reflects IGI’s consistent record of very strong operating performance and the continuous improvement in its enterprise risk management framework.”

We take pride in providing proactive claims management, coupled with open communication, leading to the efficient handling of claims. We endeavour to act fairly and honourably in our relations with clients and brokers.