The 3 trends driving the growth of parametric insurance in 2021

Authored by Floodflash Adam Rimmer

As FloodFlash CEO, my focus gravitates towards certain news items as they float across my personal ticker. So far this year I’ve been drawn to lockdown announcements and how they impact the brokers that we work with across the UK, and then to the Met Office as the weather forecasts showed the first low-pressure rumblings that ultimately became Storm Christoph.

Christoph filled my newsfeed as rain and snow threatened Wales and northern England in January, eventually leading to widespread floods. FloodFlash claims are almost entirely automated, so having that heads-up two days in advance has little impact. We have removed loss adjustment from the process so there’s no need to mobilise early or book support functions. Nonetheless I always monitor the events and trends that will impact FloodFlash in the coming hours, months and decades.

A note on trends

A career quantifying the probability of ‘black swan’ events has taught me that the world is full of randomness. I sympathise with the unknowableness espoused by Nassim Taleb rather than the idea of pre-written destiny found in the world of Hollywood (although the latter makes for a better movie). However, trends sit below the randomness. The confluence of these trends have the power to steer products, companies and markets.

One such market, that of catastrophe insurance, plays host to two sets of unstoppable macro trends. Climate change, population growth and urbanisation are all driving up annual catastrophe damages. And increasing computer power and the proliferation of IoT networks mean that mass-market parametric insurance is possible for the first time. These trends will shape the catastrophe insurance market for years to come. They are also why Ian and I started FloodFlash.

Lloyd’s of London markets featured at the centre of climate protests, but the innovations within that and other insurance markets stand to protect people from the effects of climate change in the future.

Those macro trends explain why parametric insurance has started to take hold. In this article I want to explore three smaller but significant trends that are accelerating parametric growth. Together they explain why parametric insurance has gone from a conference buzzword to form award-winning covers used by clients worldwide.

Parametric insurance trends #1: for the first time, all businesses understand what they need to survive a catastrophe

Catastrophes kill businesses. The US Federal Emergency Management Agency (FEMA) says “90% of smaller companies fail within a year unless they can resume operations within 5 days”. COVID has created a world in which every business is alert to the threat, and the outcome, of being closed.

The best way to steady a business whose source of income is in crisis is to provide cash fast. This is where the gap between traditional and parametric insurance products begins to emerge.

Traditional claims employ an arduous loss adjustment processes. Catastrophic flood claims take months to resolve. That’s months in which a business might have no source of income, but plenty of debt in the form of mortgages, rent, staff wages or tax liabilities. When protecting a business’s balance sheet you sacrifice time at the altar of perfect indemnity. Not just time waiting for the final settlement, but staff resource managing and chasing the claim too. Statistics like the FEMA one above show it’s the one thing businesses can’t afford to lose.

The physical impact of flooding is often only the tip of the iceberg when it comes to the final costs. When cash flow is disrupted wages, bills and rent/mortgage costs quickly stack up posing a real threat to business survival.

Parametric insurance uses pre-defined values for claims. That means insurers remove the value of damage from the underwriting equation, and with it the requirement for claim adjustment. Parametric claims happen in hours, not the months it can take traditional catastrophe covers to pay out. FloodFlash paid Storm Christoph claims in 9 hours and 44 minutes, even during a national lockdown. In the wake of COVID that’s what businesses demand, and need, to survive.

‘It’s a relief to think that you don’t have to mither with chasing insurance companies. Most businesses with any sort of business interruption spend so much time trying to sort out the claim[…] It does involve the individual running the firm, and usually the top person within the firm. To take away that worry so the people running it can just get on with their business is a hell of a relief’ - Clive Steggel whose business CRS Consultants flooded during Storm Christoph in January

Parametric insurance trends #2: hard markets drive insurance innovation

Like any other market, insurance has the dynamics of supply and demand. On one hand, there are people looking to buy insurance cover for their risks. On the other are those with capital looking for a return by covering that risk. When there is plenty of money in the system, supply of capital is plentiful. That means lower insurance premiums and looser policy wordings: a ‘soft market’.

When money flows out of the insurance market – typically due to paying out claims from one or a series of catastrophe events – the supply of capital tightens. There is less capital to insure the same amount of risk. Premiums rise and risks are harder to cover. We are experiencing a “hard market” right now.

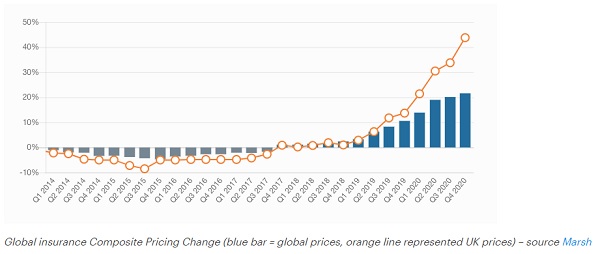

Insurance prices have risen consistently over the last few years and COVID-19 has made capital and capacity even harder to come by. According to the Marsh Market Index, global property insurance pricing increased by 22% in Q4 2020, capping off many months of increases.

One of the first casualties in a hard market is catastrophe cover. When the supply of capital runs dry, insurers are more reserved about the business they write. Policy wordings tighten, prices increase and exclusions start to creep in. This is where parametric insurance comes into its own.‘The scope of cover and the availability of insurance for some risks is fundamentally changing.’ - David Worsfold, The Insurance POST

Parametric insurance is attractive in hard markets for two reasons. The first is the lack of uncertainty: using pre-defined values for a claim means the insurer is exposed to fewer variables. Insurers then pass that benefit onto clients as lower premiums.

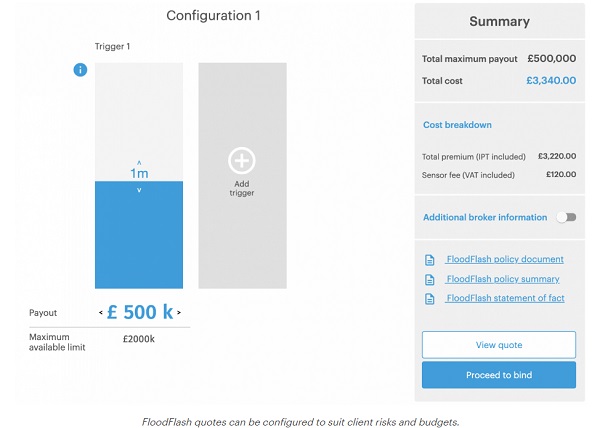

The second reason comes down to how parametric covers are structured. If a client sees an unattractive price, they can adjust the parameters of the cover to suit their budget. They might not get penny-perfect indemnification, but they have cover in place to protect their cash flow and survive.

FloodFlash quotes can be configured to suit client risks and budgets.

The old adage that ‘necessity is the mother of invention’ holds true in the insurance market. Previous recessions have hosted the creation of some of the worlds most successful technologies. Necessity is now driving the demands for parametric covers. As a specialist parametric broker told me this week: “It has gone crazy since Christmas”.

Parametric insurance trends #3: the word is out

I’m not the only person recognising these trends. Venture capitalists concerned with what the world looks like in ten years have also cottoned on. Renowned VC and early Facebook exec Chamath Palihapitiya announced his latest venture at the end of January: OTT Risk, a platform for pricing and trading parametric business interruption cover. Descartes Underwriting, Parsyl and Arbol have all announced big equity raises from VC funds in recent months.

Fueled by this interest, new and exciting applications of parametric insurance principles are emerging and growing faster than ever:

- Parametric earthquake insurance providers Jumpstart are expanding their service to Washington and Oregon after a successful launch in California

- Understory has made hail protection simple in the US picking up AgTech awards and protecting many leading car dealers

- Interesting applications of parametric cover such as protecting coral reefs in Mexico are capturing the imaginations of journalists and the public

- Platforms like Blink Parametric and Skyline Partners are looking to productise the cover in different ways

- On a personal level, I have had four founders of early-stage parametric insurance start-ups reach out to me for insights in the last two months – as many as in the previous eighteen.

Clients, brokers, insurers and investors have woken up to the possibilities of simpler, faster catastrophe insurance, and they are already experiencing the benefits. The capital pouring into parametric insurance firms will fuel this growth further.

These parametric insurance trends mean movement is accelerating every day. Based on the trends on my news ticker 2021 is set to be a landmark year. By December, more livelihoods and more businesses in more markets will be protected – and survive – because of parametric insurance.

About FloodFlash

On January 22nd 2021, FloodFlash fully settled a commercial property flood claim in 9hrs 44mins without leaving their desks. That process typically takes months, and when it does, businesses fail. FloodFlash uses computer models and IoT tech to bring parametric insurance to the mass market. The result is that businesses protect their cash flow and survive. CLICK HERE to find out more about award-winning cover from FloodFlash.

About FloodFlash

FloodFlash is a new type of rapid-payout flood insurance. It uses the latest data modelling and connected tech to bring parametric insurance to the mass market for the first time. The result is fast, easy and flexible cover that pays claims within days of a flood.

FloodFlash is parametric or `event-based` insurance. When buying the cover, the client chooses the depth of flooding they wish to insure against and how much they’d receive when that flood happens. When the FloodFlash sensor installed at the property detects flood water at the selected depth, the claim is paid in full. No waiting. No haggling.

FloodFlash rapid-payouts were put to the test in February 2020 when Storm Ciara swept across the UK. Claims related to the storm were paid in full within a single day. That speed of claims payment remains the fastest and best proof of mass-market parametric insurance to date gaining acclaim at industry awards and recognition from The Times, The Telegraph and the BBC.

FloodFlash operates across Britain, is headquartered in London. Floodflash is a registered coverholder at Lloyd`s of London and is authorised and regulated by the Financial Conduct Authority.