5 statistics brokers should know about commercial flood risk in Britain

Authored by FloodFlash

Earlier this year, we released our industry leading 2022 Commercial Risk Report, which raises awareness of the flood risk facing commercial properties in Britain. This blog contains the report’s headline insights. Each insight is a key tool to help clients understand their flood-related risks.

Fact 1 – 40% of small businesses close for good after catastrophic flooding

Small businesses lose an average of 50 working days to a flood event. 4 in 10 ultimately close for good, wiping out livelihoods and incomes. The 40% of small businesses that close for good includes those that have flood insurance, and those with flood defences in place. This shows that traditional insurance and resilience measures aren’t always enough on their own.

The speed at which companies can get back on their feet is key for recovery.

Following a disaster, 90% of smaller companies fail within a year unless they can reusme operations within 5 days

FEMA – the US Federal Emergency Management Agency

The FloodFlash sensor helps us pay our claims within two days, enabling businesses to reopen earlier and significantly increasing the chance they survive through a flood.

Nearly half of small businesses that suffer catastrophic flooding close for good. Getting a quick payout can help businesses reopen quickly and survive a flood.

Fact 2 – 14.4% of commercial properties in Britain have a significant flood risk

That’s almost 1 in 8, or 236,000, commercial properties. This is the same as the number of commercial properties in all of Greater London and Manchester put together. Many of these struggle to get traditional insurance or face large premiums due to that risk.

Adding Bristol, Edinburgh, and Merseyside to Greater London and Manchester gives you nearly 300,000 commercial properties. This is around the same number as those facing at least a moderate flood risk. That’s 18.1% of all commercial properties.

Finally, if you add in North, South, and West Yorkshire, you get just over the total number of commercial properties in at least a low flood risk zone – 436,000 properties, or 26.6% of all commercial properties. That’s nearly 2.5 times the number of commercial properties in all Greater London.

Fact 3 – Of the commercial properties at risk from flooding, 80% are at risk from surface water

Surface water flooding, or ‘flash flooding”, is caused by the collection of intense localised rainfall. This means it may occur in areas which are remote from any rivers or other sources of water.

More British businesses are at risk from surface water flooding than river or coastal flooding. Of the commercial properties at risk from flooding, 33% are at risk from river flooding and 7% from coastal flooding. This makes it clear that businesses in urban areas are very much at risk of flooding, regardless of whether they are near coasts or rivers.

Worse still, around 20% of British commercial properties at risk suffer from double jeopardy. This means they face a risk from two sources of flooding.

Fact 4 – Nearly half of businesses that have flooded in the past 10 years experienced a period of business interruption after the flood

Business interruption (BI) is one of the key costs for businesses that flood. BI is also something that traditional insurance policies typically exclude in their payouts. The costs associated with BI includes a loss of revenue, ongoing wage costs, contract fulfilment fines, tax bills, and many others.

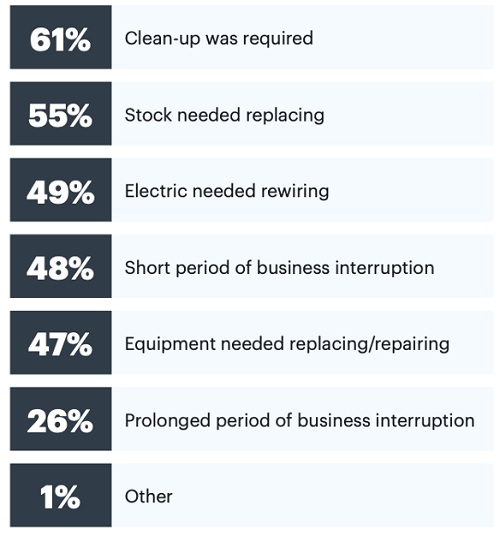

On top of this, most businesses will need to replace or repair equipment and stock, rewire their electrics, and carry out clean-up. These not only cost money, but increase the time taken for businesses to get back on the ground.

The main costs incurred by businesses who have recently flooded. Source: The 2022 Commercial Risk Report

Fact 5 – Retail and industrial properties make up over half of the commercial properties facing flood risk in Britain

Retail is the most at risk sector, making up nearly one third of the commercial properties at risk. To make matters worse, 58% of retail companies don’t have comprehensive insurance cover.

Manufacturing, wholesaling and logistics properties make up over 20% of those at risk, but 76% of these companies do have comprehensive insurance. This suggests that even when exposures are comparable, the attitude towards insurance (or their ability to buy it) changes between sectors. The third most at-risk sector is office-based businesses, who make up more than 10% of the businesses at risk. Just over half of these businesses have comprehensive insurance cover.

It is worth pointing out that our research didn’t include residential property due to our commercial focus. However, significant amounts of residential property are owned or operated by businesses. They make up a huge amount of the at-risk properties that can benefit from a FloodFlash policy.

What you can do

This blog just scratches the surface of our 2022 Risk Report. If you want to read the report in full, visit the website and download the report. If you would like more information, such as data at a regional or sector level, then contact chris@floodflash.co for bespoke support for your clients, audience or partners.

Feeling inspired? We’d love you to share around this blog or the full report to someone you think might benefit from it. By providing this information to others in the industry and beyond, more people will understand the flood risks facing businesses, and more businesses will be better equipped to deal with those risks.

About FloodFlash

FloodFlash is a new type of rapid-payout flood insurance. It uses the latest data modelling and connected tech to bring parametric insurance to the mass market for the first time. The result is fast, easy and flexible cover that pays claims within days of a flood.

FloodFlash is parametric or `event-based` insurance. When buying the cover, the client chooses the depth of flooding they wish to insure against and how much they’d receive when that flood happens. When the FloodFlash sensor installed at the property detects flood water at the selected depth, the claim is paid in full. No waiting. No haggling.

FloodFlash rapid-payouts were put to the test in February 2020 when Storm Ciara swept across the UK. Claims related to the storm were paid in full within a single day. That speed of claims payment remains the fastest and best proof of mass-market parametric insurance to date gaining acclaim at industry awards and recognition from The Times, The Telegraph and the BBC.

FloodFlash operates across Britain, is headquartered in London. Floodflash is a registered coverholder at Lloyd`s of London and is authorised and regulated by the Financial Conduct Authority.