DAS UK Group publishes financial results for year ending 31st December 2020

DAS UK Group (DAS UK), the UK’s leading specialist legal expenses insurer, has published its financial results for the year ending 31st December 2020. DAS UK includes a legal expenses insurance company (DAS LEI) and a law firm (DAS Law).

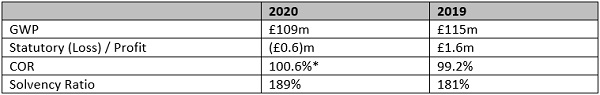

2020 saw DAS UK deliver a strong underlying performance although the results were impacted by the combined effects of Brexit and the Covid-19 global pandemic. GWP of £109m is down on prior year driven by the disposal of the company’s branch in the Republic of Ireland and a Norwegian portfolio put into run-off; both actions taken in response to Brexit. On an underlying basis, the Before the Event (BTE) portfolio grew by 4% off-setting a contraction in the After the Event (ATE) portfolio driven by lower volumes in the Clinical Negligence sector.

DAS UK secured two significant new partnerships in 2020. The first was for the provision of Commercial Legal Expenses Insurance (LEI), Landlord LEI, and Landlord Home Emergency products for Simply Business, one of the UK’s largest small business and landlord insurance providers. The other was the broadening of DAS UK’s partnership with specialist global insurer Hiscox to provide a bespoke home emergency product for Hiscox’s home insurance customers.

The company has worked hard to support all customers impacted by the Covid-19 global pandemic. It has seen an increase in landlord rent guarantee claims and has reserved for an anticipated impact on employment and contract claims once the Government’s furlough scheme comes to an end. In total, the financial impact of Covid-19 amounts to 5.1ppts on the 2020 COR of 100.6%. Excluding this, the underlying COR of 95.5% represents an underlying improvement of 3.7ppts on 2019.

Key Performance Indicators:

*Excluding the impact of Covid-19 the 2020 underlying COR was 95.5%

Commenting on the 2020 results, Andrew Burke said: “Firstly, let me say that I am immensely proud of DAS UK’s response to the pandemic. Our primary objective was to protect the welfare and health of our colleagues, while continuing to respond to the needs of our customers and business partners by paying claims and keeping our help and advice lines open. No one was furloughed and we invested in technology to enable effective remote working. The response of all of my colleagues has been terrific and I’m personally really grateful to them.

“In terms of results, the pandemic has clearly had an impact but I’m proud of the improved underlying performance and am confident we can build on that in 2021 and beyond. Our strategy remains to grow the business through long-term sustainable partnerships where we share a desire to improve customer outcomes, underpinned by disciplined underwriting, claims and expense management. The combined impact of Brexit and Covid-19 will clearly be felt going into 2021 but neither is a reason for us to change direction. The long term prospects remain strong.”

More on DAS UK’s response to Covid-19 Response and its impact to date:

• DAS UK has actively supported its people with initiatives such as extra support for child carers, help with working from home, and mental wellbeing programmes. It has not furloughed a single person and has put significant effort into internal communications and engagement to help everyone stay connected. These initiatives have resulted in some of the most postive employee feedback and support that DAS UK has ever experienced.

• Phone lines have remained open throughout the crisis and there has been a rise in NPS scores across the business; the Legal Advice team has seen historically high numbers of calls whilst delivering an NPS score of +60.

• Legal cover has never been more relevant than during the Covid-19 crisis. Teams of qualified legal advisers have also produced numerous guides for businesses, sole traders and employees, as well as for specific sectors such as landlords. DAS UK has made this information broadly available to the public via its dedicated microsite – www.das.co.uk/covid19

• DAS UK was able to successfully manage a complex onboarding of a major new partner (Simply Business) alongside its transition to remote working, demonstrating DAS UK’s operational resilience and technical capability.

• After an initial spike in volume, DAS UK saw the number of calls regarding redundancies drop, which does appear to support the view that the furlough scheme was largely successful in protecting jobs. However, the next few months are crucial as businesses start to re-open and business leaders re-appraise how they are able to trade under the new conditions.

• DAS UK has seen increased queries relating to landlord and tenants and anticipates an increase in calls on employment and contract disputes. The extent to which it grows or develops into claims will be dependent upon the way the government and businesses navigate their way out of full lockdown.

Authored by DAS

About DAS Group

The DAS UK Group comprises an insurance company (DAS Legal Expenses Insurance Company Ltd), a law firm (DAS Law), and an after the event (ATE) legal expenses division.

DAS UK introduced legal expenses insurance (LEI) in 1975, protecting individuals and businesses against the unforeseen costs involved in a legal dispute. In 2018 it wrote more than seven million policies.

The company offers a range of insurance and assistance add-on products suitable for landlords, homeowners, motorists, groups and business owners, while it’s after the event legal expenses insurance division offers civil litigation, clinical negligence and personal injury products. In 2013, DAS also acquired its own law firm – DAS Law – enabling it to leverage the firm’s expertise to provide its customers with access to legal advice and representation.

DAS UK is part of the ERGO Group, one of Europe’s largest insurance groups (the majority shareholder in ERGO is Munich Re, one of the world’s largest reinsurers).