Aviva plc publishes Q3 2021 Trading Update

Authored by Aviva

Growth and strategic execution drive strong year-to-date performance at Aviva

Remain on track to meet or exceed cash remittance and cost saving targets

Strong solvency and liquidity positions. Capital return of at least £4bn underway with c.£450m of the £750m share buyback completed

Amanda Blanc, Group Chief Executive Officer, said:

“Aviva has delivered strong performance in the first nine months. Record inflows in Savings & Retirement and excellent growth in General Insurance support our confidence in Aviva’s growth potential. Savings & Retirement net flows were up 21% year-to-date, continuing the strong first half performance. Bulk annuity volumes accelerated sharply in the third quarter. General Insurance premiums1 grew 5% year-to-date reflecting solid customer retention and new business wins, particularly in commercial lines.

“We continue to make excellent and rapid strategic progress, right across Aviva. The completion of disposals in France and Italy GI since the half year are significant milestones as we deliver a radically simplified and refocused Aviva. We are delivering our commitment to return at least £4bn of capital to shareholders, with c.£450m of the £750m share buyback already successfully completed.

“Aviva is targeting Net Zero by 2040 and we welcome the Government's plan, mandating financial institutions to publish transition plans. This will help to ensure that every firm making a Net Zero commitment - whether an insurer, a bank or an asset manager - is doing so in a robust and consistent way.

“We look forward with confidence. We expect the good trading momentum to continue in the fourth quarter, and we remain on track to meet or exceed our cash and cost saving targets.”

Strong growth in Life sales2 and GI premiums

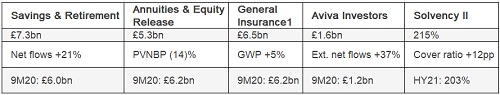

UK&I life sales of £25.3bn (9M20: £21.8bn) with strong growth in Savings & Retirement. Improved annuity volumes versus the first half with £2.4bn BPAs written in Q321, bringing 9M21 volumes to £4.0bn (9M20: £5.0bn).

General Insurance gross written premiums (GWP)1 up 5% to £6.5bn at 9M21 (9M20: £6.2bn) and COR1 92.4% (9M20: 98.1%).

Continued focus on cost efficiency

Controllable costs1,3 down 2% (excluding cost reduction implementation and IFRS 17 costs) to £2,045m at 9M21 (9M20: £2,080m) despite the headwinds of inflation and targeted investments in growth.

On track to achieve savings target of £300m in 2022 relative to our 2018 baseline and net of inflation. Focus over the longer term remains to deliver top-quartile cost efficiency.

Positive outlook for cash remittances

Expecting strong growth in cash remittances for the year from the £1.4bn achieved last year (9M21 continuing cash remittances: £1.1bn) and we remain on track to achieve our target of over £5bn in cumulative business unit cash remittances1 in 2021 to 2023.

Solvency and liquidity remain strong

Solvency II shareholder cover ratio of 215% at Q321 (HY21: 203%).

Pro forma prospective cover ratio at Q321 of c.197%, adjusted for remaining disposals, illustrative capital return, further debt reduction, and also for the estimated impact of interest rate reduction between 30 September and 5 November 2021 (HY21: 195%) - please refer to page 5 for further details.

Centre liquidity (Oct 21) of £4.5bn (Jul 21: £2.8bn), with the increase since July mainly reflecting divestment proceeds received.

Solvency II debt leverage ratio of 28% at Q321 (HY21: 26%).

Focus the portfolio nears completion. Capital return underway

Recently completed disposals of France for £2.8bn and Italy GI for £284m. The remaining completions in Poland, Italy (Life) and Vietnam are expected by the end of the year, bringing to a conclusion the £7.5bn divestment programme.

£750m share buyback commenced with c.£450m completed. We expect at least £4bn to be returned by HY22 with further details to be provided at FY21 results in March 2022 (subject to regulatory and shareholder approvals, remaining completions and market conditions).

Download our trading update – third quarter 2021 announcement

About Aviva

Aviva Insurance Limited is one of the UK’s leading insurance companies, part of the Aviva group with 34 million customers Worldwide. Aviva Insurance has been in the insurance business for more than 300 years.

In UK commercial, the insurance market remains challenging for insurance brokers and customers, due to the ongoing economic conditions. Aviva Insurance are focusing on improving our processes to ensure Aviva provide commercial customers with insurance cover at an acceptable price. Insurance brokers also recognised our excellent customer service by voting us Insurance Times General Insurer of the Year in 2012, for the second year running. youTalk-insurance sharing Aviva insurance news and video.