Allianz publishes Q3 Trading Update

Authored by Allianz

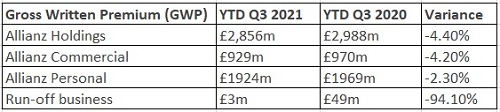

Allianz Holdings plc, the holding company which comprises Allianz Commercial and Allianz Personal, unveils its quarterly update for the three months ended 30 September 2021.

Financial and strategic highlights

- Revenues down due to lower premiums in competitive motor market

- Sustainable product and service solutions introduced with focus on electric vehicles

- Supporting customers hit by the July floods

- Restructure creates Allianz Commercial and Allianz Personal business units

Allianz Holdings

As announced in July, our strategic restructure has created two distinct Commercial and Personal businesses, reflected in the presentation of this trading update. This has led to greater coordination and clarity, which has received positive feedback from the market.

Jon Dye, CEO, Allianz Holdings, said: “This update is being released as the eyes of the world are focused on COP26. It is therefore fitting that our activity in Q3 continued Allianz’s focus on sustainability in both operational practices and product development. While revenues are down, mainly due to lower motor pricing levels, our well-balanced business is well equipped not just to respond to the climate emergency but to accompany and support the transition to a low-carbon economy. Clients and partners can rely on our expertise and commitment.”

Allianz Commercial

By the end of Q3 2021, GWP stood at £929m, down 4.2% compared to the same period in 2020. This is mainly due to a reduction in motor premiums, as lower claims frequency is being reflected in rates. We have continued to see further improvement in the pricing of our property and liability lines as we engage with customers and brokers on managing an uncertain risk environment. Our Engineering, Construction and Power (EC&P) business continues to show strong growth and we are now beginning to see emerging opportunities in other areas of the market.

Simon McGinn, CEO, Allianz Commercial, said: “This quarter saw further improvement in the performance of our business fundamentals, with good profitability flowing from commercial motor and EC&P, and property and packages improving despite some impact from the July floods. Economic volatility is creating a number of emerging trends which we are monitoring while we continue to pursue the prospects for growth we have identified in partnership with our brokers.”

“The initiatives we launched in Q3 have been geared toward a post-pandemic economy with a strong environmental focus. We enhanced our fleet products to provide cover for electric vehicles and we unveiled a sustainable procurement charter to prioritise suppliers who share our ESG commitments. To support our partners, we gave independent brokers free access to our legal helpline. This is the latest example of how we share our expertise and offer services to strengthen long-term relations with our broker partners.

“As claims continue to be a core aspect of our proposition to customers, the July floods saw us mobilise immediately to assist and quickly compensate our customers. For Covid-related Business Interruption, we have issued a final or interim payment for 93% of accepted claims, much higher than the industry average (68%). With inflationary pressures in the broader environment adding to those specific to insurance claims, we continue to work with our loss adjusters and other supplier partners to contain that trend on behalf of our customers.”

Allianz Personal

GWP in the first three quarters dropped slightly by 2.3% to £1.92bn compared to the same period in 2020. In LV= General Insurance (LV= GI), GWP was down by 5.9% to £1.48bn (Q3 2020: £1.57bn) as a result of falling premiums in an extremely competitive motor market. The Specialty business, which comprises Petplan, Home & Legacy and Allianz Musical Insurance, saw GWP increase by 11.5% to £444m (Q3 2020: £399m), primarily driven by growth in Petplan which recorded its highest ever GWP and best growth in five years as a result of people insuring more new pets.

Steve Treloar, CEO, Allianz Personal, said: “We continue to maintain our relentless focus on providing excellent customer service and supporting our colleagues, while ensuring we have a positive influence on society. Operationally, we are making good progress on the integration of our businesses that we have recently brought together in creating Allianz Personal. From a service perspective, we were proud to once again be recognised by Which? with them naming LV= GI as the winner of Insurance Brand of the Year. GoCompare also announced LV= GI as the best car insurance provider for customer service at its recent annual awards.

“As one of the largest insurers of electric cars in the UK, we further strengthened our breakdown capabilities with LV= Britannia Rescue partnering with LAR Traffic Services to launch a comprehensive electric car service to customers who break down in Central London.

“During the quarter, we supported the Family Action #CreatingHappyMemories toy appeal, which saw our people and claims suppliers donate around 600 toys and games to families in need. In recognition of the fantastic and tireless work the NHS has provided throughout the pandemic, we also supported the annual NHS Parliamentary Awards as a main sponsor. Finally, Petplan once again hosted its annual Pet Awards for customers, which celebrate the special relationship owners have with their pets.”

Outlook

As we return to our offices with our new ways of working, Allianz Commercial will intensify broker interactions. At a time when energy provision has come front of mind, our upcoming products will cover solutions for energy storage and efficiency.

As for Allianz Personal, with the upcoming FCA changes coming into effect in January 2022, our focus naturally continues to be on ensuring we’ve implemented all the necessary changes in advance. We will also continue to progress the integration and closer alignment of our businesses as Allianz Personal.

Jon Dye concluded: “After eight years as CEO of Allianz Holdings, this is the last trading update I will be issuing. I am hugely proud of what the team has achieved. The revenues that we are reporting at Q3 2021 (£2.86bn) are almost double the result that we achieved at the beginning of my tenure in Q3 2013 (£1.46bn). Sincere thanks to all of my colleagues and all of our broker partners who have supported the business over the years. They can be proud to share in this profitable growth story and I am pleased to hand over a great business to Colm.”

Allianz Holdings will welcome Colm Holmes as CEO on 1 December.

About Allianz

Allianz Insurance is one of the largest general insurers in the UK and part of the Allianz Group, a leading integrated financial services provider and the largest property and casualty insurer in the world.

The mission of Allianz Insurance is to be the outstanding competitor in our chosen markets by delivering products and services that our clients recommend, being a great company to work for and achieving the best combination of profit and growth. We aim to achieve this by putting the customer at the heart of everything we do.

Allianz is able to offer customers a wide range of products and services including home and motor and commercial insurance with full range of products and service for sole traders' right up to large commercial organisations.

Allianz Insurance employs over 4,500 people across a network of 20 offices in the UK and the company’s Head Office is situated in Guildford, Surrey. Our heritage and financial strength help make Allianz what it is today; a safe and trusted partner. Over 40 FTSE100 companies partner with Allianz. youTalk-insurance sharing Allianz Insurance news and video