Allianz delivers robust results for 2020

Authored by Allianz

Allianz Holdings plc, the holding company which owns Allianz Insurance and LV= General Insurance (LV= GI) announces its results for the full year ended 31 December 2020.

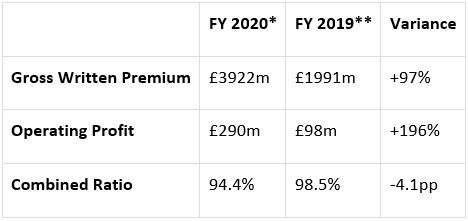

Allianz Holdings:

*Includes Allianz Insurance, LV= General Insurance and L&G General Insurance

**Allianz Insurance only

Financial highlights:

- Expanded Allianz business, incorporating LV= General Insurance and L&G General Insurance

- Almost doubles GWP

- Delivers £192m (196%) increase in Operating Profit

- Shows 4 percentage point improvement in COR.

- Total impact of COVID-19 Business Interruption BI claims in 2020 was £175m, net of reinsurance

- Payments have been made on 1800 COVID-19 Business Interruption (BI) claims to date, totalling £40m and including 78% of valid SME claims.

Jon Dye, CEO, Allianz Holdings said: “The results we are announcing today demonstrate the resilience of our business and the benefits that can be gained through managing a large and diverse portfolio. The COVID-19 crisis has impacted different lines of business in different ways, for example the reduction in claims frequency in some books and the significant claims for Business Interruption. Other external factors impacting the 2020 figures included rising claims inflation and supply chain challenges, large losses, weather events and the general slowdown in economic activity.

“But our business is resilient. Our successful 2020 result was built on the ability of our colleagues to adapt to new working environments, the trust and support of our brokers, intermediaries, customers and suppliers and our flexibility to adapt our products, processes and protocols to the changing demands and dynamics of the market.”

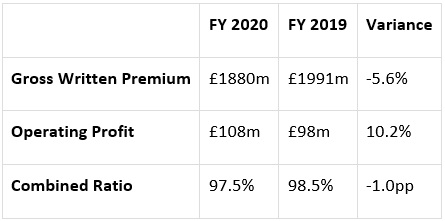

Allianz Insurance:

Allianz Insurance experienced an overall small decline in premium income (5.6%) compared to 2019. In the Commercial book this was due to the impact of COVID-19 on economic activity, with Motor and Casualty lines seeing the impact of increased mid-term adjustments, return premiums, reduced exposures and lower new business levels. In Personal Lines, the exit of a large Corporate Partner arrangement also impacted the top line figure.

Total Operating Profit increased by 10% (£10m) compared to FY 2019. COVID-19 business interruption claims impacted the 2020 result by £175m, net of reinsurance. These losses have been offset by the claims effects of the economic slowdown, in particular in Commercial Motor and Pet.

Allianz adopted a responsible and market-leading approach to dealing with BI claims, settling quickly and fairly from the outset. As at the end of January, payments had already been made on 75% of all valid claims. This approach has received extremely positive feedback from brokers.

Allianz has retained its keen focus on building stronger relationships in the market. Maintaining an ongoing dialogue with brokers has been crucial and broker engagements with Allianz increased significantly in 2020 over the previous year. Supporting customers has also been a top priority. Business risks are changing and Allianz has been proactive and flexible to enable customers to change or adjust business descriptions, sums insured, policy conditions and exposure, as well as allowing changes to payment terms.

In addition to the £10.1m Allianz donation to the COVID-19 Support Fund and the £700,000 payment to pet charities to cover their lost revenue, Allianz also donated £300,000 to the Help Musicians UK Coronavirus Support Fund, to support musicians who are struggling due to the pandemic. Allianz has continued to support its corporate charity, Mind, maintaining its fundraising momentum through virtual events and £325,000 in 2020. The launch of the Allianz Community Fund as part of its emergency Coronavirus funding saw donations to local charities, and the company doubled the volunteering allowance for colleagues, enabling everybody to spend 20 hours supporting their local community.

In Commercial lines, and particularly in the Property and Packages accounts, rising claims inflation, weather events and the pattern of large losses combined to put pressure on the book, along with issues due to lack of rate strength. Despite this, 2020 saw the business make good progress to improve underlying profitability, driving premium increases in excess of claims inflation while addressing areas of volatility to deliver improved portfolio performance in a number of areas, especially Property lines.

The Engineering, Construction & Power insurance business had a successful year in 2020, with growth in premium and profit. Special mention should also be made of the Engineering Inspection business where Allianz’s Engineer Surveyors have maintained extraordinarily high service levels in the face of considerable challenges in accessing plant and equipment. This contributed to Allianz EC&P earning NPS loyalty leadership for the 13th consecutive year.

Personal Lines performed well in 2020. The primary driver was Petplan which has now become a £500m business and saw profit ahead of 2019. This result was supported by a successful programme to drive more sales online. Allianz Legal Protection and the Corporate Partner business have both undergone significant restructuring and both returned to profit in 2020. Allianz Musical Insurance saw a decline in premium income as a result of the downturn in the live music industry but remains robustly profitable.

Q4 2020 saw the launch of Allianz’s sponsorship of England Rugby. As well as partnering with the men’s and women’s England rugby teams and the Allianz Premier 15s, the partnership shows Allianz’s support for women’s sport as title partner of Inner Warrior, the grassroots programme to encourage girls and women into sport.

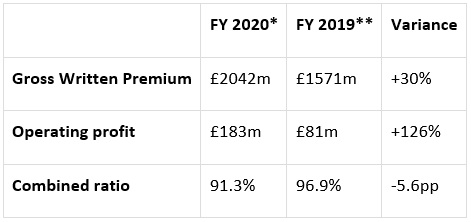

LV= General Insurance:

*Includes L&G General Insurance which became part of LV= GI in January 2020.

**Numbers reported for 2019 have been restated to be shown on a consistent Allianz accounting basis.

Steve Treloar, CEO of LV= General Insurance, said: “2020 was an extraordinary year. The impact COVID-19 had on everyone’s lives was unprecedented and from a business perspective it certainly wasn’t without its difficulties. In a short space of time, we were faced with the challenge of getting all 4,000 of our people safely working from home, which I’m pleased to say we successfully managed. Throughout the year, we also focused our efforts on ensuring we supported our customers, our partners as well as our local communities. I’m proud of what our people achieved and our business remains in a robust position.”

LV= GI enjoyed a strong year from a trading perspective. We saw a 30% growth in Gross Written Premiums (GWP) to just over £2bn, mainly due to the acquisition of L&G General Insurance, (FY 2019: £1571m) and Operating Profit at £183m (FY 2019: £81m), with the latter being achieved through a combination of being more efficient in the way we manage our business as well as an improved performance in our motor business. Our Combined Ratio (COR) reached 91.3% (FY 2019: 96.9%). In LV= Broker, GWP increased by 16%, primarily due to significant growth across a number of lines including standard motor, specialist motor and home, and growth in LV= Retail remained broadly flat, reflecting our more cautious approach to pricing in a soft market.

In the early months of the pandemic, with fewer people on the road we saw a reduced level of claims frequency which has resulted in an improved profitability of our motor book; although we expect the performance of this line of our business to return to more normal levels throughout 2021. In Home, claims frequency remained fairly static but as a result of people being at home more we did observe a number of new trends in the year including: 225% increase in fire claims, 40% increase in the proportion of blockages and 21% increase in the proportion of bicycle thefts from gardens.

Throughout the pandemic, we focused much of our efforts on helping our customers across all channels and introduced a series of measures, such as offering refunds to those struggling financially, waiving claim excesses, not charging administration or cancellation fees, lowering our motor rates and offering enhanced cover to NHS and key workers. We also increased the amount we paid to certain suppliers and didn’t furlough any of our employees. Our commitment to helping people and communities recover and rebuild from COVID-19 also extended to grassroots sport as we announced the #Funds4Runs initiative with the England and Wales Cricket Board (ECB). The £1m investment, jointly funded by the ECB and LV= GI, will focus on supporting key areas where access to cricket has been limited, particularly children from deprived backgrounds, diverse communities, disability groups and women and girls’ programmes.

Operationally, the full integration of the L&G General Insurance business into LV= GI, which was announced in the summer, continued to progress well and we’ve now started to migrate business across to LV= Broker. Our approach to customer service also saw us achieve our highest ever position in the UK Customer Satisfaction Index in July (joint eighth), building on consecutive top 10 places since January 2019, and LV= Broker was awarded the prestigious ServiceMark Accreditation from the Institute of Customer Service. We were also named a Which? Most Recommended Provider for both Home and Motor.

As we look forward, much of our focus will be on working with the Financial Conduct Authority to introduce the changes from the General Insurance Market Study, as well as managing the uncertainty of claims inflation which is inherently linked to the future strength of the UK economy.

In conclusion, Jon Dye said: “The strengths that have delivered these robust results in 2020 will also serve us well as we look to the future. The UK is still in the midst of the Coronavirus crisis and is yet to work through the implications of the Brexit deal. But Allianz has a strong platform from which to deliver further profitable growth and we will maximise this potential by continuing to invest in the skills of our people and the products and services we provide to our customers, focusing on our digital and data capabilities.”

About Allianz

Allianz Insurance is one of the largest general insurers in the UK and part of the Allianz Group, a leading integrated financial services provider and the largest property and casualty insurer in the world.

The mission of Allianz Insurance is to be the outstanding competitor in our chosen markets by delivering products and services that our clients recommend, being a great company to work for and achieving the best combination of profit and growth. We aim to achieve this by putting the customer at the heart of everything we do.

Allianz is able to offer customers a wide range of products and services including home and motor and commercial insurance with full range of products and service for sole traders' right up to large commercial organisations.

Allianz Insurance employs over 4,500 people across a network of 20 offices in the UK and the company’s Head Office is situated in Guildford, Surrey. Our heritage and financial strength help make Allianz what it is today; a safe and trusted partner. Over 40 FTSE100 companies partner with Allianz. youTalk-insurance sharing Allianz Insurance news and video