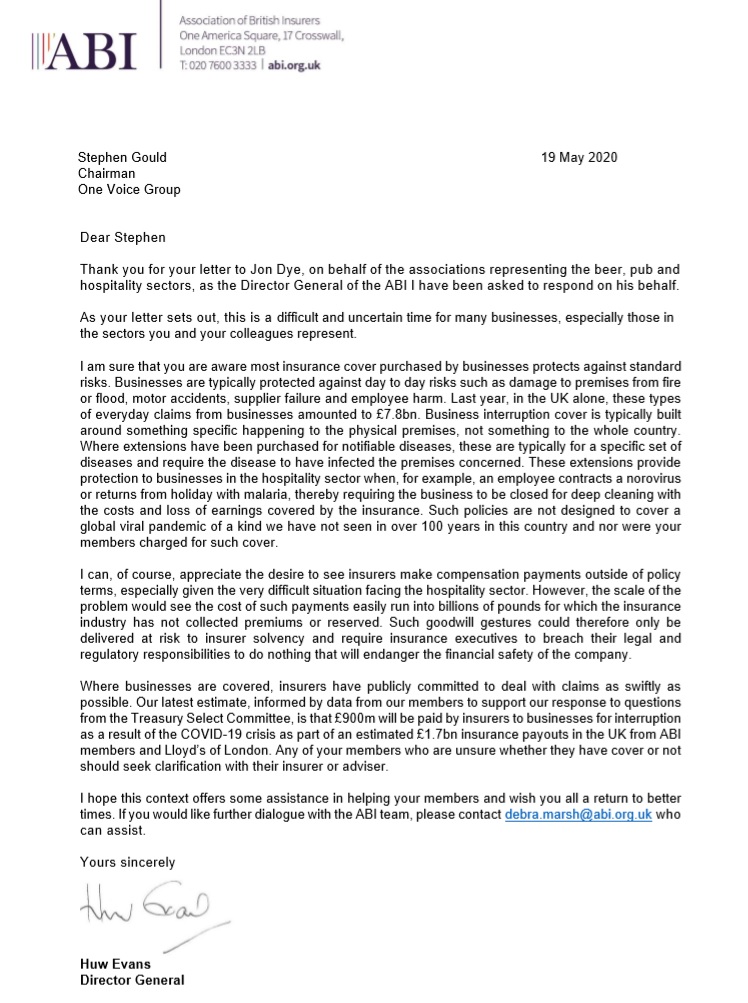

In the response Director General, Huw Evans, acknowledges the uncertainty the COVID-19 crisis has created for many businesses, particularly in the hospitality sector and outlines the industry response to COVID-19 with regard to business insurance cover:

“Businesses are typically protected against day to day risks such as damage to premises from fire or flood, motor accidents, supplier failure and employee harm. Last year, in the UK alone, these types of everyday claims from businesses amounted to £7.8bn. Business interruption cover is typically built around something specific happening to the physical premises, not something to the whole country.”

He also highlights initial estimates on the level of claims that will be paid on business insurance policies as a result of COVID-19:

“Our latest estimate, informed by data from our members to support our response to questions from the Treasury Select Committee, is that £900m will be paid by insurers to businesses for interruption as a result of the COVID-19 crisis as part of an estimated £1.7bn insurance pay-outs in the UK from ABI members and Lloyd’s of London.”

Letter from Huw Evans, Director General, Association of British Insurers to Stephen Gould, Chairman, One Voice Group

To downoad the letter from Stephen Gould, Chairman, One Voice Group to Jon Dye, Chair, Association of British Insurers CLICK HERE